Circulation Draft 5 Maui Community College Curriculum Action Request (CAR) Form

advertisement

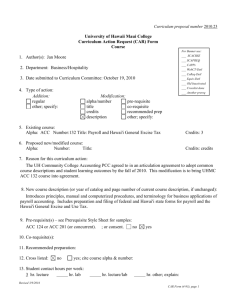

Circulation Draft 5 Curriculum proposal number 2008.07 Maui Community College Curriculum Action Request (CAR) Form Course For Banner use: ___ SCACRSE 1. Author(s): Jan Moore ___ SCAPREQ ___ CAPPs 2. Department: Business/Hospitality ___ WebCT-Detl ___ CoReq-Detl ___ Equiv-Detl 3. Date submitted to Curriculum Committee: 9/12/2008 ___ Old Inactivated ___ Crosslist done 4. Type of action: Addition: regular other; specify: ___ Another prereq Modification: alpha/number title credits description pre-requisite co-requisite recommended prep other; specify: 5. Existing course: Alpha: ACC Number: 132 Title: Payroll and Hawai'i General Excise Tax Credits: 3 6. Proposed new/modified course: Alpha: ACC Number: 132 Title: Payroll and Hawai'i General Excise Tax Credits: 3 7. Reason for this curriculum action: The prerequisites to ACC 132 are ACC 124 or ACC 201 because the student needs to know how to make journal entries and post to the general ledger before the payroll student can begin the payroll project assigned in ACC 132. Recording journal entries and posting to ledgers is taught in the beginning of ACC 124 and ACC 201; whereas, the journal and ledgers are used in the latter part of the semester for ACC132. The student will be able to take these courses concurrently. 8. New course description (or year of catalog and page number of current course description, if unchanged): 9. Pre-requisite(s) – see Prerequisite Style Sheet for samples: ACC 124 or ACC 201 (or concurrent); or consent. no yes 10. Co-requisite(s): 11. Recommended preparation: 12. Cross listed: no yes; cite course alpha & number: 13. Student contact hours per week: 3 hr. lecture hr. lab hr. lecture/lab hr. other; explain: Revised 6/28/2016 CAR Form (4-93), page 1 Circulation Draft 5 14. Grading: Standard (Letter, Cr/NCr, Audit) Explain, if not Standard grading: Revised 6/28/2016 CAR Form (4-93), page 2 Circulation Draft 5 15. Repeatable for credit: no yes; maximum is credit or unlimited. (Most courses are not repeatable for additional credit; exceptions are courses such as internships and co-op courses.) 16. Special fees required: no yes; explain: 17. Proposed term of first offering: semester of year. 18. List catalog used and then degrees, certificates, prerequisites, and catalog sections and their page numbers affected by this proposal: AAS Accounting page 25 19. Maximum enrollment: 24 Rationale, if less than 35: Uses computer classroom 20. Special resources (personnel, supplies, etc.) required: no yes; explain: 21. Course is restricted to particular room type: no yes; explain: computer classroom 22. Special scheduling considerations: no yes; explain: 23. Method(s) of delivery appropriate for this course: (check all that apply) Traditional HITS/Interactive TV Cable TV Online Other, explain: Hybrid 24. Mark all college-wide general education SLOs this course supports. Std 1 - Written Communications Std 2 – Quantitative Reasoning Std 3 - Information Retrieval and Technology Std 4 - Oral Communication Std 5 - Critical Reasoning Std 6 – Creativity Other General Education SLOs, such as Ethics, Scientific Inquiry, or Service Learning. Explain: 25. List all program SLOs this course supports? (Explain, if necessary) Program SLO 1: Analyze, explain, and record business transactions following General Accepted Accounting Principles (GAAP) Explain: Program SLO 2: Apply traditional, current, and emerging technology to solve accounting problems Explain: Program SLO 3: Explain: Program SLO 4: Explain: Program SLO 5: Explain: 26. Course fulfils a requirement for the BAS ABIT degree: Pre-ABIT (PA) Business Core (BC) Information Technology Core (IC) Capstone Course (CC) Other: Course is a specialization elective for the BAS ABIT degree (SE): Course fulfils the following general education elective for the BAS ABIT degree (GE): Quantitative (QR) English (EN) Humanities (HU) Social Science (SS) Other: Revised 6/28/2016 CAR Form (4-93), page 3 Circulation Draft 5 Course fulfils the natural science requirement for the BAS ABIT degree (NS) Revised 6/28/2016 CAR Form (4-93), page 4 Circulation Draft 5 27. 28. Course is a requirement for this CTE (Career Technical Education) program AS/AAS degree or certificate (PR): Course is a requirement for these additional CTE programs: Course is a program elective for this CTE program AS/AAS degree or certificate (PE): Course is a program elective for these additional CTE programs: Course fulfills the following general education elective for CTE (Career Technical Education) AS/AAS degrees: Quantitative (QR) English (EN) Communication (CO) Humanities (HU) Natural Science (NS) Social Science (SS) Other: Course satisfies the following category for the AA degree*: Category I: Foundations/Skills: Foundations I Written Communication in English (FW) Global and Multicultural Perspectives (FG) Symbolic Reasoning (FS) Category I: Foundations/Skills: Foundations II Computer/Information Processing and Retrieval (FI) Numercy (FN) Oral Communication in English (FO) Category II Breadth of Understanding and Experience Human Understanding The Individual (IN) The Community (CM) Human Expression (HE) Environmental Awareness (EA) Asia/Pacific Perspective (AP) Category III Focus/Specialization/Area of Interest Area of Interest Requirement: Name/Alpha of Interest Area: Elective (EL): Alpha of Elective Other Graduation Requirements Writing Intensive (is appropriate for WI) Science Lab (SL) Hawai’i Emphasis (HI) * Submit the appropriate form(s) to have the course placed in the requested category (ies). Submit a course outline, CAR, and appropriate forms to both the Curriculum Committee and the Foundations Board, if the course satisfies Category I: Foundations/Skills: Foundations I or II. 29. Course increases decreases makes no change to number of credits required for program(s) affected by this action. Explain, if necessary: 30. Course is taught at another UH campus (see Sections 5 and 6 above): no Explain why this course is proposed for MCC: yes Specify college(s), course, alpha, and number where same or similar course is taught: UHCCs ACC 132 Revised 6/28/2016 CAR Form (4-93), page 5 Circulation Draft 5 31. Course is: Not appropriate for articulation. Appropriate* for articulation as a general education course at: UHCC UH Manoa UH Hilo UHWO Previously articulated* as a general education course at: UHCC UH Manoa UH Hilo UHWO *Note: Submit Course Articulation Form if course is already articulated, or is appropriate for articulation, as a general education (100-, 200-level) course. Standardized and/or appropriate for articulation by PCC or other UH system agreement at: UHCC UH Manoa UH Hilo UHWO Explain: Appropriate for articulation or has previously been articulated to a specific department or institution: UHCC UH Manoa UH Hilo UHWO Outside UH system Explain: 32. Additional Information (add additional pages if needed): Revised 6/28/2016 CAR Form (4-93), page 6 Circulation Draft 5 Maui Community College Curriculum Action Request (CAR) Signature Page __________________________________________________________________________ Proposed by: Author or Program Coordinator Date __________________________________________________________________________ Checked by: Academic Subject Area Representative to Curriculum Committee Date __________________________________________________________________________ Requested by Department: Department Chair Date __________________________________________________________________________ Recommended by: Curriculum Chair Date __________________________________________________________________________ Approved by Academic Senate: Academic Senate Chair Date __________________________________________________________________________ Endorsed by: Chief Academic Officer Date __________________________________________________________________________ Approved by: Chancellor Date Revised 6/28/2016 CAR Form (4-93), page 7 Circulation Draft 5 Maui Community College Course Outline 1. Alpha ACC Number 132 Course Title Payroll and Hawai'i General Excise Tax Credits 3 Department Business/Hospitality Author Jan Moore Date of Outline September 12, 2008 2013 Effective Date Fall 2009 2. Course Description: 5-year Review Date Introduces principles, procedures, and terminology for business applications of payroll methods. Emphasizes federal and state payroll records and forms. Introduces Hawai'i general excise and use tax law and procedures under the law. Cross-list Contact Hours/Type 3. Pre-requisites 3 hours/lecture ACC 124 or ACC 201 (or concurrent) Pre-requisite may be waived by consent yes no Co-requisites Recommended Preparation 4. Function/Designation ` AS Program AAS Accounting BAS Category AA Category Category Additional Category List Additional Programs and Category: PR - Program Requirement List Additional Programs and Category: Developmental/Remedial Other: Explain: See Curriculum Action Request (CAR) form for the college-wide general education and/or program SLOS this course supports. This course outline is standardized and/or a result of a system-wide agreement. Responsible committee: Revised 6/28/2016 CAR Form (4-93), page 8 Circulation Draft 5 5. Student Learning Outcomes (SLOs): List one to four inclusive SLOs. For assessment, link these to #7. Recommended Course Content, and #9. Recommended Course Requirements & Evaluation. Use roman numerals (I., II. III.) to designate SLOs On successful completion of this course, students will be able to: I. Demonstrates and applies knowledge of payroll law to accurately record employee's pay in appropriate records, journals and ledgers. II. Applies knowledge of tax law to accurately complete appropriate federal and state forms and schedules. III. Demonstrates knowledge of Hawai'i's general excise and use tax laws to accurately complete appropriate tax forms. IV. 6. Competencies/Concepts/Issues/Skills For assessment, link these to #7. Recommended Course Content, and #9. Recommended Course Requirements & Evaluation. Use lower case letters (a., b., c…n.)to designate competencies/skills/issues On successful completion of this course, students will be able to: a. Describe the various laws and their provisions that affect employers in their payroll operations. b. Define the characteristics that differentiate an employee and an independent contractor. c. Distinguish between employee’s principal activities and their preliminary and postliminary activities. d. Calculate regular and overtime pay, payroll deductions and net pay. e. Identify, for social security, federal income tax withholding and unemployment purposes, those persons covered under the law and the types of compensation that are taxable under the law. f. Apply the current tax rates and wage base for FICA, FUTA, and SUTA purposes. g. Compute the amount of federal income tax to be withheld using the percentage method and the wage-bracket method. h. Apply the different requirements and procedures for depositing FICA taxes and income taxes withheld from employee’s wages. i. Complete the returns required by the Federal Insurance Compensations Act, the Federal Unemployment Tax Act, and the Internal Revenue Service in regards to payroll. j. Maintain payroll records, including the payroll register, employee’s earnings record, and general journal and general ledger. k. Identify taxable income and deductible allowances under Hawai’i’s general excise tax (GET) laws. l. Apply the appropriate tax rates to calculate Hawai’i’s general excise and use tax. m. For GET purposes, complete the various forms used by State of Hawai’i-Department of Taxation. 7. Suggested Course Content and Approximate Time Spent on Each Topic Link to #5. Student Learning Outcomes and # 6 Competencies/Skills/Issues 1-2 Weeks Payroll laws and personnel records (a, b, c) Revised 6/28/2016 CAR Form (4-93), page 9 Circulation Draft 5 1-2 Weeks Computing and paying wages and salaries (a, b, c, d, j) 1-3 Weeks Social security taxes (e, f, h, i, j) 1-2 Weeks Income tax withholding (e, g, h, i, j) 1-3 Weeks Unemployment compensation taxes (e, f, i, j) 2-5 Weeks Analyzing, journalizing, and posting payroll transactions; completing the payroll project (i, j) 1-2 Weeks General excise tax (k, l, m) 8. Text and Materials, Reference Materials, and Auxiliary Materials Appropriate text(s) and materials will be chosen at the time the course is offered from those currently available in the field. Examples include: Payroll Accounting, Beig, Thomson Southwestern, current edition. Appropriate reference materials will be chosen at the time the course is offered from those currently available in the field. Examples include: Appropriate auxiliary materials will be chosen at the time the course is offered from those currently available in the field. Examples include: Federal and state tax forms, instruction, and publications Articles and/or handouts prepared by the instructor Magazine or newspaper articles 9. Suggested Course Requirements and Evaluation Link to #5. Student Learning Outcomes (SLOs) and #6 Competencies/Skills/Issues Specific course requirements are at the discretion of the instructor at the time the course is being offered. Suggested requirements might include, but are not limited to: Examinations 40—80% In-class exercises 0—20% Homework 0—40% Quizzes 0—30% Projects/research 0—20% Attendance and or class participation 0—20% 10. Methods of Instruction Instructional methods will vary considerably by instructor. Specific methods are at the discretion of the instructor teaching the course and might include, but are not limited to: a. Lectures and class discussions b. Quizzes and other tests with feedback and discussions Revised 6/28/2016 CAR Form (4-93), page 10 Circulation Draft 5 c. d. e. f. g. h. i. j. k. l. m. n. o. p. Problem solving Comprehensive accounting project PowerPoint presentations Videos, DVDs, CD-Rom's Guest speakers Group activities Oral reports and other student presentations Games and simulations Homework assignments, such as Reading, or watching, and writing summaries and reactions to financial issues in the media including newspapers, videos, magazines, journals Reading text and completing problems and activities from text Web-based assignments and activities Reflective journals Group and/or individual research projects with reports or poster presentations Study logs and study groups Service-Learning, community service, and/or civic engagement projects; and other contemporary learning techniques (such as problem-based learning) 11. Assessment of Intended Student Learning Outcomes Standards Grid attached Assessment of Program Learning Outcomes - ACC 132 Key: Revised 6/28/2016 CAR Form (4-93), page 11 Circulation Draft 5 3 Major Emphasis: The student is actively involved (uses, reinforces, applies, and evaluated) in the student learning outcomes. The learner outcome is the focus of the class. 2 Moderate Emphasis: The student uses, reinforces, applies and is evaluated by this learner outcome, but it is not the focus of the class 1 Minor Emphasis: The student is provided an opportunity to use, reinforce, and apply this learner outcome but does not get evaluated on this learner outcome 0 No Emphasis: The student does not address this learner outcome ACC 132 Standard 1: Written Communication 1.1 Use writing to discover and articulate ideas 1.2 Identify and analyze the audience and purpose for any intended communication 1.3 Choose language, style and organization appropriate to particular purposes and audiences 2 1 2 1.4 Gather information and document sources appropriately 1.5 Express a main idea as a thesis, hypothesis, and other appropriate content 1.6 Develop a main idea clearly and concisely with appropriate content 1.7 Demonstrate mastery of the conventions of writing, including grammar, spelling, and mechanics 1.8 Demonstrate proficiency in revision and editing 1.9 Develop a personal voice in written communication 3 1 1 1 1 0 Standard 2: Quantitative Reasoning 2.1 Apply numeric, graphic and symbolic skills and other forms of quantitative reasoning, accurately and appropriately 2.2 Demonstrate mastery of mathematical concepts, skills, and applications, using technology when appropriate 2.3 Communicate clearly and concisely the methods and results of quantitative problem solving 2.4 Formulate and test hypotheses using numerical experimentation 2.5 Define quantitative issues and problems, gather relevant information, analyze that information, and present results 2.6 Assess the validity of statistical conclusions 3 2 2 0 3 1 Standard 3: Information Retrieval and Technology 3.1 Use print and electronic information technology ethically and responsibly 3.2 Demonstrate knowledge of basic vocabulary, concepts, and operations of information technology and retrieval 3.3 Recognize, identify, and define an information need 3.4 Access and retrieve information through print and electronic media, evaluating the accuracy and authenticity of that information 3.5 Create, manage, organize, and communicate information through electronic media 3.6 Recognize changing technologies and make informed choices about their appropriateness and use 2 1 1 2 1 0 Standard 4: Oral Communication 4.1 Identify and analyze the audience and purpose of any intended communication. 4.2 Gather, evaluate, select, and organize information for the communication. 4.3 Use language, techniques, and strategies appropriate to the audience and occasion. 4.4 Speak clearly and confidently, using the voice, volume, tone, and articulation appropriate to the audience and occasion Revised 6/28/2016 CAR Form (4-93), page 12 1 1 1 1 Circulation Draft 5 4.5 Summarize, analyze, and evaluate oral communications and ask coherent questions as needed. 4.6 Use competent oral expression to initiate and sustain discussion. 1 0 Standard 5: Critical Thinking 5.1 Identify and state problems, issues, arguments, and questions contained in a body of information. 5.2 Identify and analyze assumptions and underlying points of view relating to an issue or problem. 5.3 Formulate research questions that require descriptive and explanatory analyses. 5.4 Recognize and understand multiple modes of inquiry, including investigative methods based on observation and analysis. 2 1 0 1 5.5 Evaluate a problem, distinguishing between relevant and irrelevant facts, opinions, assumptions, issues, values, and biases through the use of appropriate evidence. 5.6 Apply problem-solving techniques and skills, including the rules of logic and logical sequence. 5.7 Synthesize information from various sources, drawing appropriate conclusions 5.8 Communicate clearly and concisely the methods and results of logical reasoning 5.9 Reflect upon and evaluate their thought processes, value systems, and world views in comparison to those of others 3 2 3 3 1 Program Student Learning Outcomes Analyze, explain and record business transactions following GAAP. Prepare, analyze, and interpret financial reports for internal and external users. Utilize current technology to complete accounting functions. Promote business ethics, values and integrity related to professional activities and personal relationships. Revised 6/28/2016 CAR Form (4-93), page 13 3 3 2 2