Maui Community College Course Outline 1. Alpha and Number

advertisement

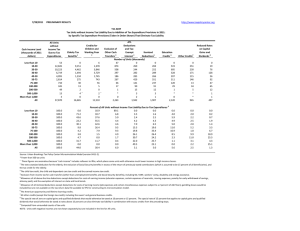

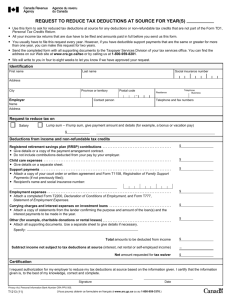

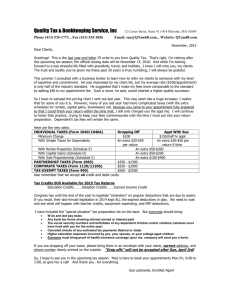

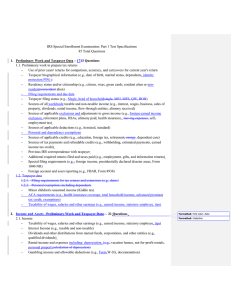

Maui Community College Course Outline 1. Alpha and Number ACC 134 Course Title Income Tax Preparation Credits Three (3) Date of Outline February 27, 2004 (J. Moore) 2. Course Description Introduces principles, procedures, terminology, and applications of the Federal income tax law for individuals with comparison to Hawai’i individual income tax law. 3. Contact Hours/Type Three (3) hours/lecture 4. Prerequisites ENG 19 with at least a C, or placement at ENG 22 or 55, or consent Corequisites Recommended Preparation Approved by Date 2 5. General Course Objective The purpose of this course is to provide a basic foundation in personal income tax. The students will acquire the fundamental knowledge and skills to apply the Federal tax laws to complete a federal tax return and its supporting forms, schedules, and worksheets. For detailed information on how ACC 134 focuses on the Maui Community College general education standards, see the attached curricular grids. ACC 134 fulfills three of the 21 credits for the Accounting requirements for the A.A.S. Accounting degree at Maui Community College, and the three credit requirement in Applied Studies for the Liberal Arts A.A. degree. 6. Student Learning Outcomes For assessment purposes, these are linked to #7, Recommended Course Content. Upon successful completion of this course, the student will be able to: a. calculate the amount of tax owed or refunded using the tax formula; b. calculate tax liability using both the tax table and tax rate schedule; c. apply standard deduction, including the additional amounts for the old age and blind, and calculate the standard deduction for a dependent; d. calculate the limitation on total itemized deductions; e. determine personal and dependent exemptions, and calculate the limitation on exemptions; f. apply the definitions of the various filing statuses to determine the appropriate filing status for a taxpayer; g. identify income items as included in or excluded from gross income; h. determine the deductibility of alimony payments, property settlement and child support; i. calculate the taxable amounts for annuities and social security benefits; j. apply the laws regarding vacation homes to determine tax treatment for primarily personal use, primarily rental use, and rental/personal use; k. calculate limitations on passive losses; l. apply the laws regarding traditional and Roth IRA accounts, including tax deductions and rollovers; m. identify and apply deductible travel, transportation, entertainment, education and other business related expenses; n. calculate total itemized deductions, including medical expenses, interest expenses, charitable contributions, casualty and theft losses, and miscellaneous deductions; o. calculate moving expenses; p. describe the difference between deductions and credits; q. apply the laws regarding the various tax credits, and calculate the credits for the following, Credit for the Elderly, Child Tax Credit, Earned Income Credit, Child and Dependent Credit, Education Tax Credits, and Adoption Credit; r. define tax terminology relating to capital assets; s. calculate capital gains tax using the appropriate tax rates; t. complete the 1040 tax return and the supporting forms, schedules and worksheets. 3 7. Recommended Course Content and Approximate Time Spent on Each Topic Linked to #6. Student Learning Outcomes 2-4 Weeks Individual Income Tax Return (a, b, c, d, e, f, t) 1-3 Weeks Income and Exclusions (g, h, i, t) 1-2 Weeks Business Expense and Retirement Plans (j, k, l, t) 1-2 Weeks Employee Expenses (m, t) 2-3 Weeks Itemized and Other Deductions (n, o, p, t) 2-3 Weeks Credits (p, q, t) 1-2 Weeks Gains and Losses (r, s, t) 8. Text and Materials, Reference Materials, Auxiliary Materials, and Content Appropriate text(s) and materials will be chosen at the time the course is to be offered from those currently available in the field. Text: Whittenburg, G & Altus-Buller, M. 2003. Income Tax Fundamentals. ThomsonSouthwestern. Mason, OH. Materials: Text may be supplemented with: Federal and state tax forms, instruction, and publications Articles and/or handouts prepared by the instructor Magazine or newspaper articles Other: Appropriate films, videos, and Internet sites Guest speakers 9. Recommended Course Requirements and Evaluations Specific course requirements are at the discretion of the instructor at the time the course is being offered. Suggested requirements might include, but are not limited to: 40 – 80% Examinations 0 – 40% In-class exercises 0 – 40% Homework 0 – 30% Quizzes 0 – 20% Projects/research 0 – 20% Attendance and or class participation 4 10. Methods of Instruction Instructional methods vary considerable with instructors and specific instructional methods will be at the discretion of the instructor teaching the course. Suggested techniques might include, but are not limited to: a. b. c. d. e. f. g. h. i. j. lectures and class discussions; quizzes and other tests with feedback and discussions; problem solving; PowerPoint presentations; videos, dvds, cd-rom's ; guest speakers; group activities; oral reports and other student presentations; games and simulations; homework assignments, such as: - reading, or watching, and writing summaries and reactions to financial issues in the media including newspapers, videos, magazines, journals; - reading text and completing problems and activities from text; k. web-based assignments and activities; l. reflective journals; m. group and/or individual research projects with reports or poster presentations; n. study logs and study groups; o. service-learning, community service, and/or civic engagement projects; and other contemporary learning techniques (such as problem-based learning).