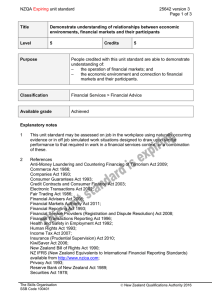

NZQA unit standard 25644 version 2

NZQA Expiring unit standard

Title

25644 version 2

Page 1 of 3

Demonstrate understanding of insurance structures, principles, products; and risk principles used by financial advisers

Level

Purpose

5 Credits 5

People credited with this unit standard are able to demonstrate understanding of:

- insurance structures, products and general principles, and their relevance to work as a financial adviser; and

- types of risk and processes for managing risk in relation to work as a financial adviser.

Classification Financial Services > Financial Advice

Available grade Achieved

Explanatory notes

1 This unit standard may be assessed on job in the workplace using naturally occurring evidence or in off job simulated work situations designed to draw upon similar performance to that required in work in a financial services context, or a combination of these.

2 References

AS/NZS 4360:2004 Risk Management ;

Commerce Act 1986;

Companies Act 1993;

Consumer Guarantees Act 1993;

Credit Contracts and Consumer Finance Act 2003;

Electronic Transactions Act 2002;

Fair Trading Act 1986;

Financial Advisers Act 2008;

Financial Reporting Act 1993;

Financial Service Providers (Registration and Dispute Resolution) Act 2008;

Financial Transactions Reporting Act 1996;

Health and Safety in Employment Act 1992;

Human Rights Act 1993;

Income Tax Act 2007;

KiwiSaver Act 2006;

New Zealand Bill of Rights Act 1990;

NZ IFRS (New Zealand Equivalents to International Financial Reporting Standards) available from http://www.nzica.com

;

Privacy Act 1993;

Reserve Bank of New Zealand Act 1989;

Securities Act 1978;

Securities Markets Act 1988;

The Skills Organisation

SSB Code 100401

New Zealand Qualifications Authority 2020 New Zealand Qualifications Aut

NZQA Expiring unit standard

Superannuation Schemes Act 1989;

Trustee Act 1956;

25644 version 2

Page 2 of 3 industry codes of practice; and all subsequent amendments and replacements.

3 All activities must comply with any policies, procedures, and requirements of the organisations involved; the standards of relevant professional bodies including codes of ethics; and any relevant legislative and/or regulatory requirements.

4 Definitions

Industry bodies and professional associations – such as Investment Savings and

Insurance Association, Institute of Financial Advisers, Professional Advisers

Association, Life Brokers Association, Society of Independent Financial Advisors,

Insurance Brokers Association of New Zealand, Health Funds Association of New

Zealand, Insurance Council of New Zealand, Loss Adjusters Institute.

Personal situation

– incorporates variables such as a client’s personal relationships and obligations, lifecycle stage, overall objectives, level of financial literacy.

Outcomes and evidence requirements

Outcome 1

Demonstrate understanding of insurance structures, products and general principles, and their relevance to work as a financial adviser.

Evidence requirements

1.1 Company types and related organisations of the New Zealand insurance industry are explained in terms of roles, relationships, and relevance to work as a financial adviser.

Range company types include but are not limited to

– insurance companies, friendly societies, reinsurance companies; related organisations include but are not limited to – industry bodies and professional associations.

1.2 Common characteristics and structures of insurance products are evaluated and related to different personal situations that may be encountered by financial advisers.

Range insurance products include but are not limited to – personal (life, disability and trauma); health risk; fire and general, business risk.

1.3 General principles of underwriting, policy terms, premium and rating factors, and extent of cover are explained in terms of risk classification, risk rating and selection for a variety of standard insurance policies.

Outcome 2

Demonstrate understanding of types of risk and processes for managing risk in relation to work as a financial adviser.

The Skills Organisation

SSB Code 100401

New Zealand Qualifications Authority 2020 New Zealand Qualifications Aut

NZQA Expiring unit standard

Evidence requirements

2.1

25644 version 2

Page 3 of 3

Types of risk are described in terms of their relevance to insurance products.

Range risk includes but is not limited to – pure risks such as personal, property liability and non-performance; and speculative risks such as investment risks associated with some insurance products and companies.

2.2 Exposures to risk and the methods for handling risk are evaluated in terms of probability of risk, potential severity and/or impact of risk consequences.

Range methods for handling risk include – risk avoidance, risk control, risk financing, risk retention, risk transfer; risk consequences include – costs, financial benefits, non-financial benefits, direct losses, consequential losses, hidden losses.

This unit standard is expiring. Assessment against the standard must take place by the last date for assessment set out below.

Status information and last date for assessment for superseded versions

Process Version Date Last Date for Assessment

Registration 1 20 February 2009 31 December 2017

Review 2 19 February 2015 31 December 2017

Consent and Moderation Requirements (CMR) reference 0003

This CMR can be accessed at http://www.nzqa.govt.nz/framework/search/index.do

.

Please note

Providers must be granted consent to assess against standards (accredited) by NZQA, before they can report credits from assessment against unit standards or deliver courses of study leading to that assessment.

Industry Training Organisations must be granted consent to assess against standards by

NZQA before they can register credits from assessment against unit standards.

Providers and Industry Training Organisations, which have been granted consent and which are assessing against unit standards must engage with the moderation system that applies to those standards.

Requirements for consent to assess and an outline of the moderation system that applies to this standard are outlined in the Consent and Moderation Requirements (CMR). The

CMR also includes useful information about special requirements for organisations wishing to develop education and training programmes, such as minimum qualifications for tutors and assessors, and special resource requirements.

The Skills Organisation

SSB Code 100401

New Zealand Qualifications Authority 2020 New Zealand Qualifications Aut