SYLLABUS - SECTION 3022

advertisement

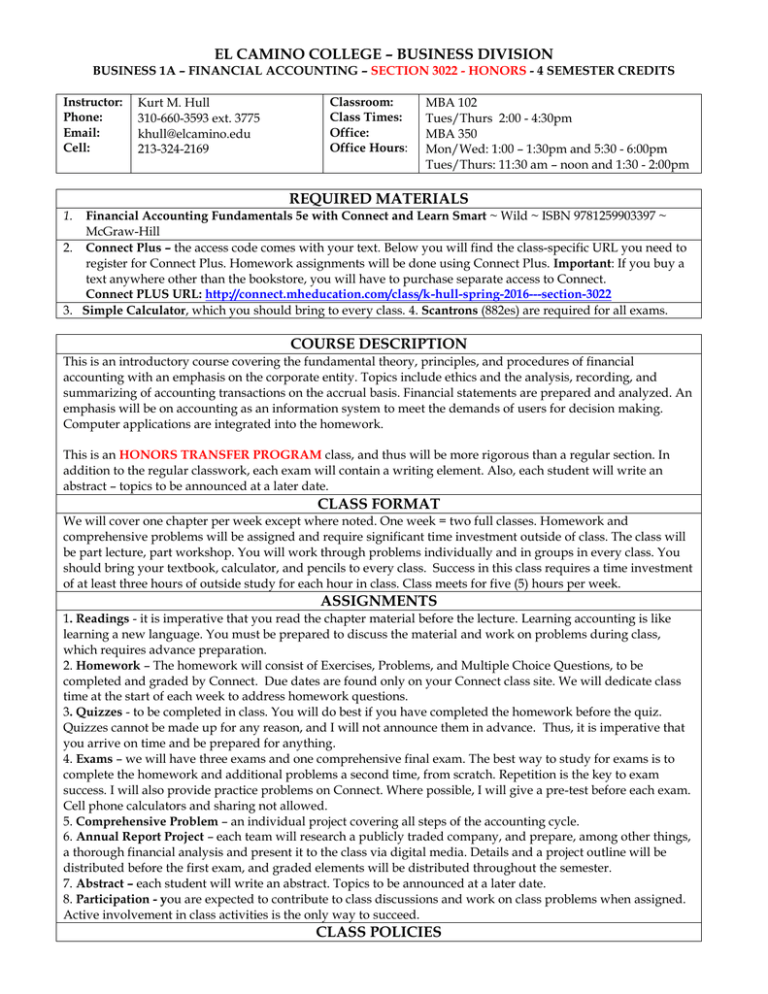

EL CAMINO COLLEGE – BUSINESS DIVISION BUSINESS 1A – FINANCIAL ACCOUNTING – SECTION 3022 - HONORS - 4 SEMESTER CREDITS Instructor: Phone: Email: Cell: Kurt M. Hull 310-660-3593 ext. 3775 khull@elcamino.edu 213-324-2169 Classroom: Class Times: Office: Office Hours: MBA 102 Tues/Thurs 2:00 - 4:30pm MBA 350 Mon/Wed: 1:00 – 1:30pm and 5:30 - 6:00pm Tues/Thurs: 11:30 am – noon and 1:30 - 2:00pm REQUIRED MATERIALS 1. Financial Accounting Fundamentals 5e with Connect and Learn Smart ~ Wild ~ ISBN 9781259903397 ~ McGraw-Hill 2. Connect Plus – the access code comes with your text. Below you will find the class-specific URL you need to register for Connect Plus. Homework assignments will be done using Connect Plus. Important: If you buy a text anywhere other than the bookstore, you will have to purchase separate access to Connect. Connect PLUS URL: http://connect.mheducation.com/class/k-hull-spring-2016---section-3022 3. Simple Calculator, which you should bring to every class. 4. Scantrons (882es) are required for all exams. COURSE DESCRIPTION This is an introductory course covering the fundamental theory, principles, and procedures of financial accounting with an emphasis on the corporate entity. Topics include ethics and the analysis, recording, and summarizing of accounting transactions on the accrual basis. Financial statements are prepared and analyzed. An emphasis will be on accounting as an information system to meet the demands of users for decision making. Computer applications are integrated into the homework. This is an HONORS TRANSFER PROGRAM class, and thus will be more rigorous than a regular section. In addition to the regular classwork, each exam will contain a writing element. Also, each student will write an abstract – topics to be announced at a later date. CLASS FORMAT We will cover one chapter per week except where noted. One week = two full classes. Homework and comprehensive problems will be assigned and require significant time investment outside of class. The class will be part lecture, part workshop. You will work through problems individually and in groups in every class. You should bring your textbook, calculator, and pencils to every class. Success in this class requires a time investment of at least three hours of outside study for each hour in class. Class meets for five (5) hours per week. ASSIGNMENTS 1. Readings - it is imperative that you read the chapter material before the lecture. Learning accounting is like learning a new language. You must be prepared to discuss the material and work on problems during class, which requires advance preparation. 2. Homework – The homework will consist of Exercises, Problems, and Multiple Choice Questions, to be completed and graded by Connect. Due dates are found only on your Connect class site. We will dedicate class time at the start of each week to address homework questions. 3. Quizzes - to be completed in class. You will do best if you have completed the homework before the quiz. Quizzes cannot be made up for any reason, and I will not announce them in advance. Thus, it is imperative that you arrive on time and be prepared for anything. 4. Exams – we will have three exams and one comprehensive final exam. The best way to study for exams is to complete the homework and additional problems a second time, from scratch. Repetition is the key to exam success. I will also provide practice problems on Connect. Where possible, I will give a pre-test before each exam. Cell phone calculators and sharing not allowed. 5. Comprehensive Problem – an individual project covering all steps of the accounting cycle. 6. Annual Report Project – each team will research a publicly traded company, and prepare, among other things, a thorough financial analysis and present it to the class via digital media. Details and a project outline will be distributed before the first exam, and graded elements will be distributed throughout the semester. 7. Abstract – each student will write an abstract. Topics to be announced at a later date. 8. Participation - you are expected to contribute to class discussions and work on class problems when assigned. Active involvement in class activities is the only way to succeed. CLASS POLICIES 1. Attendance: by registering for this class you agree to attend class meetings. Attendance includes arriving on time, being prepared for class, and being respectful. Students arriving late or leaving early may be counted as absent. The official El Camino Attendance Policy states: Students whose absences exceed 10% of the scheduled class meeting time may be dropped by the instructor (for a 3 or 4 unit course – 10% is approximately 3 classes). However, students are responsible for dropping a class within the deadlines published in the class schedule. 2. Adds/Drops: students are responsible for adding and dropping classes, with the exception noted above in #1. If you do not officially withdraw before the end of the 12 th week of the semester, then you must be assigned a grade based on what you have earned. 3. Academic Dishonesty: El Camino College places a high value on the integrity of its student scholars. When an instructor determines that there is evidence of dishonesty in any academic work (including, but not limited to cheating, plagiarism, or theft of exam materials), disciplinary action appropriate to the misconduct as defined in BP 5500 may be taken. A failing grade on an assignment in which academic dishonesty has occurred and suspension from class are among the disciplinary actions for academic dishonesty (AP 5520). Students with any questions about the Academic Honesty or discipline policies are encouraged to speak with their instructor in advance. http://www.elcamino.edu/administration/board/boarddocs/5500%20%20Academic%20Honesty.pdf. 4. ADA – Students with disabilities are an integral and vital part of the El Camino College community. The SRC provides support services, adaptive equipment, computer technology, and specialized instruction to serve students with verified disabilities. The SRC provides accommodations for both academic and extracurricular college activities. The SRC’s primary goal is to provide accommodations necessary to assist students with achieving their educational and vocational goals while promoting self-advocacy and independent learning. The SRC Office promotes shared responsibility with the student, instructor, and college staff for student success. The assistance provided by the SRC is in addition to services and instruction otherwise available to all students. Details can be found at: http://www.elcamino.edu/academics/src/applyeligibility.asp or call (310) 660-3295. 5. Late Work will not be accepted, except in extreme situations at the discretion of the instructor. GRADING 4 exams (100 points each) 400 Quizzes ( 5 points each, in class) 30 Learn Smart Modules (3 points each, graded by Connect) 33 Homework ( 4 points each, graded by Connect) 44 Comprehensive Problem 33 Abstract 30 Annual Report Project (Group Project – see separate outline/rubric below) 60 630 Total Points LETTER GRADES will be based on the following standard grading system: A (90-100%) ~ B (80-89.9%) ~ C (70-79.9%) ~ D (60-69.9%) ~F (Below 60%) I do not curve. All grades are based on points earned. There are no extra credit assignments. 63.49% 4.76% 5.24% 6.98% 5.24% 4.76% 9.53% 100% TENTATIVE COURSE SCHEDULE AND ASSIGNMENT LIST ~ SPRING 2016 Date Tuesday - 1/19 2 3 4 5 6 7 8 Thursday - 1/21 Tuesday – 1/26 Thursday – 1/28 Tuesday – 2/2 Thursday – 2/4 Tuesday – 2/9 Thursday – 2/11 9 10 11 12 Tuesday – 2/16 Thursday – 2/18 Tuesday – 2/23 Thursday – 2/25 Homework assignments can be found on our Connect class site. Class 1 The instructor reserves the right to make changes in the schedule. Details Introductions Chapter 1 Chapter 1 Chapter 1 Chapter 2 Chapter 2 Chapter 3 Chapter 3 Exam 1 Pretest Annual Report Task 1 Due (In class) Exam 1 – Chapters 1-3 Chapter 4 Chapter 4 Chapter 5 13 14 15 16 17 18 19 20 21 22 Tuesday – 3/1 Thursday – 3/3 Tuesday – 3/8 Thursday – 3/10 Tuesday – 3/22 Thursday - 3/24 Tuesday – 3/29 Thursday – 3/31 Tuesday – 4/5 Thursday – 4/7 23 24 25 26 27 Tuesday – 4/12 Thursday – 4/14 Tuesday – 4/19 Thursday – 4/21 Tuesday – 4/26 28 29 30 Thursday – 4/28 Tuesday – 5/3 Thursday – 5/5 31 32 Tuesday – 5/10 Thursday – 5/12 Chapter 5 Exam 2 Pretest Exam 2 – Chapters 4-5 Chapter 6 Chapter 6 Chapter 7 Chapter 7 Chapter 8 Chapter 8 Exam 3 Pretest Annual Report Project – Task 2 Due (In Class) Exam 3 – Chapters 6-8 Chapter 9 Chapter 9 Chapter 10 Chapter 10 Abstracts Due in class Chapter 11 Chapter 11 Final Exam Pretest Annual Report Project – Task 3 Due (In Class) Annual Report Presentations - Tasks 4 and 5 Final Exam - Comprehensive ANNUAL REPORT PROJECT DETAILS Task # 1 2 3 4&5 Task Description Due Date Points Group formation/company selection Thursday – 2/11 9 Ratio Set #1 Thursday – 4/7 11 Ratio Set #2 Thursday – 5/5 10 Presentations & Peer Evaluations Tuesday – 5/10 30 Total Points 60 IMPORTANT DATES AND OTHER INFORMATION **Holiday/No Class: Monday, January 18 (MLK Day) and Monday February 15 (Washington’s Day). Spring Recess: Sat-Fri March 12-18, 2016 Last day to add a full-semester class: Friday, January 29, 2016 Last day to drop and be eligible for a refund: Friday, January 29, 2016 Last day to drop without a notation on permanent record: Friday, January 29, 2016 Last day to drop with a “W”: Friday, April 15, 2016 STUDENT LEARNING OUTCOMES 3 Upon completion of the course, students will be able to: Evaluate the financial position and profitability of the business entity using various financial ratios. Solve a comprehensive accounting problem that involves preparation of 3 of the 4 basic financial statements, which include the balance sheet, the income statement, and the statement of retained earnings. Understand and utilize financial accounting concepts and terminology. 1 Upon completion of this course, students should achieve the following course objectives. Define Accounting terminology. 1 2 COURSE OBJECTIVES 2 Interpret, analyze record and process a wide array of business transactions in accordance with acceptable accounting theory, principles, and practices as well as government regulation, federal tax laws, and generally accepted accounting principles. 3 Appraise the changing role of accountants in today’s business. 4 Reformulate an accounting system into an information system. 5 Analyze financial transactions and their effect on the accounting equation. 6 Measure a company’s performance through its financial statements. 7 Describe and perform the accounting functions of the accounting cycle for service and merchandising businesses. 8 Apply the principles and concepts of accounting to accounting situations. 9 Compare the cash basis to accrual basis accounting. 10 Evaluate the concept of the present value of money. 11 Identify the characteristics of corporations and the stockholders’ equity section of balance sheets. 12 Evaluate and interpret the Statement of Cash Flows. 13 Calculate Financial Statement ratios using analysis tools. 14 Prepare general ledger entries using computer software programs. 15 Collaborate in a group environment to analyze ethical implications of business decisions.