Spring Branch Fall 2010.doc

advertisement

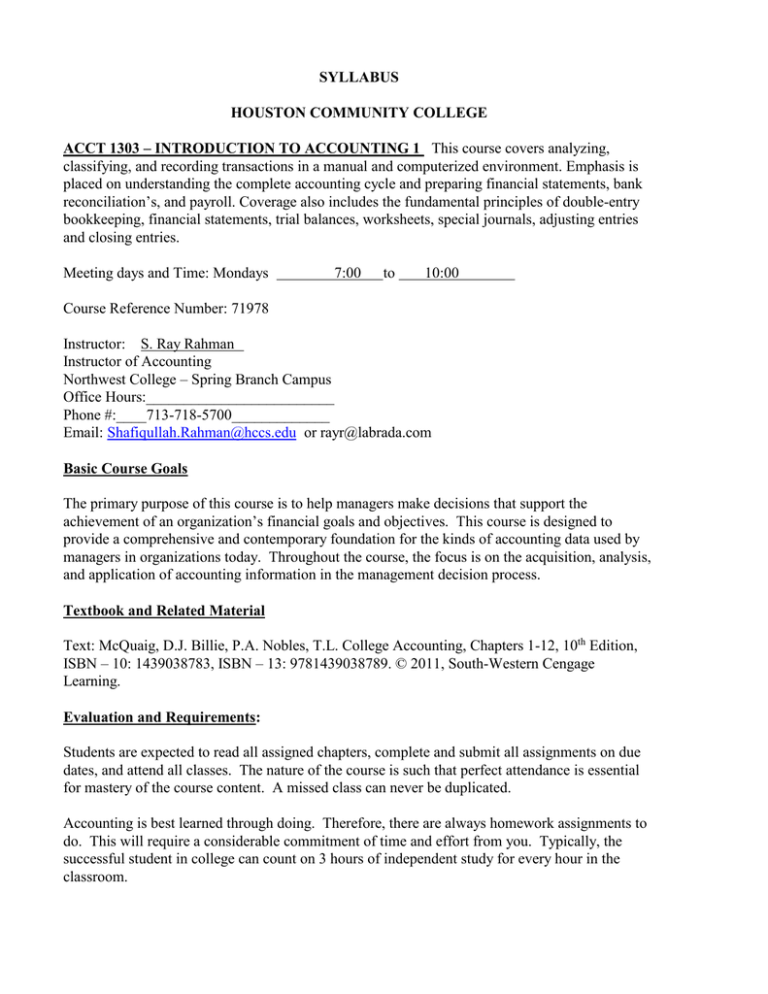

SYLLABUS HOUSTON COMMUNITY COLLEGE ACCT 1303 – INTRODUCTION TO ACCOUNTING 1 This course covers analyzing, classifying, and recording transactions in a manual and computerized environment. Emphasis is placed on understanding the complete accounting cycle and preparing financial statements, bank reconciliation’s, and payroll. Coverage also includes the fundamental principles of double-entry bookkeeping, financial statements, trial balances, worksheets, special journals, adjusting entries and closing entries. Meeting days and Time: Mondays 7:00 to 10:00 Course Reference Number: 71978 Instructor: S. Ray Rahman Instructor of Accounting Northwest College – Spring Branch Campus Office Hours:_________________________ Phone #:____713-718-5700_____________ Email: Shafiqullah.Rahman@hccs.edu or rayr@labrada.com Basic Course Goals The primary purpose of this course is to help managers make decisions that support the achievement of an organization’s financial goals and objectives. This course is designed to provide a comprehensive and contemporary foundation for the kinds of accounting data used by managers in organizations today. Throughout the course, the focus is on the acquisition, analysis, and application of accounting information in the management decision process. Textbook and Related Material Text: McQuaig, D.J. Billie, P.A. Nobles, T.L. College Accounting, Chapters 1-12, 10th Edition, ISBN – 10: 1439038783, ISBN – 13: 9781439038789. © 2011, South-Western Cengage Learning. Evaluation and Requirements: Students are expected to read all assigned chapters, complete and submit all assignments on due dates, and attend all classes. The nature of the course is such that perfect attendance is essential for mastery of the course content. A missed class can never be duplicated. Accounting is best learned through doing. Therefore, there are always homework assignments to do. This will require a considerable commitment of time and effort from you. Typically, the successful student in college can count on 3 hours of independent study for every hour in the classroom. Students are responsible for the “learning objectives” at the beginning of each chapter. Accounting is a subject that cannot be mastered passively. The concepts and ideas can be compared to building blocks - each serves as a foundation for new ones. It is extremely important that each student be actively involved in the learning process. This requires intensive study of each chapter, the study guide, and continuous application of the ideas to homework problems. Your final grade for this course will be based on how well you do in meeting the evaluation requirements listed on your assignment schedule and applying the grading scale which is listed below. Drops and Withdrawals: It is the responsibility of each student to officially drop or withdraw from a course. Failure to officially withdraw may result in the student receiving a grade of F in the course. A student my officially withdraw in any of the following ways: 1. Complete an official withdrawal form at any HCCS campus. 2. Send a letter requesting withdrawal to: Registrar Houston Community College System P.O. Box 667517 Houston, TX 77266-7517 The withdrawal will be effective as of the date of the postmark. Withdrawals will NOT be accepted by telephone. Class Attendance: Students are expected to attend class regularly. Students are responsible for materials covered during their absences, and it is the student’s responsibility to consult with the instructor for any make-up assignments. Although it is the responsibility of the student for non-attendance, the instructor has full authority to drop a student for excessive absences. A student may be dropped from any course for excessive absences after the student has accumulated absences of 12.5% of the hours of instruction. For example, in a 3 credit hour lecture class meeting 3 hours per week, a student may be dropped after 6 hours of absence. Examinations: There will be a total of three sectional examinations (there will be no make-up examinations). The two highest grades received on these exams will be used to compute the student’s final grade for the course. The lowest score will be dropped. If a student misses an exam, that becomes the dropped exam. Incompletes The grade of “I” (incomplete) is conditional and at the discretion of each instructor. If you receive an “I,” you must arrange with your instructor to complete the course work by the end of the following term (excluding Summer). After the deadline, the “I” becomes an “F.” Students with Disabilities Any students with a documented disability (e.g. physical, learning, psychiatric, vision, hearing, etc.) who needs to arrange reasonable accommodations must contact the Disabilities Services Office at the respective college at the beginning of each semester. Faculty are authorized to provide only the accommodations requested by the Disability Support Services Office. Academic Honesty Students are responsible for conducting themselves with honor and integrity in fulfilling course requirements. Penalties and/or disciplinary proceedings may be initiated against a student accused of scholastic dishonesty. “Scholarly dishonesty” includes, but is not limited to, cheating on a test or project, plagiarism, and collusion. Accounting Department Website Our website is: www.hccs.edu Tutoring/Lab Hours: See your instructor for locations, days and times. Assignment Schedule: An assignment schedule is attached to this syllabus. This schedule will be followed throughout this course. Any modifications to this schedule will be announced in class. INTRODUCTION TO ACCOUNTING 1 Assignment Schedule Course 1303: CRN # 71978 Instructor: S. Ray Rahman Spring Branch Campus Room # 216 (713) 718-5700 Class Time: 7:00 - 10:00 TEXT: McQuaig, D.J. Bille, P.A. Nobles, T.L. College Accounting, Chapters 1-12, 10th Edition, ISBN-10: 1439038783, ISBN-13: 9781439038789. © 2011, South-Western Cengage Learning 90 80 70 60 0 - 100 A 89 B 79 C 69 D 59 F Test # 1 15% Test # 2 15% Test # 3 15% Final 30% Peachtree Project 10% Excel Project 10% Homework 15% Attendance 5% Total 100% MONDAY Session Date 1 24-Jan-11 Chapter Topic Homework 1 Introduction - Course overview Asset, Liability, Owner's Equity, Revenue & Expense Accts Problem 1-4A 2 31-Jan-11 2 T Accts, Debits & Credits, Trial Balance and Fin Statements Problem 2-4A 3 7-Feb-11 3 The General Journal and the General Ledger Problem 3-1A, 3-3A, 3-4A 4 Adjusting Entries and the Worksheet Problem 4-3A, 4-4A 5 Closing Entries and the Post-Closing Trial Balance Problem 5-4A 4 14-Feb-11 Start Peachtree Project (Review for Exam # 1) 5 21-Feb-11 President's Day Holiday 6 28-Feb-11 Exam # 1 - (Chapters 1-5) 7 7-Mar-11 6 Bank Accounts and Cash Funds Problem 6-2A, P6-4A Submit Peachtree Project 8 14-Mar-11 9 21-Mar-11 Spring - Break 7 Employee Earnings and Deductions Problem 7-3A, P7-4A 8 Employer Taxes, Payments, and Reports Problem 8-2A, P8-4A (Review for Exam # 2) 10 Exam # 2 - (Chapters 6-8) 28-Mar-11 Start Excel Payroll Register Project 11 4-Apr-11 9 Sales & Purchases; Appendix - Perpetual Method (P 385) Problem 3A, P9A-1 Payroll Submit Excel Payroll Register Project 12 11-Apr-11 10 Cash Receipts & Cash Payments Problem 1A, P39A 13 18-Apr-11 11 Work Sheet and Adjusting Entries Problem 2A 14 25-Apr-11 12 Financial Statements, Closing Entries, and Reversing Entries Problem 1A, 2A (Review for Exam # 3) 15 2-May-11 Exam # 3 - (Chapters 9-12) Review for Final 16 9-May-11 Final Exam (Chapters 1-14) [ Comprehensive } ************************************************************************ Examinations: There will be three sectional examinations (there will be no make-up examinations) . The two highest grades received on these exams will be used to compute the student's final grade for the course. The lowest score will be dropped. If a student misses an exam, that becomes the dropped exam. However, you may make special arrangements with me to take an exam early.