Farm Bill Impacts on Southern Producers Steven L. Klose

advertisement

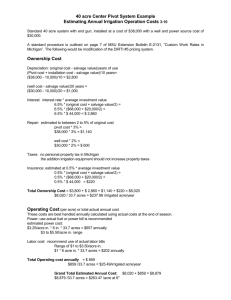

Farm Bill Impacts on Southern Producers 2008 Southern Region Outlook Conference September 22-24, 2008 Steven L. Klose Financial And Risk Management Assistance Department of Agricultural Economics Texas AgriLife Extension Service The Texas A&M University System 2008 Farm Bill, Southern Impacts Loan Rates ACRE Program Details Critical Factors AFPC Representative farms Sensitivity Conclusion Loan Deficiency Payments (LDPs)/Marketing Loan Gains (MLGs) Generally work as in the past except… Repayment of loans for loan commodities other than (upland cotton, rice, els cotton, and sunflower seed) will be at the lesser of: The loan rate established for the commodity plus interest or A rate calculated based off of the average market prices for the loan commodity during the preceding 30day period or An alternative developed by the Secretary Cotton and rice continue to use an adjusted world market price formula Example of New Grain PCP Calculations vs Actual LDP Rates for 05/06 Wheat, Moore County, TX 0.50 Month LDP uses an average of 25 reporting days per month 0.45 30 Day LDP uses the previous 30 reported prices 0.40 LDP Rate is the rate reported by FSA 0.35 0.30 0.25 0.20 0.15 0.10 0.05 0.00 9/1/2005 10/21/2005 12/10/2005 1/29/2006 LDP Rate 3/20/2006 Month LDP 5/9/2006 30 Day LDP 6/28/2006 8/17/2006 ACRE Program Irrevocable Election beginning 2009 Current program or ACRE + 80%DP + 70%LR Choice by Farm Number Average Crop Revenue Election State ACRE Guarantee = 90% * 5-Year Olympic State Avg. Yield * 2-year Natl. Average Mkt. Yr. Price State Revenue = > Actual Actual State Planted Acre Yield * MAX[ Natl. Average Mkt. Yr. Price OR 70% Loan Rate] Restricted to < 10% change/year AND Farm ACRE Benchmark = Farm's 5-Year Olympic Avg. Yield * 2-year Natl. Average Mkt. Yr. Price + Ins Premium > Actual Farm Revenue = Actual Farm’s Planted Acre Yield * MAX[ Natl. Average Mkt. Yr. Price OR 70% Loan Rate] THEN Farm Payment = 0.833 (0.85 in 2012) * Actual Planted or Considered Planted Acres * [ Farm's 5-Year Olympic Average Yield / State’s 5-year Olympic Average Yield ] * MIN[ (State ACRE Guarantee – Actual State Revenue) OR State ACRE Guarantee * 25%] Note: All Yields are Planted Acre Yields Average Crop Revenue Election (ACRE) Payment (Cont.) The total number of planted acres for which payments are received cannot exceed base acres on the farm Producer has option to choose planted acres to enroll in ACRE The bill reads as if the reduction in LRs applies to entire farm There are provisions for assigning yields, etc. by using yields from a similar state There are provisions for determining whether a state will have both irrigated and non-irrigated state guarantees If a state has at least 25% of the acres of a crop that are irrigated and at least 25% of the acres of the crop that are non-irrigated then Secretary shall calculate separate irrigated ACRE Choice Critical Factors Price / Local Yield / State Yield Correlation Relevance of existing TP / LR at current price levels Base years for price calculation Corn Price-Yield Correlation Correlation Coefficient Les s than -0.5 (Stronges t) -0.5 - -0.25 -0.25 - -0.1 Greater than -0.1 (W eakest) Cotton Price-Yield Correlation Correlation Coefficient Les s t han -0.5 (St ronges t) -0.5 - -0. 25 -0.25 - -0. 1 Great er t han -0.1 (W eakest ) Cotton Revenue Risk Coefficient of Variation Less than 30 30 - 40 40 - 50 Greater than 50 LR & TP Relevance Crops Corn ($/bu) Sorghum ($/bu) Wheat ($/bu) Upland Cotton ($/lb) Rice ($/cwt) Barley ($/bu) Oats ($/bu) Soybeans ($/bu) Peanuts ($/ton) Loan Rates 2008-09 70% 1.95 1.365 1.95 1.365 2.75 1.92 0.52 0.364 6.50 4.55 1.85 1.295 1.33 0.931 5.00 3.50 355 248.5 TP 2.63 2.57 3.92 0.7125 10.50 2.24 1.44 5.80 495 Outlook 2009 5.22 4.91 6.68 0.74 14.19 5.22 3.55 11.58 473 20% of Direct Payment Direct Payments Crops Full 80% Cost of ACRE 20% Corn ($/bu) 0.28 0.224 0.056 Sorghum ($/bu) 0.35 0.28 0.07 Wheat ($/bu) 0.52 0.416 0.104 0.0667 0.05336 0.01334 Rice ($/cwt) 2.35 1.88 0.47 Barley ($/bu) 0.24 0.192 0.048 0.024 0.0192 0.0048 0.44 0.352 0.088 36 28.8 7.2 Upland Cotton ($/lb) Oats ($/bu) Soybeans ($/bu) Peanuts ($/ton) Average Crop Revenue Election (ACRE) Payment (Cont.) AFPC risk-based decision aid to evaluate expected benefits from current programs (DP,LDP,CCP) vs (ACRE and reduced DP, LDP) The decision has a lot of moving parts (farm yields, state yields, marketing year prices and expected future prices) Correlation of moving parts Results of Total Gov’t Payments: Cotton Texas Southern Plains (3745 Acres) Comparison of Average Annual Payments under ACRE and CCP in TXSP3745 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 50,000 100,000 150,000 200,000 Sum ACRE 250,000 300,000 Sum CCP 350,000 400,000 450,000 Cotton Alabama (3000 Acres) Comparison of Average Annual Payments under ACRE and CCP in ALC3000 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 50,000 100,000 150,000 Sum ACRE 200,000 Sum CCP 250,000 300,000 Cotton Tennessee (4050 Acres) Comparison of Average Annual Payments under ACRE and CCP in TNC4050 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 50,000 100,000 150,000 200,000 Sum ACRE 250,000 Sum CCP 300,000 350,000 400,000 Cotton Georgia (2300 Acres) Comparison of Average Annual Payments under ACRE and CCP in GAC2300 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 50,000 100,000 150,000 Sum ACRE 200,000 Sum CCP 250,000 300,000 350,000 Cotton North Carolina (1500 Acres) Comparison of Average Annual Payments under ACRE and CCP in NCC1500 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 20,000 40,000 60,000 Sum ACRE 80,000 Sum CCP 100,000 120,000 140,000 ACRE Choice: Cotton farms Certainty Equivalent Farms ACRE Old Program (06-07 Base) Texas (3745) 175,195 102,674 Alabama (3000) 106,590 126,684 Tennessee (4050) 118,331 139,003 Georgia (2300) 126,126 158,370 47,275 49,492 North Carolina (1500) Grain Texas Northern Plains (8000 Acres) Comparison of Average Annual Payments under ACRE and CCP in TXNP8000 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 100,000 200,000 300,000 400,000 Sum ACRE 500,000 Sum CCP 600,000 700,000 800,000 Grain Iowa (3400 Acres) Comparison of Average Annual Payments under ACRE and CCP in IAG3400 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 50,000 100,000 150,000 200,000 Sum ACRE 250,000 Sum CCP 300,000 350,000 400,000 Grain Tennessee (2750 Acres) Comparison of Average Annual Payments under ACRE and CCP in TNG2750 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 180,000 200,000 Sum ACRE Sum CCP Grain South Carolina (3500 Acres) Comparison of Average Annual Payments under ACRE and CCP in SCG3500 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 50,000 100,000 150,000 Sum ACRE 200,000 Sum CCP 250,000 300,000 ACRE Choice: Grain farms Certainty Equivalent Farms ACRE 2006-07 Old Program Texas (8000) 252,444 147,373 Iowa (3400) 105,808 74,981 63,099 42,387 148,716 104,120 Tennessee (2750) South Carolina (3500) Wheat Washington (3500 Acres) Comparison of Average Annual Payments under ACRE and CCP in WAAW3500 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 10,000 20,000 30,000 40,000 Sum ACRE 50,000 60,000 Sum CCP 70,000 80,000 90,000 Wheat Kansas (4000 Acres) Comparison of Average Annual Payments under ACRE and CCP in KSCW4000 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 20,000 40,000 60,000 Sum ACRE 80,000 Sum CCP 100,000 120,000 140,000 ACRE Choice: Wheat farms Certainty Equivalent Farms ACRE 2006-07 Old Program Washington (3500) 32,201 28,664 Kansas (4000) 60,005 58,803 Rice Arkansas (3240 Acres) Comparison of Average Annual Payments under ACRE and CCP in ARSR3240 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 Sum ACRE Sum CCP Rice Louisiana (1000 Acres) Comparison of Average Annual Payments under ACRE and CCP in LASR ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 20,000 40,000 60,000 Sum ACRE 80,000 Sum CCP 100,000 120,000 Rice California (2365Acres) Comparison of Average Annual Payments under ACRE and CCP in CAR2365 ($s) 1 Prob 0.8 0.6 0.4 0.2 0 - 100,000 200,000 300,000 Sum ACRE 400,000 Sum CCP 500,000 600,000 ACRE Choice: Rice farms Certainty Equivalent Farms ACRE 2006-07 Old Program Arkansas (3240) 228,701 198,391 Louisiana (1000) 59,271 58,345 California (2365) 226,274 255,865 Average Crop Revenue Election (ACRE) Payment (Cont.) FSA currently working on rules for 2009 2012 Current controversy over whether USDA will use 2006 and 2007 price or 2007 and 2008 price to determine revenue guarantee Bill clearly says the previous two years ACRE: Cotton Price Base 0.9 0.8 0.7 0.6 0.5 0.4 0.3 2006 Price 2007 06-07Min 2008 2009 06-07Max 2010 2011 07-08Min 2012 07-08Max ACRE Choice: Cotton farms Certainty Equivalent Farms ACRE ACRE (07-08 Base) (06-07 Base) Old Program Texas (3745) 204,228 175,195 102,674 Alabama (3000) 121,679 106,590 126,684 Tennessee (4050) 146,667 118,331 139,003 Georgia (2300) 149,818 126,126 158,370 57,869 47,275 49,492 North Carolina (1500) Conclusion It depends... Interpretation Expected Price Level Interaction of program & crop revenues Education is a moving target