TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition

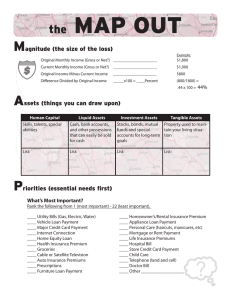

advertisement

TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition College Course Materials Deanna L. Sharpe, Ph.D., CFP®, CRPC®, CRPS® Associate Professor CFP® Program Director Personal Financial Planning Department University of Missouri-Columbia Please Note: Correct answers for each question are indicated in bold type. After each question, the number of the page containing information relevant to answering the question is given. When a calculation is necessary or the reasoning behind a given answer may be unclear, a brief rationale for the correct answer is also given. Part B: Employee Benefit Planning Health Coverage Chapter 49: Long-Term Care Plan True/False 49.1 COBRA continuing coverage requirements apply to long term care plans 49.2 The employee’s share of premiums for purchase of an employer-provided long term care plan can be paid from a cafeteria or flexible spending type of account 49.3 Subject to an age-based limitation, a self-employed person can deduct 100% of premiums for a qualified long term care contract. Answers: 49.1 False [p. 377] 49.2 False [p. 377] 49.3 True [p. 378] Multiple Choice 49.4 Tax benefits for a long term care plan are a. b. c. d. e. premium costs deducible to the employer premiums and benefits are nontaxable to employees within certain limits premiums and benefits are nontaxable to beneficiaries within certain limits all of the above only a and b Answer: D [p. 378] 49.5 An employer-provided long term care plan is useful a. when the employee group is relatively older b. because it reduces cost of obtaining coverage c. because employee share of premium can be paid with a flexible spending account or cafeteria plan d. a and b e. a and c Answer: D [p. 377] 49.6 A long term care policy contract has the same tax treatment as an accident and health insurance contract if a. b. c. d. e. the only insurance provided is qualified long term care services refunds of premium are paid to the employee the contract has no cash surrender value a and b a and c Answer: E [p. 378] Application 49.7 B. G. Hart, owner of Beneficial Industries, has 50 employees. His 5 top managers are in their 50’s. Ten of his assistant manages are in their mid-to-late 40’s. Average age of his line workers is 29. Advantages of offering long term care insurance as an employee benefit include all but which of the following? a. he can offer employee a tax-favored benefit that employees might not be able to afford on their own b. all of his employees are likely to appreciate employer assistance with long term care c. Beneficial’s payment of the premium will not result in taxable income to employees d. employees or their beneficiaries will receive plan benefits tax-free e. Beneficial gets a tax deduction for making premium payments Answer: B [p. 377] 49.8 Abigail Thompson is a self-employed business woman. At age 62, she is interested in purchasing qualified long-term care insurance through her business. If she does so, a. b. c. d. she cannot deduct any premiums costs but may get a lower price she can deduct 100% of premiums regardless of cost she can deduct 50% of premiums regardless of cost she can deduct 100% of premiums, limited first to the 7.5 percent of adjusted gross income floor under the tax code e. she can deduct 100% of premiums after she reaches age 65 Answer: D [p. 378] 49.9 Maria Estaban has a flexible spending plan at her place of employment. Maria can use funds from her flexible spending plan to pay her share of the premiums for long term care insurance offered as an employer-sponsored plan. a. true b. false Answer: B [p. 377] 49.10 The owner of Aging Industries is interested in offering his workforce long term care insurance as an employee benefit. The average age of his workforce is 52 and several employees are already struggling with finding care for aging parents. The owner of Aging, however, is concerned that meeting COBRA provisions coupled with the high cost of long term care insurance will place a heavy burden on company finances since a relatively large number of employees are retiring this year. The owner of Aging Industries’ concern about this high cost is valid. a. true b. false Answer: B [p. 377]