WHEAT AND CORN OUTLOOK

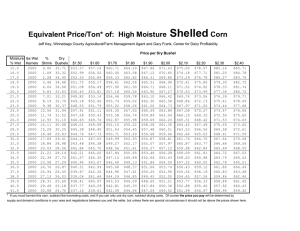

advertisement

WHEAT AND CORN OUTLOOK George A. Shumaker, PhD Professor, Ag & Applied Economics University of Georgia Prepared for 2003 Southern Regional Outlook Conference September 29 – October 1, 2003 Atlanta, GA 1 WHEAT OUTLOOK Global Wheat Situation The gap between global use of wheat and production has widened resulting in a draw down in global wheat carry over stocks. Lower U.S. spring wheat production, crop shortfalls in both Argentina and Australia along with relatively strong demand from traditional wheat importing countries all have contributed to the reduction in wheat ending stocks. These are the primary factors behind the rise in wheat prices over the last two years and given the level of stocks, price should remain relatively strong for at least one more year. The high plains area of the U.S. has very dry conditions heading into the planting season and unless moisture levels improve during the winter, we can expect lower hard red production in the U.S. next spring. This implies that a solid bottom exists in the market and the potential for volatility remains high. GLOBAL SUPPLY & DEMAND Production Use End Stocks 700 Million Metric Tonnes 600 500 400 300 200 100 0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2003 Crop Plantings and Production U.S. wheat plantings for harvest during 2003 totaled 60.9 million acres, up from 60.1 million acres in 2002 according to the September, 2003 USDA crop report. That was the 2 U.S. Wheat Acres Million Acres Planted Acres Harvested Acres 90.0 85.0 80.0 75.0 70.0 65.0 60.0 55.0 50.0 45.0 40.0 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 second consecutive year of increased wheat plantings following six years of declines. Acres for harvest as grain totaled 52.7 million acres, up a remarkable 6.9 million acres from such a slight increase in plantings. Much of that increase is due to a rebound in harvested acres in the southern plains where abandonment was unusually high last year. The increase in harvested acreage bucks a five year trend in declining harvested acres. Growing conditions were generally excellent across the nation as indicated by the record high national average yields of 43.5 bushels per acre. U.S. Wheat Yields 50.0 45.0 Bushels Per Acre 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 1976 1979 1982 1985 1988 3 1991 1994 1997 2000 2003 The wet weather during much of the growing season in many parts of the country fostered vegetative growth that produced multiple large seed heads. The only negative concerning the crop was that wet conditions continued into the harvest period resulting in some low test weights and sprouting. Total U.S. production is pegged near 2.29 billion bushels, up sharply down from the 1.62 billion bushels harvested in 2002 due both to the higher yields and increased harvested acreage. That is the highest total production figure recorded in four years. Total available wheat supplies for the 2003 marketing year will be up nearly 16 percent from a year ago at 2.864 billion bushels. Carry in stocks were very tight this year at 492 million bushels versus 772 million bushels a year ago. The increase in supplies will allow for greater use this year compared to last year when tight supplies limited off take. U.S. Wheat Total Supply Carry In Production 4,500 4,000 Million Bushels 3,500 3,000 2,500 2,000 1,500 1,000 500 0 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 Projected Use for Wheat Total wheat use from the 2003 marketing year is expected to rise from 1.98 billion bushels to 2.22 billion bushels. Only domestic mill use is expected to decline from year ago levels, down 25 million bushels to 910 million to create a three year down trend. 4 Exports are projected to rise sharply from 860 million bushels to 1.05 billion bushels reversing a four year declining trend. Smaller global supplies and a weaker dollar versus other currencies will make U.S. wheat attractive. Feed use of wheat will also increase from a record low of only 102 million bushels fed last year to a still low, by historical standards, 175 million. U.S. Wheat Use Domestic Mill Use Exports Seed Feed 3,000 Million Bushels 2,500 2,000 1,500 1,000 500 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 0 Ending Stocks and Prices Wheat ending stocks will rise and will likely be near 644 million bushels, but will be at the 2nd lowest level since the 1996 crop year. The stocks-to-use ratio would be near 29%, meaning that stocks represent 29 percent of annual use. The 644 million bushels in projected stocks is a bullish level and may lead to price improvement during the marketing year. Stocks-to-use ratios can be used as a predictor of prices due to the very strong inverse relationship the ratio has to season average price. Using the following chart we can conclude the season average price received by farmers should be near $3.25. WHEAT PRICE vs STOCK-USE RATIO $5.00 95 $4.50 96 $4.00 $3.50 94 92 93 91 $3.00 '02 '03 97 '01 90'00 $2.50 98 99 $2.00 $1.50 $1.00 $0.50 $0.00 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 5 30.0% 35.0% 40.0% 45.0% That compares favorably with the range of prices provided by USDA of between $3.10 and $3.50 per bushel. That is down slightly from year ago levels but still attractive compared to the previous five year’s average price. Given current cash prices, it is unlikely there will be a deficiency payment available for the crop this year. Price vs Stocks-to-Use Ratio Price Stocks-to-Use Ratio $5.00 120.0% $4.50 100.0% $4.00 80.0% $3.50 60.0% $3.00 40.0% $2.50 20.0% $2.00 0.0% 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 The Future Wheat production has declined in importance in the Southeast in recent years given changing cropping patterns and weak prices. However, since wheat is a crop produced by many nations around the world production can quickly respond to changes in price. It is likely we will see some expanded wheat acreage not only in the U.S. and here in the Southeast, but in other producing nations as well in response to improved prices. One aspect of the decline of wheat, and other grain production as well, in the Southeast has been the loss of country grain handling facilities. Losing local buyers means losing purchaser competition in the market place as well as increased hauling costs to the producer. An ongoing cooperative study of basis patterns for wheat in Georgia and South Carolina has found that wheat basis has weakened by as much as 18 cents per bushel as a result of loss of buying points and other structural changes in the wheat markets of those two states. The average weakening of the basis was about 7 cents per bushel over the last six years. The New Farm Bill provides price support levels for wheat. The loan rate for the 2004 crop years is about $2.80 per bushel but it varies by county. The price threshold at which there would be no Counter Cyclical Payment is $3.34. That is very near the mid point of the range of potential season average prices issued by USDA. So, if the supply – demand 6 scenario plays out as described in this article, there would be little or no CCP for the 2003 wheat crop. FEED GRAIN OUTLOOK GLOBAL SITUATION Global production of course grains has not kept pace with off take for the last five years. As a result ending stocks have been drawn down each of the last five years. The stocksto-use ratio is now at the lowest level since 1995 and just about one-half of the 2000 crop year level. Increased demand from China has had a major impact on use while relatively short U.S. crops in recent years along with drought in Europe this year have contributed to the short supply. GLOBAL COURSE GRAIN SUPPLY & DEMAND Production Use End Stocks 1000 900 Million Metric Tonnes 800 700 600 500 400 300 200 100 0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 DOMESTIC SITUATION The U.S. supply demand situation is also quite tight. According to the September SUDA Crop Production Report, U.S. farmers planted the same acreage to corn this year as last (79.1 million acres) but are projected to harvest 2.6 million acres more than last year (71.8 million acres). Improved growing conditions this year versus last year in the eastern corn belt, south and mid-south will account for most of the added harvest acres. 7 U.S. CORN ACREAGE Planted Harvested 90.0 85.0 Million Acres 80.0 75.0 70.0 65.0 60.0 55.0 50.0 45.0 19 76 19 77 19 78 19 79 19 80 19 81 19 82 19 83 19 84 19 85 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 40.0 Yields U.S. national average corn yields are projected to be 138.5 bushels per acre. If these yields do occur, they would be just off the record of 138.6 bushels per acre set in 1994. The high yields come about because of generally very good weather across much of the corn belt and excellent grain growing weather across the mid-south and southeast. Several states in those latter areas will set new yield records. Areas with less than ideal conditions lay to the west of the Mississippi River where hot and dry conditions may trim yields. An interesting phenomenon exists this year with respect to yields. As our collegue Steve Riggins at Kentucky pointed out to me, even though we are flirting with national average yields near record levels, it is possible that this year we could actually see yields falling below the trend line for the second consecutive year. According to Dr. Riggins, the last time that happened was back in 1975 and 1976. But in the years since then we have not seen yields fall below the trend line for two years in a row. Total Supplies Beginning stocks as of September 1, 2003 were just about 1 billion bushels and the lowest amount since 1996. We ended last year with a stocks-to-use ratio of 10.5% also the tightest since 1996. Production this year is currently projected to be near 9.94 billion bushels, up 936 million bushels compared to last year but just under the record of 10.1 billion bushels produced in 1994. The 9.94 billion bushels to be harvested this year 8 exceeds use during the past marketing year and should allow for expansion of off-take this year. U.S. Corn Yields 150.0 140.0 Bushels Per Acre 130.0 120.0 110.0 100.0 90.0 80.0 70.0 60.0 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 U.S. Corn Total Supply Production Carry In Stocks 14,000 10,000 8,000 6,000 4,000 2,000 9 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 0 1977 Million Bushels 12,000 Prospects for Demand Within the September USDA Corn Supply and Demand report, they project total off take to be record large at 9.9 billion bushels. USDA is predicting a drop in feed use from 5.7 billion bushels to 5.625 billion bushels due to an expected decline in Grain Consuming Animal Units. While there is likely to be modest gains in the both the poultry and hog sectors, those gains will not make up for the expected drop in the fed cattle numbers. As of August1, 2003, the cattle on feed number was down about 5 percent from last year and down 12 percent compared to two years ago when the record for feed use was set. The loss in use in feeding will be more than off set by gains in both exports and domestic food/seed/industrial sectors. The current USDA projection is for a 200 million bushel increase to 1.8 billion bushels in export sales compared to last year. Japan is our largest customer for corn and is likely to buy more this year than last. Mexico, especially since NAFTA, is our second best buyer and also is projected to buy more this year. Competition for exports comes from Argentina and China and current estimates are they both will have smaller crops this year and thus may not export as much as previously believed. The dollar is also weaker this year against most foreign currencies and that makes our corn a bargain compared to some sellers. The GMO issue still needs to be addressed if we are to return to the export levels we enjoyed during the middle of the 1990s. The Starlink problem still haunts some buyers and other nations simply have not yet accepted GMO products as safe despite all evidence to the contrary. USDA is projecting an increase in food/seed/industrial uses of 165 million bushels, a rise of 7.1 percent, if it comes to pass. Total use in this category is projected to be 2.475 billion bushels. It appears this major use category has clearly surpassed exports as the second most important market for corn. Last year, use in this category rose by 256 million bushels with the largest share of that going to ethanol production. There have been several ethanol plants come on line in the last two years with more yet to be completed. Existing plants have also expanded capacity. Increased energy costs and a strong drive to increase domestic production of all fuel sources are strong supporting factors. A total of 1 billion bushels of corn (over 10 percent of production) will be converted to ethanol during the current marketing year. Total off take will be a record 9.9 billion bushels if the USDA projects hold true. The implicit assumption is that the higher prices this demand will generate will not choke off any potential use. Time will tell if this is true or not. 10 U.S. Corn Usage Feed Use F. S.& I. Export 10,000 9,000 Million Bushels 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 FOOD, SEED & INDUSTRIAL USE OF U.S. CORN HFCS Glucose Starch Ethnaol Beverage Cereal,Other 3000 2000 1500 1000 500 03 02 20 01 20 00 20 99 20 98 19 97 19 96 19 95 19 94 19 93 19 92 19 91 11 19 90 19 89 19 88 19 87 19 86 19 85 19 84 19 83 19 82 19 81 19 19 80 0 19 Thousand Bushels 2500 Ending Stocks and Season Average Price At the end of the marketing year, it appears we will end up with stocks very close to where we started the year, that is right around 1 billion bushels. I like to use the Stocksto-Use Ratio as a way of looking at the relationship between stocks and prices. Given that there will be a very small change in the Ratio 10.8 percent for this year versus 10.5 last year, one can conclude that the season average price this year should be very similar to last year. USDA make prices projects by giving a range of potential price outcomes. Their range for this year is from $2.10 to $2.50. The mid-point of that range, $2.30, might be considered the price closest to the likely season average. Last year’s season average price was $2.30. When this data is plotted in a different fashion we have an interesting finding. Note the “top” trend line in the following diagram. It represents the trend relationship between season average prices and Stocks-to-Use Ratios during 1990-1998. Now note the “bottom” trend line that represents the trend relationship between season average prices and Stocks-to-Use Ratios during1998-2003. In effect, what we have observed is a decline in the relative importance of stocks as a season average price determinant over the last few years. My feeling is that the emergence of production of corn in other countries around the world has made the U.S. stocks position less important in price determination that it once was. That is not to say this relationship is not important, it is just less so than previously. U.S CORN PRICE vs STOCKS RATIO $3.50 95 $3.00 96 $2.50 93 "02 97 94 91 "03 $2.00 "01 $1.50 90 98 99 92 "00 $1.00 $0.50 $0.00 0.0% 5.0% 10.0% 15.0% 12 20.0% 25.0% 30.0% Final Observations and Marketing Strategies It appears we have finally moved out of the sub $2.00 price range we were in for the four years of 1998-2001. During that period supply and demand we pretty much in balance as production average 9.653 billion bushels while total use averaged 9.671 billion bushels. The average production last year and this is 9.475 while total use will average 9.755 billion bushels. We can conclude from this that only a small change in either supply or demand can have a pretty significant impact upon price. One way I go about answering the question “Should I sell now or wait?” is to use the following diagram. The Projected Price line in the chart represents the seasonal tendency of December corn futures “fitted to the actual January average of December futures”. The Actual Price is the monthly average price of December futures up to this point in time. When the Actual is greater than the Projected, then the market is providing a more “favorable” price than would be expected and the converse is also true. So, the answer I would provide is that we can get more now for our corn now than I would have projected and the tendency over the next two month is for weaker prices. RELATIVE CORN PRICES Projected vs Actual Projected Price Actual Price $2.45 $2.40 $2.35 $2.30 $2.25 $2.20 $2.15 $2.10 $2.05 $2.00 $1.95 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec However, marketing strategies are very case specific. For grower in areas where the basis strengthens significantly from harvest into the storage season, storage can be an effective strategy to follow. In cases where the basis does not show much strength after harvest, returns to storage must be generated from futures market spread or gain. In there current market (Sep. 15) there is an 8 cent spread Dec to Mar, an added 4 cents spread Mar to May for a “paper” return of 12 cents to hold from now until March. Any futures gain on top of that would be added returns to storage. Of course, there is no guarantee that futures will not fall and that is a big part of the risk of unpriced storage. 13 It is possible that there could be a modest LDP in some parts of the region at or shortly after harvest if the local supply swamps local demand. If an LDP occurs, the wise grower will claim it on any unsold corn. The chances for a Counter Cyclical Payment remains iffy but there could also be a modest CCP if prices do sag under harvest pressure and farmers sell a good portion of the crop under price duress. However, the threshold at which a CCP is triggered is a season average price of $2.32 which is real close to the mid point of the USDA price range. 14