Document 15272257

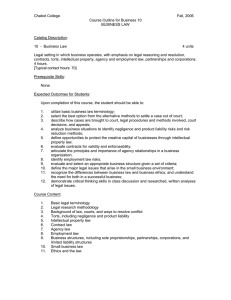

advertisement