Chapter 56

advertisement

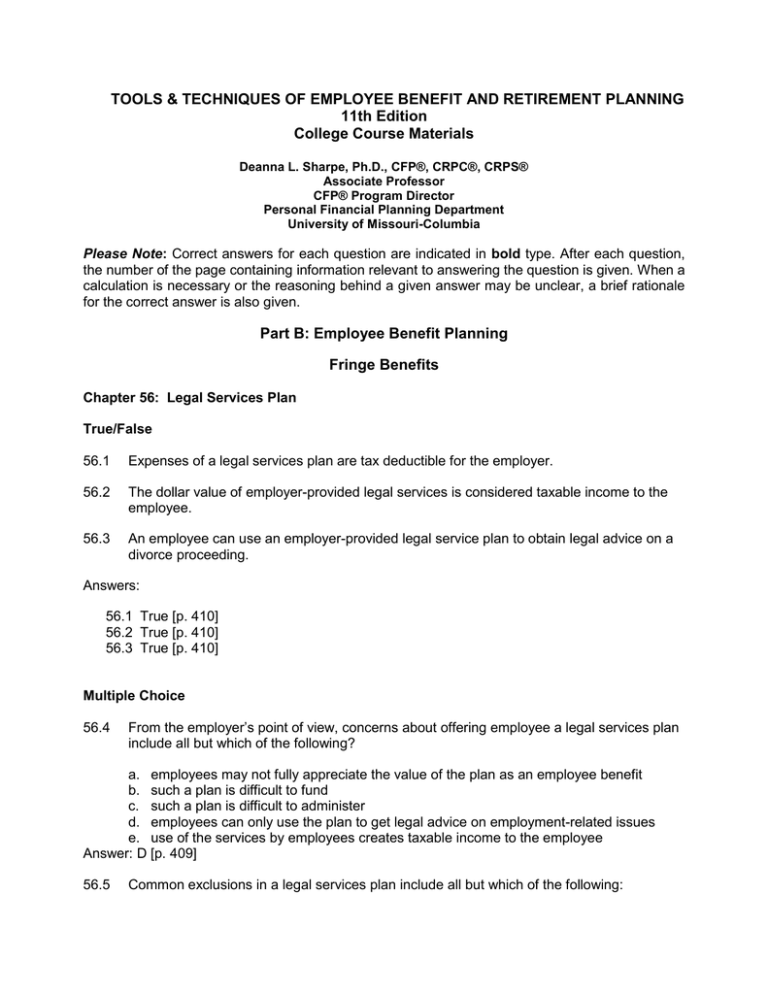

TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition College Course Materials Deanna L. Sharpe, Ph.D., CFP®, CRPC®, CRPS® Associate Professor CFP® Program Director Personal Financial Planning Department University of Missouri-Columbia Please Note: Correct answers for each question are indicated in bold type. After each question, the number of the page containing information relevant to answering the question is given. When a calculation is necessary or the reasoning behind a given answer may be unclear, a brief rationale for the correct answer is also given. Part B: Employee Benefit Planning Fringe Benefits Chapter 56: Legal Services Plan True/False 56.1 Expenses of a legal services plan are tax deductible for the employer. 56.2 The dollar value of employer-provided legal services is considered taxable income to the employee. 56.3 An employee can use an employer-provided legal service plan to obtain legal advice on a divorce proceeding. Answers: 56.1 True [p. 410] 56.2 True [p. 410] 56.3 True [p. 410] Multiple Choice 56.4 From the employer’s point of view, concerns about offering employee a legal services plan include all but which of the following? a. employees may not fully appreciate the value of the plan as an employee benefit b. such a plan is difficult to fund c. such a plan is difficult to administer d. employees can only use the plan to get legal advice on employment-related issues e. use of the services by employees creates taxable income to the employee Answer: D [p. 409] 56.5 Common exclusions in a legal services plan include all but which of the following: a. b. c. d. e. class action suits personal bankruptcy actions against a labor union audits by the IRS actions arising out of an employee’s business transactions that are not related to the employer providing the legal services plan Answer: B [pp. 409-410] 56.6 Disadvantages of a legal services plan include all of the following except: a. b. c. d. e. it may not be a widely used employee benefit employees can use the plan to take legal action against their employer it is difficult to fund a legal services plan administration of a legal services plan is difficult value of legal services provided is taxable income to employees Answer: B [p. 409] Application 56.7 Afton Granger is one of your clients. Recently, Afton received notice from the IRS that he will be audited this year. Afton’s employer has a legal services plan, set up on a comprehensive basis that contains the most common exclusions. Can Afton use the legal services plan at his place of employment if he needs the services of a lawyer to while contending with the IRS audit. a. yes b. no Answer: B [pp. 409-410] 56.8 Beneficient Enterprises is considering installing a legal services plan, but is concerned about controlling costs. As her financial advisor, you tell the owner of Beneficent that she can limit benefits under the plan: a. b. c. d. e. to a flat amount for a given service by setting a maximum hourly rate by putting a cap on the amount of benefit each employee receives all of the above only a and c Answer: D [p. 410] 56.9 As Joe Burton’s financial advisor, you’ve encouraged Joe to see a lawyer to finalize his will and to resolve a legal dispute that has arisen over an easement on a lot that Joe owns. Joe tells you that he has a legal services plan at work that will provides up to $1,000 in legal service fees per year. Since he’s friends with the company accountant, he knows that his employer has a “pay-as-you-go”-plan. Joe asks you about the tax consequences of using the legal services plan. You tell Joe: a. b. c. d. e. if he’s fully vested in the benefit, he’ll get the legal service benefits tax-free he’ll be taxed on the value of the benefits that he receives his employer will get a tax deduction a and c b and c Answer: E [p. 410 – “A” is true if the employer pays a group legal insurance premium to an insurance company. In this case, however, the employer pays for benefits out of current revenue as employees receive benefits. With this structure, the employee is taxed on the value of benefits as they are received, and the employer gets a tax deduction.] 56.10 The owner of Braxton Steel Corporation and you have been discussing installation of a legal services plan at Braxton. The owner has asked you to explain the features of an open-panel prepayment legal services plan. You reply: a. b. c. d. e. the employees can choose their own lawyer the employees can choose a lawyer from an approved list the lawyer must agree in advance to a fee schedule set by the legal services plan all of the above only a and c Answer: D [p. 410]