Understanding the Nash Equilibrium

advertisement

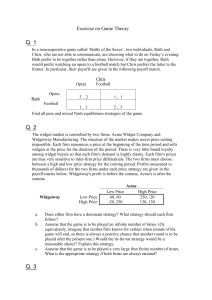

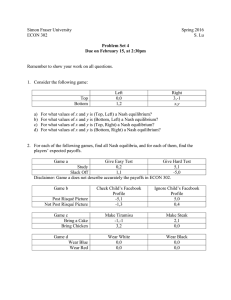

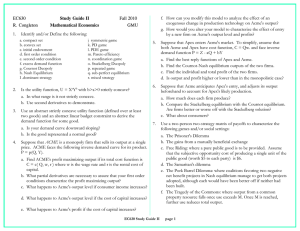

Prisoner’s Dilemma An illustration of Nash Equilibrium Art and Bob are both suspects in a crime, and they are both offered the following deal if they confess… Art’s Strategies Deny Bob’s Strategies Confess Confess 3 yrs. 3 yrs. 1 yr. 10 yrs. Deny 10 yrs. 1 yr. 2 yrs. 2 yrs. Consider Art’s options… 1. If Bob denies and Art denies, then Art will get two years. Art is better off confessing and getting one year. 2. If Bob confesses and Art denies, then Art will get ten years, so Art is much better off confessing and taking three years. Consider Bob’s options… 1. If Art denies and Bob denies, then Bob will get two years. Bob is better off confessing and getting one year. 2. If Art confesses and Bob denies, then Bob will get ten years, so Bob is much better to confess and take three years. Thus, both parties will rationally choose to confess, and take three years – even though they could have been better off denying. Each party does this because, considering the possible options of the other party, they always found the better option was to confess. When neither party has an incentive to change their strategy, they are in “Nash Equilibrium.” Nash Equilibrium John F. Nash, 1928 - Russell Crow portrays John Nash in A Beautiful Mind NASH EQUILIBRIUM An important concept in game theory, a Nash equilibrium occurs when each player is pursuing their best possible strategy in the full knowledge of the other players’ strategies. A Nash equilibrium is reached when nobody has any incentive to change their strategy. It is named after John Nash, a mathematician and Nobel prize-winning economist. The Implications: The Duopolist’s Dilemma Acme and Belco are the only firms operating within a given market. Thus, they are operating in a duopoly. Both firms could increase their profits if they were to collude with each other in an effort to restrict output. However, each firm could make even more money if they agreed to collude, but then cheated and secretly increased their output. Thus, each firm is faced with the following payoff matrix… Consider Acme’s options… Acme’s Strategies Comply Belco’s Strategies Cheat Confess Cheat Comply $0 $0 -1.0m 4.5m 4.5m -1.0m 2.0m 2.0m 1. If Belco complies and Acme complies, then Acme will earn 2 million. Acme is better off cheating and earning 4.5 million. 2. If Belco cheats and Acme complies, then Acme will lose 1 million, so Acme is again better off to cheat and earn zero profit. Consider Belco’s options… 1. If Acme complies and Belco complies, then Belco will earn 2 million. Belco is better off cheating and earning 4.5 million. 2. If Acme cheats and Belco complies, then Belco will lose 1 million. Belco is again better off to cheat and earn zero profit. Thus, both parties will rationally choose to cheat, and earn zero profits – even though they could have been better off by complying with a collusive deal to restrict output. They will compete as fiercely as pure competitors continually lowering their prices and increasing production until they reach a point where they are breaking even. This is where they will find themselves in Nash Equilibrium. They will have no motivation to move from this point.