Chapter 41 G -T L

advertisement

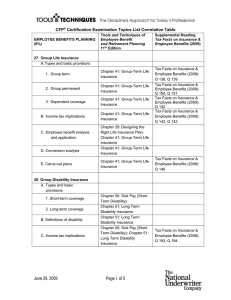

Chapter 41 GROUP-TERM LIFE INSURANCE LEARNING OBJECTIVES: A. Have a basic understanding of group-term life insurance B. Identify key issues related to a group life insurance carve-out for executives REVIEW: This chapter covers group-term life insurance along with the carve-out for executives. The chapter begins by highlighting the $50,000 tax-free benefit under Code section 79. Design features are discussed, focusing on the following nondiscrimination requirements: coverage rules, benefit rules, and who can be excluded. Requirements of Section 79 regulations are also covered in this section. Group life insurance carve-out for executives has extended coverage, and includes the carve-out concept, advantages of carve-out coverage over group-term, and how to structure the carve-out coverage. Tax implications are discussed, including Table I rates for group term insurance. Group-term life is an ERISA welfare benefit plan. Several alternatives are discussed, including life insurance in a qualified plan, split dollar, a death benefit only plan, and personally-owned insurance. Brief mention is made on how to install a plan. This is followed by two references on where to learn more. The chapter ends with a question and answer section, and a chart comparing group-term vs. carve-out. CHAPTER OUTLINE: A. What Is It? B. When Is It Indicated? C. Design Features 1. Nondiscrimination Requirements 2. Requirements of Section 79 Regulations 3. Group Life Insurance Carve-Out for Executives 1 Chapter 41 D. E. F. G. H. I. J. Tax Implications ERISA and Other Requirements Alternatives How to Install a Plan Where Can I Find Out More About It? Questions and Answers Chapter Endnotes FEATURED TOPICS: Group-term life insurance FIGURES: Figure 41.1 Group-Term vs. Carve-Out CFP® CERTIFICATION EXAMINATION TOPIC: Topic 27: Group life insurance A. Types and basic provisions 1) Group term COMPETENCY: Upon completion of this chapter, the student should be able to: 1. Have a basic understanding of group-term life insurance 2. Identify key issues related to a group life insurance carve-out for executives KEY WORDS Group-term life insurance IRC Section 79 $50,000 tax-free limit Executive carve-out Table I rates Chapter 41 Group universal life insurance (GULP) DISCUSSION: 1. Discuss requirements of Section 79 regulations in order to obtain the $50,000 exclusion. 2. Discuss issues related to group life insurance carve-out for executives. QUESTIONS: 1. Which of the following rules must be followed in order to meet nondiscrimination requirements in a group term life insurance plan? (1) the plan must not benefit a nondiscriminatory classification of employees, as determine by the IRS (2) some benefit available to key employees do not have to be available to other plan participants (3) the plan must benefit at least 70 percent of all employees (4) the plan must benefit a group of which at least 85 percent are not key employees a. b. c. d. (1) and (2) only (3) and (4) only (1) (2) and (3) only (2) (3) and (4) only Chapter 41, p. 319 2. Which of the following are requirements of Section 79 regulations? (1) insurance amounts for employees must be determined under a formula that assures individual selection (2) the plan must provide a general death benefit (3) the benefit must be provided to a group of employees as compensation for services (4) the insurance policy must be carried directly or indirectly by the employer a. b. c. d. (1) and (3) only (2) and (4) only (1) (2) and (3) only (2) (3) and (4) only Chapter 41, p. 320 Chapter 41 3. Which of the following are advantages of carve-out coverage over group-term life insurance? (1) executives can be provided with more insurance (2) the plan can provide cash growth which is a portable benefit (3) doing the carve-out may save an otherwise discriminatory plan (4) the same multiple of salary can be used for the executive as for all other employees a. b. c. d. (1) and (2) only (3) and (4) only (1) (2) and (3) only (2) (3) and (4) only Chapter 41, p. 320 4. For which of the following self-employed persons or S corporation shareholders may group-term insurance be provided on a tax favored basis? (1) regular employees (less than 2% shareholders of an S corporation) (2) self-employed proprietors (3) self-employed partners (4) more than 2% shareholders of an S corporation a. b. c. e. (1) only (1) (2) and (3) only (2) (3) and (4) only (1) (2) (3) and (4) Chapter 41, p. 321 ANSWERS: 1. b 2. d 3. c 4. a