Wheat and Feed Grain Market Outlook and Situation

advertisement

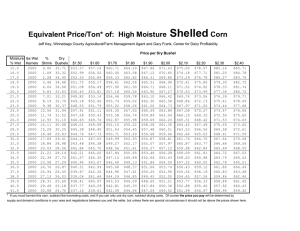

Wheat and Feed Grain Market Outlook and Situation Southern Extension Outlook Conference Tunica, Mississippi September 24, 2002 Kurt M. Guidry LSU Agricultural Center Current Market Situation •Significantly Improved Markets From Last 3 Years •Supply Driven Rally •Improved Fundamentals Increase Market Sensitivity •Since June, Futures Prices Have Increased Wheat Futures Moved Over $1.00 Per Bushel Higher Corn Futures Moved Over $0.70 Per Bushel Higher Where Will Prices Go ? •Prices Have Softened With Harvest Pressure And Likelihood Of Increased Acres For Wheat •Demand Will Likely Play Big Role In Continued Price Movement •Increased Prices Will Likely Bring More Acreage Into Production •Improved Supply and Demand Fundamentals Should Provide Support Estimated Costs and Returns For Selected Commodities - Southern States Corn Wheat Soybeans Cotton Grain Sorghum Yield 103.5 45.0 27.3 628.0 63.1 Price $2.59 $3.52 $5.21 $0.53 $2.46 Revenue $267.99 $158.23 $142.23 $332.85 $155.28 Variable Cost $151.14 $87.85 $85.60 $334.24 Returns Above Variable Cost $116.85 $70.38 $56.63 -$1.40 $94.63 $60.66 U.S. Corn Supply and Use (Domestic Measure) 2001/02 2001/02 Item Area Planted Harvested Yield per harvested acre ------------------ 2002/03------------- 2002/03 -----Estimate (Sept. - Aug.) August September (Sept. - Aug.) Million Acres Change Million Acres Million Acres Change 75.8 68.8 Bushels 138.2 Million Bushels Beginning stocks 1,899 Production 9,507 Imports 10 Supply, total 11,416 Feed and residual 5,825 Food, seed, & industrial 2,055 Domestic, total Exports Use, total Ending Stocks Stocks To Use Avg. Farm Price ($/bu) 7,880 1,900 9,780 1,636 16.73% 1.97 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 78.8 71.0 Bushels 125.2 78.8 70.5 Bushels 125.4 Million Bushels Million Bushels 1,636 1,636 8,886 8,849 15 15 10,537 10,499 5,600 5,600 2,170 2,170 7,770 2,000 9,770 767 7.85% 2.30 - 2.70 7,770 2,000 9,770 729 7.46% 2.35 - 2.75 Source: USDA, World Agricultural Supply and Demand Report, September 12, 2002. 0.00 -0.50 0.20 0.00 -37.00 0.00 -38.00 0.00 0.00 0.00 0.00 0.00 -38.00 U.S. Corn Production Million Bushels 10,000 9,500 9,000 8,500 8,000 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 U.S. Corn Food, Seed, and Industrial Use Million Bushels 2,200 2,100 2,000 1,900 1,800 1,700 1,600 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 Source: DTN AgDayta U.S. Corn Exports Million Bushels 2,050 2,000 1,950 1,900 1,850 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 Source: DTN AgDayta U.S. Corn Ending Stocks Million Bushels 2,000 1,500 1,000 500 0 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 World Corn Production 1,000 Metric Tons 610000 605000 600000 595000 590000 585000 580000 575000 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 1,000 Metric Tons Corn Production Of Selected Countries 140000 120000 100000 80000 60000 40000 20000 0 Argentina 1998/99 Brazil 1999/00 China 2000/01 Hungary 2001/02 South Africa 2002/03 World Corn Imports 1000 Metric Tons 78000 76000 74000 72000 70000 68000 66000 64000 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 1,000 Metric Tons Corn Exports Of Selected Countries 14000 12000 10000 8000 6000 4000 2000 0 Argentina 1998/99 Brazil 1999/00 China 2000/01 Hungary 2001/02 South Africa 2002/03 Corn Ending Stocks 1,000 Metric Tons 200000 150000 100000 50000 0 China 1998/99 1999/00 United States 2000/01 2001/02 World 2002/03 U.S. Sorghum Supply and Use (Domestic Measure) 2001/02 2001/02 Item Area Planted Harvested Estimate Million Acres Yield per harvested acre 10.3 8.6 Bushels 59.9 Beginning stocks Production Imports Supply, total Feed and residual Food, seed, & industrial Domestic, total Exports Use, total Ending Stocks Stocks To Use Avg. Farm Price ($/bu) Million Bushels 42 515 0 556 215 45 260 240 500 56 11.20% 1.95 ------------------ 2002/03------------2002/03 -----(Sept. - Aug.) August September (Sept. - Aug.) Change Million Acres Million Acres Change 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 9.3 7.5 Bushels 50.3 9.3 7.5 Bushels 51.0 Million Bushels Million Bushels 56 56 380 384 0 0 436 441 135 135 45 45 180 180 220 220 400 400 36 41 9.00% 10.25% 2.30 - 2.70 2.35 - 2.75 Source: USDA, World Agricultural Supply and Demand Report, September 12, 2002. 0.00 0.00 0.70 0.00 4.00 0.00 5.00 0.00 0.00 0.00 0.00 0.00 5.00 U.S. Wheat Supply and Use (Domestic Measure) 2001/02 2001/02 Item Area Planted Harvested Yield per harvested acre Beginning stocks Production Imports Supply, total Food Seed Feed and Residual Domestic, total Exports Use, total Ending Stocks Stocks To Use Avg. Farm Price ($/bu) Estimate Million Acres 59.6 48.7 Bushels 40.2 Million Bushels 876 1,958 108 2,941 928 81 199 1,208 961 2,169 772 35.59% 2.78 ------------------ 2002/03------------2002/03 -----(Sept. - Aug.) August September (Sept. - Aug.) Change Million Acres Million Acres Change 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -2.00 0.00 2.00 0.00 0.00 0.00 0.00 60.1 47.6 Bushels 35.4 60.1 47.6 Bushels 35.4 Million Bushels Million Bushels 772 772 1,686 1,686 105 85 2,563 2,543 940 930 81 81 175 175 1,196 900 2,096 467 22.28% 3.20 -3.80 1,186 950 2,136 407 19.05% 3.45 - 4.05 Source: USDA, World Agricultural Supply and Demand Report, September 12, 2002 0.00 0.00 0.00 0.00 0.00 -20.00 -20.00 -10.00 0.00 0.00 -10.00 50.00 40.00 -60.00 Marketing Year 20 02 /0 3 19 98 /9 9 19 99 /2 00 0 20 00 /2 00 1 20 01 /2 00 2 19 97 /9 8 19 96 /9 7 Million Bushels U.S. Wheat Production 3,000 2,500 2,000 1,500 1,000 500 0 Source: DTN AgDayta Source: DTN AgDayta Marketing Year 20 02 /0 3 19 98 /9 9 19 99 /2 00 0 20 00 /2 00 1 20 01 /2 00 2 19 97 /9 8 19 96 /9 7 Million Bushels U.S. Wheat Food Use 960 940 920 900 880 860 Marketing Year 20 02 /0 3 19 99 /2 00 0 20 00 /2 00 1 20 01 /2 00 2 19 98 /9 9 19 97 /9 8 19 96 /9 7 Million Bushels U.S. Wheat Feed And Residual Use 500 400 300 200 100 0 Marketing Year 20 02 /0 3 19 98 /9 9 19 99 /2 00 0 20 00 /2 00 1 20 01 /2 00 2 19 97 /9 8 19 96 /9 7 Million Bushels U.S. Wheat Exports 1,100 1,050 1,000 950 900 850 Marketing Year 20 02 /0 3 19 98 /9 9 19 99 /2 00 0 20 00 /2 00 1 20 01 /2 00 2 19 97 /9 8 19 96 /9 7 Million Bushels U.S. Wheat Ending Stocks 1,000 800 600 400 200 0 1,000 Metric Tons World Wheat Production 595000 590000 585000 580000 575000 570000 565000 560000 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 1,000 Metric Tons Wheat Production Of Selected Countries 120000 100000 80000 60000 40000 20000 0 Argentina Australia Canada European Union 1998/99 1999/00 2000/01 2001/02 2002/03 Source: DTN AgDayta World Wheat Imports 1,000 Metric Tons 115000 110000 105000 100000 95000 90000 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 1,000 Metric Tons Wheat Exports Of Selected Countries 25000 20000 15000 10000 5000 0 Argentina Australia Canada European Union 1998/99 1999/00 2000/01 2001/02 2002/03 World Wheat Ending Stocks 1,000 Metric Tons 200000 150000 100000 50000 0 1998/99 1999/00 2000/01 Marketing Year 2001/02 2002/03 CBOT Corn Futures Contract Prices Contract 2-Sep 2-Dec 3-Jan 3-Mar 3-May 3-Jul 3-Sep 3-Dec Open High Low Last 2714 2714 2660 2664* 2650 2656 2600 2606* 2102 2102 2102* 2724 2724 2670 2680* 2750 2760 2712 2714* 2750 2764 2710 2712* 2640 2530 2640 2540 2584 2490 2590* 2490* Source: DTN AgDayta CBOT Wheat Futures Contract Prices Contract 2-Sep 2-Dec 3-Mar 3-May 3-Jul Open High Low Last 4022 4040 3950 3950* 3930 4054 3910 4000* 3944 4050 3934 3980* 3750 3480 3860 3550 3750 3474 3790* 3516* Source: DTN AgDayta Conclusions •Despite Improved Fundamentals, Increased Acres And A Return To More Typical Yields Will Place Pressure On Price •Improved Fundamentals Likely Will Cause More Sensitivity To Production Difficulties And/Or Improved Demand •Potential For Increased Production Provides Incentive To Consider Current Prices For Expected 2003 Production