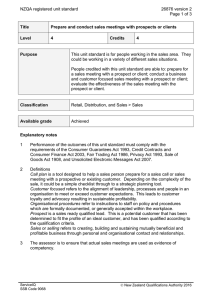

NZQA unit standard 24769 version 2

advertisement

NZQA Expiring unit standard 24769 version 2 Page 1 of 4 Title Prospect for new customers for financial products and/or services in the financial services industry Level 4 Credits 3 Purpose People credited with this unit standard are able to, in the financial services industry: – establish relationship with the prospect; – identify the prospect's needs and goals; – secure commitment; and – manage prospect information. Classification Financial Services > Financial Services - Relationship Management Available grade Achieved Explanatory notes 1 This unit standard has been based on the Australian unit of competency FNSICSAM403B, Prospect for new clients available at http://ntis.gov.au. This is supported and endorsed by the Australian standard setting body Innovation and Business Services Australia and ETITO (ElectroTechnology Industry Training Organisation). 2 Assessment against this unit standard may be on job, or off job in a simulated work environment or a combination of these within the financial services industry context. 3 References New Zealand Bill of Rights Act 1990; Commerce Act 1986; Companies Act 1993; Consumer Guarantees Act 1993; Credit Contracts and Consumer Finance Act 2003; Electronic Transactions Act 2002; Fair Trading Act 1986; Financial Reporting Act 1993; Financial Transactions Reporting Act 1996; Health and Safety in Employment Act 1992; Human Rights Act 1993; Income Tax Act 2007; KiwiSaver Act 2006; NZ IFRS (New Zealand equivalent to International Financial Reporting Standards) available from http://www.nzica.com; Privacy Act 1993; Securities Act 1978; The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016 NZQA Expiring unit standard 24769 version 2 Page 2 of 4 Securities Markets Act 1988; Securities Markets Amendment Act 2006; Superannuation Schemes Act 1989; Trustee Act 1956; Trustee Amendment Act 1988; industry codes of practice; and all subsequent amendments and replacements. 4 All activities must comply with any policies, procedures, and requirements of the organisations involved; the standards of relevant professional bodies including codes of ethics; and any relevant legislative and/or regulatory requirements. 5 Definition Prospect, or prospecting – a continuous process of gathering the names of potential buyers who are likely to be interested in purchasing the salesperson’s financial product and/or service. These may include – friends and family, referrals, business associates and associations, internal company referral systems, networking groups and events, direct mail, databases, brokers, advertisements, telemarketing. Outcomes and evidence requirements Outcome 1 Establish a relationship with a prospect in the financial services industry. Evidence requirements 1.1 A range of communication and interpersonal skills are used to establish a relationship with the prospect. Range 1.2 General introduction to the financial services organisation is provided to prospect in accordance with organisational requirements. Range 1.3 includes but is not limited to – questioning and listening skills, rapport building skills, establishing the prospect’s level of financial literacy where relevant, tailoring communication to prospect’s level of financial literacy where relevant. may include – organisation values, mission and ethics, customer charter information, types of products and services, how process works. Disclosure requirements are met, and prospect is informed of the role of the adviser in accordance with organisational procedures, legislation and industry codes of practice. Range may include – adviser disclosure statement. Outcome 2 Identify the prospect’s needs and goals in the financial services industry. The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016 NZQA Expiring unit standard 24769 version 2 Page 3 of 4 Evidence requirements 2.1 Prospect is encouraged to express their financial needs and goals, and prospect’s questions and concerns are identified and responded to appropriately, in a clear and unambiguous way, and in a manner consistent with prospect’s level of financial literacy. 2.2 Prospect’s financial needs and goals are identified and documented in accordance with organisational procedures. Outcome 3 Secure commitment in the financial services industry. Evidence requirements 3.1 Reasons for resistance are identified and addressed in an appropriate manner in accordance with organisational procedures. Range resistance may include but is not limited to – no perceived need, uncertainty about financial product and/or service, price resistance, timing issues, poor rapport with salesperson; addressing resistance may include – listing and describing superior benefits of financial products and/or services, using assertive messages, providing additional information, education, and support such as statistical information, giving trial offers or offers of incentive, giving referrals such as satisfied customers to contact. 3.2 Prospect’s personal, financial and business details and commitment to proceed are confirmed and documented in accordance with organisational procedures and relevant legislation. 3.3 Next steps in the process are explained to prospect in accordance with organisational procedures. Outcome 4 Manage prospect information in the financial services industry. Evidence requirements 4.1 Prospect information is recorded in an appropriate way in accordance with organisational procedures and relevant legislation. 4.2 Additional financial product and/or service research is conducted and documented to determine possible appropriate products and/or services to meet prospect needs. 4.3 A range of options are considered and documentation prepared for next contact in accordance with personal authorities and organisational procedures. The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016 NZQA Expiring unit standard 24769 version 2 Page 4 of 4 This unit standard is expiring. Assessment against the standard must take place by the last date for assessment set out below. Status information and last date for assessment for superseded versions Process Version Date Last Date for Assessment Registration 1 20 June 2008 31 December 2017 Review 2 18 June 2014 31 December 2017 Consent and Moderation Requirements (CMR) reference 0003 This CMR can be accessed at http://www.nzqa.govt.nz/framework/search/index.do. Please note Providers must be granted consent to assess against standards (accredited) by NZQA, before they can report credits from assessment against unit standards or deliver courses of study leading to that assessment. Industry Training Organisations must be granted consent to assess against standards by NZQA before they can register credits from assessment against unit standards. Providers and Industry Training Organisations, which have been granted consent and which are assessing against unit standards must engage with the moderation system that applies to those standards. Requirements for consent to assess and an outline of the moderation system that applies to this standard are outlined in the Consent and Moderation Requirements (CMR). The CMR also includes useful information about special requirements for organisations wishing to develop education and training programmes, such as minimum qualifications for tutors and assessors, and special resource requirements. The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016