Oilseed Situation and Outlook

advertisement

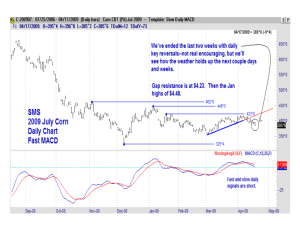

U.S. Oilseed Situation and Outlook 2000-01 Nick Piggott North Carolina State University Southern Regional Outlook Conference corn soybean Year 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 wheat 1990 Stock/Use Ratios (%) 60.0 55.0 50.0 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Rising Stock to Use Ratios for U.S. Crops, 1990-2000 U.S. Farm Sector Income Billions of Dollars 60 50 40 Net Farm Income Govt. Payments LDP's 30 20 10 0 1996 1997 1998 Year 1999 2000F Loan Deficiency Payments for 1999 $2,500 Millions of Dollars $2,107 $1,993 $2,000 $1,500 $1,000 $890 $687 $534 $500 $0 SOYBEANS CORN WHEAT Commodity COTTON OTHER corn wheat soybean Linear (corn) Linear (soybean) Linear (wheat) Acres Planted in the U.S, 1996-2000 Millions of Acres 90 80 79.2 79.5 75.1 70.0 80.2 72.0 79.6 y = -0.1364x + 79.602 77.4 73.8 70 y = 2.4385x + 63.586 74.5 65.8 70.4 y = -3.2008x + 77.013 64.2 62.8 60 62.9 50 1996 1997 1998 Year 1999 2000 Southern Region Soybean Production State Area Harvested 1999 2000 Yield Production % 1999 2000 % (000's acres) (Bushels/Acre) 1999 2000 % (000's bushels) Southern Region AR NC KY MS TN LA VA TX SC OK GA AL 3,350 1,300 1,150 1,900 1,190 990 440 380 450 360 190 200 3,400 1.5 1,330 2.3 1,080 -6.1 1,650 -13.2 1,160 -2.5 900 -9.1 460 4.5 360 -5.3 450 0.0 430 19.4 180 -5.3 170 -15.0 Total (Sth Reg) 11,900 11,570 -2.8 Total U.S. 72,476 73,474 1.4 (Sth Reg/U.S) % 16.4 15.7 28 23 21 23.5 18 27 27 27 20 19 19 16 26 30 36 23 26 23 34 33 23 24 21 19 -7.1 30.4 71.4 -2.1 44.4 -14.8 25.9 22.2 15.0 26.3 10.5 18.8 93,800 29,900 24,150 44,650 21,420 26,730 11,880 10,260 9,000 6,840 3,610 3,200 22.4 26.5 18.4 285,440 88,400 -5.8 39,900 33.4 38,880 61.0 37,950 -15.0 30,160 40.8 20,700 -22.6 15,640 31.6 11,880 15.8 10,350 15.0 10,320 50.9 3,780 4.7 3,230 0.9 311,190 9.0 36.5 39.5 8.2 2,642,908 2,899,571 9.7 61.3 67.1 10.8 10.7 Current Soybean Crop Conditions State VP P F G WI NC KY IL IN MI MN SD OH IA ND MO MS TN AR NE KS LA 1 1 0 2 2 1 2 2 4 4 6 5 16 11 20 27 27 34 3 2 3 5 6 5 6 11 10 11 14 16 22 22 22 23 34 30 14 19 28 25 28 32 33 28 28 28 25 27 32 38 30 31 26 27 54 67 43 55 52 54 47 42 44 46 47 39 24 25 24 16 12 9 28 11 26 13 12 8 12 17 14 11 8 13 6 4 4 3 1 0 7 12 28 42 11 18 states Total Prev Wk Prev Yr 8 9 12 15 28 32 40 36 EX (G+EX) Prod. Share Rank 12 8 Source: USDA, Crop Progress, September 18, 2000 82 78 69 68 64 62 59 59 58 57 55 52 30 29 28 19 13 9 63,360 39,900 38,880 481,750 260,360 89,790 298,200 148,750 188,770 495,850 68,310 193,800 37,950 30,160 88,400 176,700 68,400 20,700 0.022 0.014 0.013 0.166 0.090 0.031 0.103 0.051 0.065 0.171 0.024 0.067 0.013 0.010 0.030 0.061 0.024 0.007 2,899,571 0.962 13 14 15 2 4 9 3 8 6 1 12 5 16 17 10 7 11 18 Projected Supply/Demand for U.S. Soybeans 2000-01 Million Bushels • Beginning Stocks: 265 • Production: 2,900 (73.5 million acres @ 39.5 bu/acre) • Total Supply: 3,167 • Crush: 1,630 • Exports: 1,000 • Total Use: 2,802 • Ending Stocks: 365 • U.S. Season Average Price: $4.35-$5.15 Soybean Supply and Disappearance 1968-2000 3,500 2,500 production crush exports ending stocks 2,000 1,500 1,000 500 Year 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 0 1968 Millions of Bushels 3,000 Record Soybean Use in 2000-01 • Record Crush of 1.63 billion bushels – 2.5 % in meal use from 99/00 2 % domestically from 99/00 4 % exports from 99/00 – 5% in oil use from 99/00 * 3 % domestically from 99/00 * 31 % exports from 99/00 • Record exports of 1 billion bushels – in Brazil and Argentina exports helpful – improved export prospects to China World Soybean Trade Major Soybean Importers Year Year 00/01 99/00 98/99 97/98 96/97 00/01 99/00 98/99 97/98 96/97 95/96 94/95 93/94 Brazil 95/96 Argentina EU Japan China 94/95 US 1200 1000 800 600 400 200 0 93/94 Million Bushels 1200 1000 800 600 400 200 0 Million Bushels Major Soybean Exporters U.S. Soybean Exports by Destination 10,000 9,000 EU Metric Tons 8,000 7,000 JAPAN 6,000 STH KOREA 5,000 CHINA 4,000 MEXICO 3,000 INDONESIA 2,000 1,000 0 1995 1996 1997 Year 1998 1999 World Soybean Supply, Trade, and Ending Stocks 98/99 % World 99/00 % 00/01 % World World % 99/00-00/01 (Million Metric Tons) Production World U.S. Brazil Argentina Other 159.84 74.60 31.30 20.00 33.94 47 20 13 21 156.33 71.93 31.40 20.70 32.30 46 20 13 20 166.57 78.91 32.80 21.50 33.36 47 21 13 21 7 10 4 4 3 Exporters World 38.63 United States 21.90 Argentina 3.23 Brazil 8.90 Other 4.60 57 8 23 12 46.47 26.67 5.10 10.20 4.50 57 11 22 10 45.34 27.22 4.20 9.40 4.52 60 9 21 10 -2 2 -18 -8 0 Importers World EU-15 Japan China Other 40.24 16.77 4.81 3.85 14.81 42 12 10 37 46.79 16.79 4.80 9.00 16.20 36 10 19 35 45.43 16.44 4.70 7.25 17.04 36 10 16 38 -3 -2 -2 -19 5 Ending Stocks World U.S Brazil Argentina Other 27.15 9.48 6.30 6.22 5.15 35 23 23 19 23.41 7.20 4.90 4.65 6.66 31 21 20 28 25.29 9.93 5.00 4.70 5.66 39 20 19 22 8 38 2 1 -15 Source: USDA, WASDE-366-23, September 12, 2000 Price Prospects for U.S. Soybeans • USDA projecting price in $4.35/bu to $5.15/bu range – improvement from the earlier $3.90/bu-$4.80/bu estimates • S-Nov 2000 contract low of $4.501/2/bu – rallied to around $5.00 level after August weather • Burdensome ending stocks dampen rally • The carry between S-Nov 00 and S-Mar 01 is about $0.20/bu currently Marketing Strategies • With cash prices below the loan rate program details become important for loans, LDP’s, and certificates • On-farm or off-farm storage availability? – What does it costs to store soybeans? • On-farm: 4-5 cents/month • Off-farm: 7-8 cents/month for a 5 month period • Rough calculations of returns to soybean storage – currently about “38 cents - storage costs” for storage until March (using Elizabeth City, NC example) – on-farm storage returns 13 cents – off-farm storage is about break-even On-Farm Storage Strategies • Storage Hedge – conservative: store grain, price using forward or hedge, and take the LDP at same time – moderate: store grain, hedge using a put option, and take the LDP at same time – aggressive: store grain, leave grain unpriced, and take the LDP at same time • Merits of storage are stunted when prices are below loan rate – must try to capture large LDP or use 60 day lock-in to get some upside potential No On-Farm Storage • Less flexibility to do better than the loan rate • Commercial storage only if: – forward price charges and interest or – local basis is extremely weak at harvest • use a HTA contract • Sell soybeans at harvest, take the LDP, and buy a call option – currently an at-the-money S-Mar 01 call costs $0.27/bu Looking Ahead to 2001/02 • If bumper crop prevails in 2000-01 and ending stocks are 365 mill. bu. this will dampen prospects for 2001/02 – similar acreage and trend yields and declining exports in world market means production > demand in 2001-02 • Brazil and Argentina production important for U.S. exports • Planting price opportunities and weather premiums • U.S. prospects hinge on – new markets for U.S. soybeans, and meal and oil – large increase in demand to offset supply