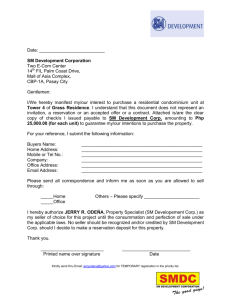

C O A.

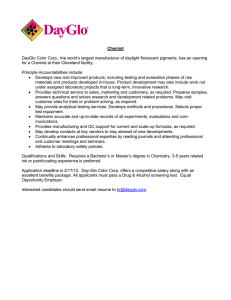

advertisement