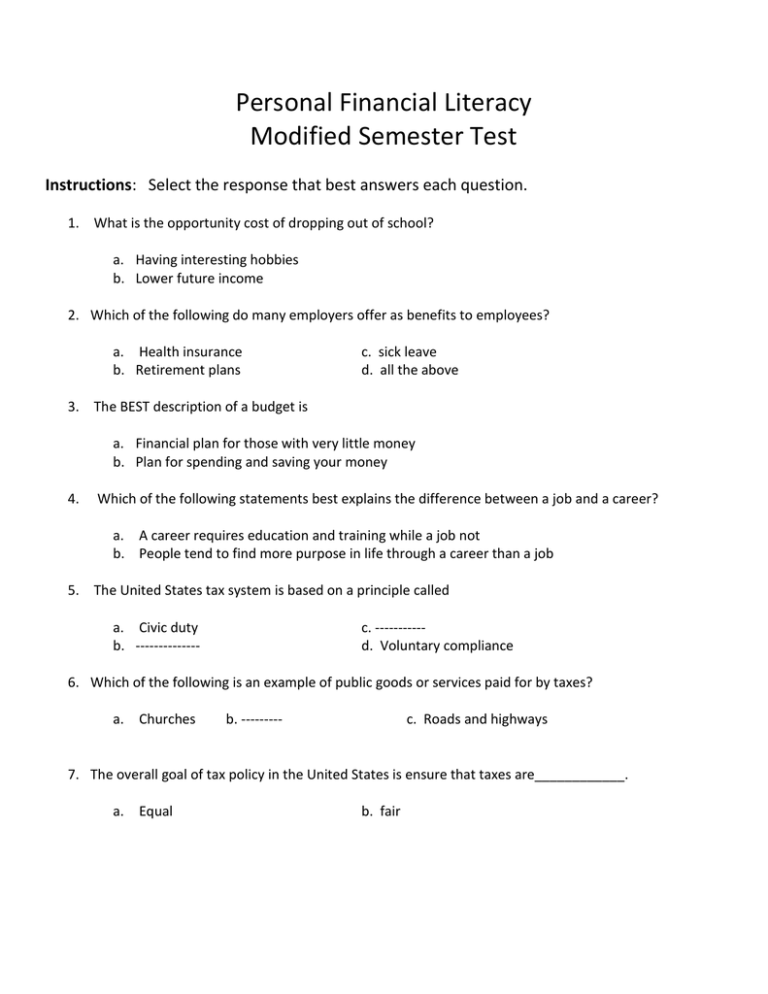

Personal Financial Literacy Modified Semester Test Instructions

advertisement

Personal Financial Literacy Modified Semester Test Instructions: Select the response that best answers each question. 1. What is the opportunity cost of dropping out of school? a. Having interesting hobbies b. Lower future income 2. Which of the following do many employers offer as benefits to employees? a. Health insurance b. Retirement plans c. sick leave d. all the above 3. The BEST description of a budget is a. Financial plan for those with very little money b. Plan for spending and saving your money 4. Which of the following statements best explains the difference between a job and a career? a. A career requires education and training while a job not b. People tend to find more purpose in life through a career than a job 5. The United States tax system is based on a principle called a. Civic duty b. -------------- c. ----------d. Voluntary compliance 6. Which of the following is an example of public goods or services paid for by taxes? a. Churches b. --------- c. Roads and highways 7. The overall goal of tax policy in the United States is ensure that taxes are____________. a. Equal b. fair 8. The PRIMARY purpose of taxes is to a. b. c. d. Provide people with free goods and services --------------------------Provide services that improve the quality of life in the United States 9. The main difference between a bank and a credit union is a. A bank is for-profit and a credit union is a non-profit financial service provider b. No difference 10. The PRIMARY reason for the expansion of financial services is a. Changes in federal laws giving banks increased powers b. ------------------c. Changes in technology that makes more services available 11. The PRIMARY purpose of a checking account is to a. Allow to buy now and pay later b. Assist with financial transaction 12. A check is defined as a written document (or order) a. Ordering a financial institution to transfer money from your account to a second party b. Showing the balance in your checking account 13. A debit card a. ------------b. Is the same as a credit card c. Is the same as a check, only in plastic form 14. Deposits represent funds that are a. Added to your checking account b. Not available in your checking account 15. Reconciling or balancing a bank statement is used to a. Determine if there are any mistakes in your records b. Find your daily account balance 16. Inflation refers to a. An overall increase in prices. b. The amount of money earned by investing. 17. Stocks and bonds are similar in that both a. Have a guaranteed rate of return. b. -------c. Have relatively high levels of risk. 18. Which of the following BEST describes diversifying a portfolio? a. Buying stocks every year in the same company. b. ------------c. Buying stocks in several different companies to spread the risk. 19. Government savings bonds a. Generally are a very risky investment options. b. --------------c. Are backed by the U.S. government, so there is little or no default risk. 20. When planning for retirement, you need to determine a. -----------b. How much money you want your children to inherit. c. How much money you will need and how many years you will need it. 21. As a young person, saving for your retirement is an example of a ____________________ goal. a. Short-term b. --------- c. ----------d. long-term 22. If your company has a retirement plan, a. You can wait until you are in your 40’s to start participating without any costs. b. You should sign up as soon as possible so your investment will start growing. 23. Most credit cards are a. The same as cash b. ---------c. An example of installment credit 24. The term APR is the a. Annual Parsonage Residence b. Annual Percentage Rate 25. The most important factor of earning a high credit (FICO) score is a. Being a good person b. --------- c. Pay your bills on time 26. Which of the following is an example of secured credit? a. Borrowing to buy a car b. Getting a credit card 27. Before getting a credit card, it is important to a. Ask about the free gift b. ---------- 28. c. Read the fine print to understand the terms d. ------------ The minimum payment on your statement indicates the a. Amount the credit card company will pay you b. c. Least amount you can pay without additional late fees 29. The “s” in https indicates you are using a ___________________ Web site. a. Superfast b. Secure 30. Whether buying online or buying from a local merchant, always a. Use play money b. --------- c. Buy from a reputable company 31. Using a person’s name or personal information to make purchases or get loans is called a. Fraud b. --------- c. Identity Theft 32. People who attempt to swindle or trick you into illegal schemes are commonly called a. Schemers b. Con artists 33. _________ is a legal term used when someone knowingly deceives you for their own personal gain. a. Fraud b. Phishing 34. One of the advantages of renting is a. Can build equity b. c. have less responsibility 35. A lease specifies ________________ when renting a place to live. a. b. c. d. What you cannot do -------------------The rights and responsibilities of the tenant and landlord 36. A down payment is the a. Part of the purchase paid in cash up front b. Amount that a person must pay when renting an apartment 37. A month to month lease can be terminated a. By the landlord or tenant b. Only by the tenant 38. You decide to move into an apartment. Which kind of insurance will provide protection for your personal property? a. Liability insurance b. Renter’s insurance 39. The amount of out of pocket money you pay before your insurance begins to provide coverage is a. Benefit b. Copay 40. _____________ are the payments you make for insurance coverage. a. Benefits 41. b. --------- c. ------- d. Premiums _____________ is the likelihood that something will happen. a. Gambling b. --------- c. Probability d. ----------- 42. Flipping a coin is an example of a ____________ event. a. ---------b. Gambling c. Independent 43. ___________________ implies that you have some knowledge about outcome of your choices. a. ----- b.------- - c. Predictability 44. Investing in the stock market is basically a form of a. Gambling b. Predictability 45. The odds of winning gambling games favor the_____________. a. Player b. Sponsor (or house) d. Gambling 46. Which of the following is NOT considering a good option to bankruptcy? a. Consumer credit counseling c. ------b. ----------d. Stopping payment on all bills 47. The type of bankruptcy that reorganizes your personal debt with a payment plan is a. -------------48. d. Chapter 13 c. ------------d. student loans A charity organization that is more focused on the service it provides than on making money Is a __________________organization. a. Bankrupt 50. c. -------------- All of the following debts are discharges by filing bankruptcy EXCEPT a. Divorce b. ----------- 49. b. Chapter 9 c. nonprofit You can go online to check out charitable organizations at the ________________web site. a. ------------b. Goodsamaritan.com c. Guidestar.org