Chapter 24 Specialis..

advertisement

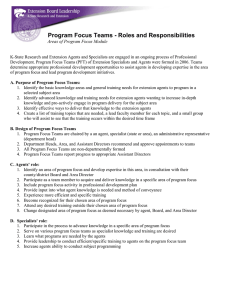

Chapter 24 Specialists NYSE Structure 1366 members (specialists & floor brokers) Seat = Member = Right to buy & sell on the NYSE Floor Approximately 3000 listed companies Specialists 7 specialist firms Approximately 450 specialists Typically 5 to 10 years on-the-job training Handle equities across all industries Most individual specialists handle between 3 and 10 stocks Stocks Each stock assigned to one firm Stocks allocated one of two ways: • Allocation interviews 3-5 Specialist firms participate in 30 minute interviews • Either by phone or in person Assigned by NYSE Allocation Committee Each stock trades at one location on floor Specialists’ affirmative obligations Specialists are traders of last resort. • Have to quote firm two-sided markets during trading hours. Specialists have an obligation to smooth prices by intervening to prevent large price reversals (provide price continuity). • Expensive if informed traders in the market. • Profitable if the spread is wide because other traders are distracted. Exchanges regularly evaluate specialists based on the width of their quotes, the depth at their quotes, and price continuity. Specialists provides • Liquidity when there are order imbalances • Price continuity • Limit order display • Supposedly stabilize prices Specialists also do… Specialists also work orders entrusted to them by floor brokers. Specialists generally charge brokers commissions for these services. Specialists act as oral bulletin boards for brokers. Specialists have a responsibility to make sure that all traders follow the exchange rules. • Conduct an orderly market. Specialists’ negative obligations Abide by order precedence rules, including public order precedence rule. Public liquidity preservation principle is typically enforced at primary exchanges. • Specialists can trade only with incoming marketable orders. Third market dealers and regional specialists are generally not subject to the public liquidity preservation principle. Specialist privileges Specialists can engage in: • Speculative trading on their own account based on their ability to predict short-term price changes • Quote-matching (see p. 249) • Cream-skimming - observe broker IDs for incoming market orders and step in front of the book by improving the price • Strategies to take advantage of stop orders Specialists control the quotes • Limit display to top-of-file – most valuable • Constrained by order exposure rules Specialists can stop incoming marketable orders. Specialists conduct the open. Specialists receive brokerage commissions for system orders. Specialists have a unique information advantage that they can use to generate dealer profits. Specialist Profitability: A Challenging Environment Seat Prices Down 40% from highs Current return on Specialist Capital near zero 5/1/2003 4/1/2003 3/1/2003 2/1/2003 1/1/2003 12/1/2002 11/1/2002 10/1/2002 9/1/2002 8/1/2002 7/1/2002 6/1/2002 5/1/2002 4/1/2002 3/1/2002 2/1/2002 1/1/2002 12/1/2001 11/1/2001 10/1/2001 9/1/2001 8/1/2001 7/1/2001 6/1/2001 5/1/2001 4/1/2001 3/1/2001 2/1/2001 1/1/2001 12/1/2000 NYSE Seat Sales December 2000 - Present $2,800,000 $2,600,000 $2,400,000 $2,200,000 $2,000,000 $1,800,000 $1,600,000 $1,400,000 $1,200,000 $1,000,000 Top Line Revenue Pressure QTRLY Specialist Revenues as a Percent of Volume Annualized 2.5 Pennies and Dow 12000 2 1.5 1 Dow Loses 10% 0.5 Source: NYSE Website and Bloomberg 3 3Q -0 3 1Q -0 2 3Q -0 2 1Q -0 1 3Q -0 1 1Q -0 0 3Q -0 0 1Q -0 9 3Q -9 8 9 1Q -9 3Q -9 8 1Q -9 7 3Q -9 1Q -9 7 0 Specialist Return On Capital (excludes NYSE Specialist Investigation Settlement Charges) 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% Source: NYSE Website 0.0% 7 7 8 8 9 9 0 0 1 1 2 2 3 3 -9 -9 -9 -9 -9 -9 -0 -0 -0 -0 -0 -0 -0 -0 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q 1Q 3Q Recent Controversy Issues surrounding former NYSE CEO Dick Grasso and SEC’s specialist investigation occur simultaneously Results: • • • • Reputation decline for NYSE Decline in market share Dual listing on NASDAQ of 7 stocks Dramatic decrease in NASDAQ transfers Despite these issues, NYSE still capturing bulk of IPO volume Chapter 25 Internalization, Preferencing, and Crossing Discuss JFE paper