EC18/2006/7- Part 3

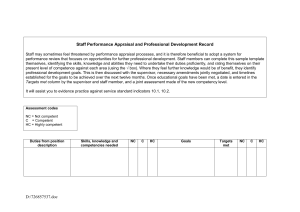

advertisement