C

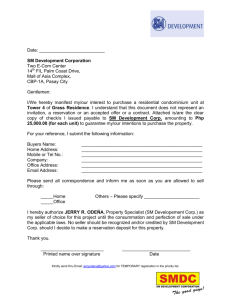

advertisement