Deans’ Forum October 7, 2009 1

advertisement

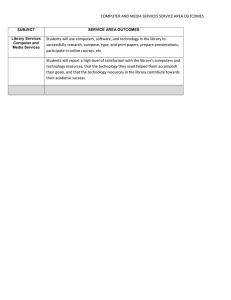

Deans’ Forum October 7, 2009 1 Agenda B&F Overview and Strategic Framework • Tim Slottow Highlights – Scope, Accomplishments, Challenges • • • • • Hank Baier – Facilities and Operations Erik Lundberg – Investments Rowan Miranda – Finance Laura Patterson – Information and Technology Services Laurita Thomas – University Human Resources Question/Answer 2 B&F Fast Facts Q. U-M is one of how many public universities to have a AAA credit rating from Moody’s and Standard & Poor’s? A. B. C. D. Q. Approximately how many Human Subject Fee payments are made per year? A. B. C. B. 3 7 13 20 Q. How many tax forms do we file per year? Q. Roughly what were the net assets of the University in 2009? A. B. C. D. . 10,000 50,000 120,000 500,000 A. B. C. D. $12.9 billion $4.2 billion $8.7 billion $8.0 billion 3 None – we are a non profit 1 125 1,500 The CFO and the University Who is Shirley Smith? 4 The Challenge 5 Strategic Framework B&F Mission and Motto We partner with the University community to provide the technical, financial, physical, information and human resource infrastructure essential to being one of the greatest public universities in the world. “WE MAKE BLUE GO” 6 Strategic Framework B&F Vision We will become a high-performance organization by: • Being known for our deep expertise (both technical and business) • Demonstrating our understanding of the University’s businesses • Serving as fiduciaries of the University assets (physical, financial, human, information and technology assets) 7 Strategic Framework Goals and Initiatives Three B&F Strategic Goals • Become the University’s PROVIDER of CHOICE for the UM services we offer • Become the EMPLOYER of CHOICE for high performing staff members and teams • Demonstrate BEST IN CLASS LEADERSHIP in managing University resources with respect to quality, cost, service and long term impact for the University • • • Internal implementation of major U-wide initiatives Best Practices in Leadership and Management Cost-Savings and Reinvestment Top Ten Key Initiatives • • • Clear metrics Updated annually to align with University goals Transparent reporting and performance 8 Goal 1 Provider of Choice Mean Overall Customer Satisfaction 2007 2009 Mean Mean Diff 20072009 B&F OVERALL SATISFACTION SCORE 7.3 7.5 *.2 FACILITIES & OPERATIONS FINANCE UHR MAIS (including ITSS) 7.0 7.1 7.4 7.7 7.2 7.3 7.4 7.8 .2 *.2 .0 .1 B&F Overall % Satisfied (rating of 8, 9,10) 56% 59% *3 B&F Overall % Dissatisfied (rating of 1, 2, 3) 7.1% 7.1% 0 Number of Surveys Received 6,085 11,526 + 5,441 OVERALL CUSTOMER SATISFACTION RATING BY B&F AREA *Statistically significant differences 9 Goal 1 Provider of Choice Academic Units Only SERVICE ATTRIBUTE RATINGS Academic Units Only 1 Understanding of customer's business needs 2 Explanation of University policies and procedures 3 Communication of service standards 4 Functional/technical expertise 5 Communication of service changes 6 Implementation of service changes 7 Accessibility of service and/or service provider 8 Level of courtesy Overall Customer Satisfaction Number of Surveys Received 2007 Mean 2009 Mean Diff 20072009 7.3 7.5 *0.2 7.3 7.5 *0.2 7.2 7.7 7.1 7.1 7.4 7.2 7.3 2,530 7.5 7.8 7.3 7.3 7.6 7.4 7.6 3,542 *0.3 *0.1 *0.2 0.2 *0.2 *0.2 *0.3 *Statistically significant differences 10 Goal 2 Employer of Choice Employee Survey Dimension Climate Supervisor Autonomy/Involvement Workload Resources/Environment Recognition Co Workers Communication Training and Development Task Significance Compensation Benefits Upper Management Advancement B&F Job Satisfaction Jan 2005 59 69 64 61 71 60 72 58 60 72 51 72 54 64 Oct 2006 60 69 66 62 73 60 74 58 61 76 53 72 57 59 March 2008 *62 69 *67 *63 *75 *62 *74 58 61 *76 *56 *74 *58 61 71 71 72 *Statistically significant differences from 2005 to 2008 11 Goal 2 Employer of Choice Employee Survey Dimension Climate Supervisor Autonomy/Involvement Workload Red indicates Resources/Environment dimensions Recognition with the highest Co Workers impact on Communication Job Training and Development Satisfaction Task Significance in 2008 Compensation Benefits Upper Management Advancement B&F Job Satisfaction Jan 2005 59 69 64 61 71 60 72 58 60 72 51 72 54 64 Oct 2006 60 69 66 62 73 60 74 58 61 76 53 72 57 59 March 2008 *62 69 *67 *63 *75 *62 *74 58 61 *76 *56 *74 *58 61 71 71 72 *Statistically significant differences from 2005 to 2008 12 Customer Survey and Employee Survey Scores Employee Satisfaction Score ‘08 B&F Mean (7.5) Perfect 1:1 Relationship 9.0 8.5 8.0 7.5 B&F Mean (7.2) 7.0 6.5 6.0 5.5 Customer Satisfaction Scores 5.0 5.0 6.0 7.0 8.0 Customer Satisfaction Score ‘09 9.0 Best in Class Financial Leadership Target • Three years of budget savings • While maintaining employee satisfaction • And increasing customer satisfaction Budget 4-6% total savings during FY07-FY09 R 14 Achieved Goal 3 Facilities and Operations Hank Baier Associate Vice President for Facilities and Operations 15 A Thriving Campus! Six-year campus growth: • Research expenditures • Population • Space • General Fund space 36% 11% 12% 10% Facilities and Operations performance (six years): • Operations: • Utilities: Fuel costs, BTU/sf • Capital projects: $94,600,000 funds returned 16 Architecture, Engineering and Construction 17 18 Occupational Safety and Environmental Health 19 Parking and Transportation 20 Plant Operations 21 Public Safety 22 Operations Budget $100M $90M $80M $70M $60M $68M $68M $50M $40M $30M $20M $10M $0M -$10M FY2003 FY2004 Budget FY2005 FY2006 Base Adjustments 23 FY2007 New Space FY2008 Inflation FY2009 Utilities Budget FY09 total expenditures: $111.7 million Other, $3.0 Housing, $8.0 Parking , $1.1 General Fund, $71.0 HHC, $22.4 Athletics, $2.9 Auxilliary Units, $3.3 24 Utilities $120,000,000 200,000 180,000 $100,000,000 160,000 Total Cost Total Cost BTUs/SF $60,000,000 120,000 100,000 80,000 $40,000,000 60,000 40,000 $20,000,000 20,000 $0 0 2003 2004 2005 2006 2007 Fiscal Year Total cost: BTUs/SF 56.0% 5.9% 25 2008 2009 BTUs/SF 140,000 $80,000,000 Capital Activity 26 Capital Budget Fiscal Year Projects Budget Final Cost (millions) (millions) Funds Returned (millions) 2003 153 $156.7 $149.5 $7.2 2004 165 $414.9 $416.2 ($1.3) 2005 131 $101.7 $87.1 $14.6 2006 147 $536.2 $508.6 $27.6 2007 196 $250.6 $235.1 $15.5 2008 174 $239.5 $217.3 $22.2 2009 (est.) 89 $53.8 $45.0 $8.8 $1,753.4 $1,658.8 $94.6 Totals 1,055 27 FY10 and Long-term Challenges Capital: • Benchmarking • Major projects (North Quad, C&W) Utilities: • Planet Blue - 6% savings on pilot buildings • 30 buildings annually Operations: • • • • Custodial-OS1 Facilities Maintenance-Work Control-Payroll Office of Sustainability Thriving campus 28 29 Investment Office Erik Lundberg Chief Investment Officer 30 University Financial Assets June 30, 2009 Total Market Value = $7.5 billion Endowment Funds Working Capital Funds Veritas Other(a) (a) ‘Other’ includes life income trusts, assets that cannot be commingled in the University's investment pools, uninvested cash balances and other reserves. 31 Endowment Growth Endowment Funds – End of Fiscal Year Market Value $9 $8 $7.1 Dollars in Billions $7 $6 $5.7 $7.6 $6.0 $4.9 $5 $4.2 $4 $3.5 $3.6 $3.4 $3.5 $3 $2 $1 $0.4 $0.4 $0.5 $0.6 $0.8 $1.0 $1.3 $1.6 $2.0 $2.3 $2.5 $0 '89 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 32 Endowment Growth Endowment Funds – End of Fiscal Year Market Value $9 $8 Dollars in Billions $7 Compound Average Annual Growth Rate 20 yrs: 14.2% 10 yrs: 9.1% $7.1 $6 $5.7 $7.6 $6.0 $4.9 $5 $4.2 $4 $3.5 $3.6 $3.4 $3.5 $3 $2 $1 $0.4 $0.4 $0.5 $0.6 $0.8 $1.0 $1.3 $1.6 $2.0 $2.3 $2.5 $0 '89 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 33 LTP Investment Performance Long Term Perspective Periods Ending 6/30/09 Total LTP (estimates) Major Markets U.S. Stocks: S&P 500 Non-U.S. Stocks: BMI ex-U.S. Bonds: Lehman Aggregate Endowment Universe(b) Top Quartile Median 5 Years(a) 7.2% 10 Years(a) 8.9% -2.2% 3.7% 5.0% -2.2% 2.9% 6.0% 4.7% 3.5% 5.3% 4.1% (a) Annualized returns. (b) Based on Cambridge Associates’ survey of endowments and foundations at about 130 colleges and universities. 34 Investment Strategy LTP Actual Allocation vs. Model Portfolio June 30, 2009 Allocation Absolute Return 20% Cash 1% Fixed Income 10% Venture Capital 8% Model Portfolio Absolute Return 16% Private Equity 14% Fixed Income 12% Real Estate 12% Energy 10% Equities 35% Equities 25% 35 Venture Capital 5% Private Equity 12% Real Estate 12% Energy 8% Goals and Challenges Generate sufficient returns to sustain spending and grow the endowment in real terms over the long run. Provide steady stream of distributions to support University operations. 36 Finance Rowan A. Miranda Associate Vice President for Finance 37 Functional Responsibilities Transaction Processing Cash Disbursements Accounts Payable Travel Expense Revenue & Debt Cycle Billing & Collections Debt Issuance Grant Billing Accounting & External Reporting Fixed Assets/ Property Disposition Sponsored Research General Ledger Compliance Management Tax Management Tax Management Treasury Management Cash Management Compliance Management Internal Controls Payroll Administration Payroll Administration Financial Reporting Planning and Business Transformation Budgeting Capital Planning Business Analysis Business Transformation Budget Development for B&F (& support campus process) Business Analysis & Cost Accounting Efficiency & Effectiveness Initiatives Procurement Purchasing Requisition & PO Processing Negotiation & Contract Development Sourcing & Supplier Management 38 38 Fast Facts In FY09… • Payroll processed $230M+ in monthly payments • Property Disposition had 16,000+ sales transactions and returned $1.6M back to schools & units • Procurement Services processed 270,000+ purchase orders, 640,000+ invoices, and close to $2.5 billion in spending 39 Fast Facts (continued) In FY09… • Treasury issued 50,000 MCards to faculty, staff, and students • We administered and maintained over 85,000 unique chartfield fund, department, project, and program combinations • We tracked nearly 7,000 endowment funds with over $6 billion of market value 40 Major Accomplishments • New payment process and initial pilot for human subject fee participants • Internal controls certification by all units • Employment, PCard, cash handling, and journal entry processes • Collaborative management with Investment Office of university’s liquidity situation • Project plan for implementation of revised travel and business hosting expense policy and pilot of Concur 41 Budget Wins • Savings of $10M annually through Work Connections • Self-insurance through Veritas produced savings of $23M over the past six years • Additional indirect cost recovery of more than $25M over the next three years due to new rate agreement • Continued growth of Strategic Supplier Program and university-wide contracts • JPMorgan Chase chosen as new PCard vendor ($1M signing bonus) 42 FY10 and Long-term Challenges • Support campus-wide administrative efficiency efforts • Benchmarking of select administrative services Finance HR/Payroll Procurement Information Technology Communications Development Sponsored Research Student Services 43 FY10 and Long-term Challenges • Procurement Strategic Partnering Program • Promote smarter buying in academic and administrative units by analyzing spending patterns and encouraging greater use of strategic contracts • Campus wide rollout of Concur • Federal Stimulus Act Compliance and Reporting • Support IT rationalization efforts especially on issues related to funding model/chargeback approach 44 Information and Technology Services Laura Patterson Associate Vice President and Chief Information Officer 45 46 Functional Responsibilities • University-wide Applications • Financial, HR, • Student Administration, • eResearch • DAC (replacement DART) • M-Reports • eMploy • Wolverine Access • Business Intelligence & Data Management • Central Services (Directory, eMail, Web, Kerberos) • Campus Computing Sites • Data Center Management • Voice & Data Networks • Video Streaming and Conferencing • Servers, Data Storage, & Protection • Security Services 47 U-M IT Strategy 48 U-M IT Strategy 49 IT Rationalization Implement IT sourcing strategy that provides more competitive services for less money Unit Provided Services Shared Services (Units working together) Central IT Provided Services 50 External Provided Services MAIS Effort Rationalization Increased capacity equivalent to $1.6 million Effort to maintain administrative systems. Effort reinvested in-• Business Intelligence • eResearch • Enhanced system features = est. $1.6 M 51 Application Rationalization Shadow Financial Systems • 16 units eliminated shadow financial systems in 2009 • 22 additional units in transition • 28 additional departments in assessment 52 MAIS Infrastructure Rationalization $3 million base reduction in hardware/software costs $8,000,000 New Initiatives (Cumulative) Original Base $7,000,000 $6,000,000 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 FY03 FY04 FY05 53 FY06 FY07 FY08 FY09 Telephone Outsourcing • Third party analysis of traditional landline service • Findings: No cost savings by outsourcing our landline telephone service (35,615 ports) Provider Cost ATT $15.00 per port Verizon: $7.60 per port U-M ITCom $7.03 per port 54 Rationalization Approach Fall 2009 • Benchmarks • ITS Services • Unit Assessments Winter • Funding Model 2010 20102011 ???? • Unit Projects • University-wide Projects • Re-measure 55 FY10 Strategic Imperatives IT Rationalization Shared Products & Services • Benchmarks • Unit assessments • New funding model Shared Infrastructure • Tiered storage • Virtual desktop infrastructure • Consolidated data center plan • Calendar integration (Windows consolidation) 56 • • • • • • DART CTools stabilization Concur eRecruit Student Admissions App Security Assessment Services ITS Organization • Transition University Human Resources Laurita Thomas Associate Vice President for Human Resources 57 V5 Did you know… that in 2008 and 2009 the University of Michigan was named… “A Great College to Work For” by the Chronicle of Higher Education? In its second annual survey of best workplace practices and policies, U-M was recognized in nine of 26 areas within three major categories: Work Environment, Pay and Benefits, and Institutional Policies. 58 Did you know… Voices of the Staff received the 2009 Arbor Award for Excellence, the most prestigious human resources award in Michigan. The Arbor Award honors organizations for innovative human resource practices & programs. 59 Did you know… The Medical Center discontinued the sale of cigarettes on its premises in 1972. Effective July 1, 2011, the university will implement a smoke-free policy designed to help our community “kick the habit” and snuff out smoking on campus. 60 University Human Resources Functional Responsibilities 21 UHR service areas: Academic Human Resources Benefits Office Career Development Services Compensation and Classification Early Childhood Programs Faculty and Staff Assistance Program (FASAP) Health System, Flint & Dearborn Human Resources HR Strategy and Planning HR Communications HR/Payroll Service Center Human Resource Academy Human Resource Records and Information Systems (HRRIS) Human Resource Development Kids Kare at Home Mediation Services for Faculty and Staff MHealthy Office of Institutional Equity Recruiting and Employment Services Staff Human Resources Temporary Staffing Services Work/Life Resource Center Visit us on the web at: 61 hr.umich.edu Major Accomplishments 1. 2. 3. 4. 5. 6. 7. 8. 9. MHealthy Health Benefits Strategy Learning Services Talent Management Union Relations Regulatory Investment Child Care Initiative Emergency Hardship Fund Engagement Gains Achieved through Voices of the Staff 62 Investments in Health By year five of its strategic plan, MHealthy expects to "bend the health care cost trend" by 1 percent or more annually. Long-term metrics for Mhealthy include: reduction in health risk levels health status improvements improvements in health culture reductions in health care cost trend impact on avoidable costs impact on absenteeism, worker’s comp and disability. 63 Budget Wins The Committee on Sustainable Health Benefits (COSHB) and the Committee to Study Retirement Savings Plan Vesting Options were successful in devising the means to maintain our highly competitive health care and retirement benefits while curbing our longstanding rate of benefit cost increases. Implementation of COSHB’s recommendations will: Preserve access to U-M health plans. Help make the costs more affordable for those earning lower wages. Protect children with rates lower than for dependent adults. Keep our benefits at or above market averages. 64 Budget Wins • By transitioning from primarily insured to primarily self-insured medical plans in 2008, our Benefits office was able to reduce overall medical plan expenses by approximately $15 million dollars. • Cost savings in our self-insured prescription drug plan in 2008 were nearly $3 million due to generic drug use increasing over 6%. • U-M generic drug dispensing, now 73%, outpaces national averages. 65 Budget Wins • UHR launched an initiative to transform Human Resource Development (HRD) into a high-impact learning services center. • HRD’s Organizational Development consulting services were discontinued, reducing the HRD budget by 13.9% and creating a leaner professional development center of excellence focused on dynamic, collaborative learning. 66 Budget Wins HR business processes have been enhanced by leveraging technology for net efficiency gains: • Paperless, self-service systems (e.g.: benefit elections, retirement transactions) • E-business processes now capture data at the source (e.g.: self-service timekeeping) • Online transactions improve efficiency and reduce process time (e.g.: appointment changes) 67 FY10 and Long-term Challenges • • • • • • • • E-Recruit E-Verify, IPEDS, ADA Compliance Health Benefits Dependent Eligibility Audit Retiree Health Benefits Return to Work Changing Demographics Employee Value Proposition Building a Culture of Health 68 Q/A and Discussion • Tim Slottow - EVPCFO • Hank Baier – Facilities and Operations • Erik Lundberg – Investments • Rowan Miranda – Finance • Laura Patterson – Information and Technology Services • Laurita Thomas – University Human Resources 69