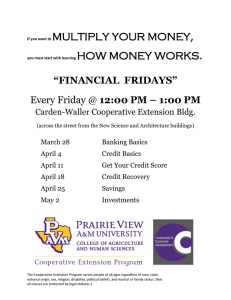

Financial Services

advertisement

Assessment Report Standard Format July 1, 2006 - June 30, 2007 Program(s) Assessed: Financial Services Major within the Department of Finance and Financial Services Assessment Coordinator: William Wood, CFP Year 1 of a 3 Year Cycle 1. ASSESSMENT MEASURES EMPLOYED Briefly describe the assessment measures employed during the year. What was done? a. Specific test questions were developed to assess knowledge. i. During the fall quarter of 2006 assessment marker questions were developed and included in the final exams of all financial services majors in the Finance 461 course. Marker questions were multiple choice format ii. During the winter quarter of 2006 assessment marker questions were developed and included in the final exams of all financial services majors in the Finance 315 and Finance 462 courses. All marker questions were multiple choice format. Who participated in the process? The Finance 461, Finance 315, and Finance 462 instructors. What challenges were encountered? We were able to accomplish this with a more seamless approach than previous years. The exam marker questions were answered on scantron answer sheets and the results were generated automatically by the testing center. Once again with a change in staffing (the retirement of our insurance professor and hiring of adjuncts to fill in gaps) and the newness of this program one course that should have been assessed and was not, namely, Fin 351. Measures will be taken to ensure this course is evaluated in the next cycle. 2. ASSESSMENT FINDINGS FINANCIAL SERVICES MAJORS We are assessing the following program objectives: Prepare students for entry level positions in the financial services industry. Prepare students to provide fundamental advice to individuals regarding the management of their personal financial affairs. Prepare students to engage in a process of life long learning This year we focused on six specific learning outcomes supporting these objectives explain the financial planning process prepare a personal risk management plan. recommend an appropriate strategy to reduce the federal income tax liability.. calculate retirement capital needs. Recommend an appropriate estate planning strategy to reduce the federal income tax liability. Construct an appropriate investment portfolio for differing lifecycle phases and risk tolerances. a. Marker Questions Marker questions were included in the Finance 461 exam in the fall of 2006 and Finance 315 and Finance 462 in winter quarter 2007. The percent responding correctly varied from a low of 35% to a high of 100% on individual marker questions in Finance 461; from a low of 56% to a high of 96% in Finance 315; and from a low of 32% to a high of 100% in Finance 462. Only 2 out of 22 or 9% of financial services majors responded incorrectly to 70% or more of the marker questions in Finance 461 which means that 91% of financial services majors had scores of at least 70% on the marker questions. For Finance 315 these numbers were 5 out of 31 or 16% of financial services majors responded incorrectly to 70% or more of the marker questions or 84% received scores of 70% or better on the marker questions. And finally these numbers were 3 out of 22 or 13.6% of financial services majors responded incorrectly to 70% or more of the marker questions or over 86% received scores of 70% or better on the marker questions. If 70% continues to be the goal, we seem to have made major improvements. 3. PROGRAM IMPROVEMENTS With the opening of the new MTC Technologies Trading Room, the faculty has revisited the curriculum and recommended the establishment of an investments track within the finance discipline. Courses have been designed to cover gaps in investment training such as derivatives, fixed income securities, and advanced portfolio management and security analysis. These courses will began in the fall of 2006 and should be valuable to the preparation of our financial services majors as well. 4. ASSESSMENT COMPLIANCE The learning outcomes assessed, assessment measures used, and the review of the findings are consistent with the Financial Services Assessment plan. We have neglected to assess one of the courses proposed in the assessment plan and will attempt to rectify this as soon as possible. 5. NEW ASSESSMENT DEVELOPMENTS We are attempting to automate this process as much as possible. Finance 315 Winter 2007 Marker Question Analysis # correct #incorrect 28 31 21 31 28 31 28 3 0 10 0 3 0 3 90% 100% 68% 100% 90% 100% 90% 10% 0% 32% 0% 10% 0% 10% T1-39 T1-50 FP Process Basics - Macro Environment FP Process Basics - Internal Environment FP Process Basics - Client Needs Assessment FP Process Basics - Internal Environment FP Process Basics - Internal Environment FP Process Basics - Macro Environment FP Process Basics - Macro Environment FP Process Basics - Internal EnvironmentAdvanced FP Process Basics - Macro Environment-Advanced 17 17 14 14 55% 55% 45% 45% T2-2 T2-8 T2-11 T2-22 T2-38 T2-40 T2-41 T2-44 T2-47 T2-50 Education Funding Basics Educatino Funding Basics Retirement Funding Basics Retirement Funding Basics Investing - Mutual Fund Basics Investing - Mutual Fund Advanced Education Funding Advanced Investing - Advanced Educatino Funding Advanced Investing - Advanced 27 31 31 21 19 26 28 24 11 26 4 0 1 10 12 5 3 7 20 5 87% 100% 100% 68% 61% 84% 90% 77% 35% 84% 13% 0% 3% 32% 39% 16% 10% 23% 65% 16% T3-4 T3-6 T3-10 T3-15 T3-21 T3-24 T3-37 T3-42 Capital Needs Analysis - Basics Capital Needs Analysis - Basics Qualified Plans - Basic Qualified Plans - Basic Estate Planning - Basics Estate Planning - Basics Capital Needs Analysis - Advanced Capital Needs Analysis - Advanced 24 31 27 23 19 27 16 24 7 0 4 8 21 4 15 7 77% 100% 87% 74% 61% 87% 52% 77% 23% 0% 13% 26% 68% 13% 48% 23% Question Topic T1-1 T1-13 T1-20 T1-21 T1-24 T1-31 T1-36 % correct % incorrect Finance 461 Fall 2006 Marker Question Analysis Question T1-1 T1-13 T1-20 T1-21 Topic QP Plan Design and Admin Attributes of QP QP Strategy Plan Design-Advanced Terms and Definitions # correct 18 19 12 22 # incorrect 4 3 10 0 % correct 82% 86% 55% 100% % incorrect 18% 14% 45% 0% T1-26 T1-31 T1-36 Compliance Testing Rules Attributes of QP Attributes of QP 16 16 15 6 6 7 73% 73% 68% 27% 27% 32% T2-9 T2-54 T2-53 T2-55 T2-42 T2-60 QP Concepts - Advanced Investment Guidelines in QP Tax Strategies with QP Non-qualified Stock Options Rabbi Trusts IRA's - 72(t) IRA's - 72(t) 22 11 13 22 14 15 0 11 9 0 8 7 100% 50% 59% 100% 64% 68% 0% 50% 41% 0% 36% 32% T3-10 T2-47 T3-26 T3-23 Retirement Capital Needs Analysis Capital Needs Analysis Basics Capital Needs Analysis Basics Capital Needs Analysis - Advanced Capital Needs Analysis - Advanced 15 17 19 18 7 5 3 4 68% 77% 86% 82% 32% 23% 14% 18% T3-35 T3-10 T3-34 T3-21 T3-24 T3-37 T3-42 Retirement Plan Distribution Strategies Distribution Strategies Distribution Strategies - Advanced Tax Treatment of Distributions Minimum Distribution Rules Minimum Distribution Rules - Advanced Minimum Distribution Rules - Advanced Retirement Income Strategies - Advanced 8 18 18 22 20 16 15 14 4 4 0 2 6 7 36% 82% 82% 100% 91% 73% 68% 64% 18% 18% 0% 9% 27% 32% Question Q1 Q2 Q3 Q4 Q5 Q6 Q14 Q18 Q7 Q19 Q9 Q11 Q15 Finance 462 Winter 2007 Marker Question Analysis # # Topic correct incorrect Characteristics of Property Titling 22 0 20 2 22 0 22 0 Gifting Strategies 16 6 19 3 11 11 16 6 Marital Deduction Planning 7 15 21 1 Estate Tax Compliance 22 0 20 2 19 3 % correct % incorrect 100.0% 90.9% 100.0% 100.0% 0.0% 9.1% 0.0% 0.0% 72.7% 86.4% 50.0% 72.7% 27.3% 13.6% 50.0% 27.3% 31.8% 95.5% 68.2% 4.5% 100.0% 90.9% 86.4% 0.0% 9.1% 13.6% Q16 Q17 Q20 12 12 21 10 10 1 54.5% 54.5% 95.5% 45.5% 45.5% 4.5% 18 16 18 11 4 6 4 11 81.8% 72.7% 81.8% 50.0% 18.2% 27.3% 18.2% 50.0% Trust Basics/Estate Plan Documents Q8 Q10 Q12 Q13 Fin 461 Student 1 Student 2 Student 3 Student 4 Student 5 Student 6 Student 7 Student 8 Student 9 Student 10 Student 11 Student 12 Student 13 Student 14 Student 15 Student 16 Student 17 Student 18 Student 19 Student 20 Student 21 Student 22 Student 23 Student 24 Student 25 Student 26 Student 27 Student 28 Percent incorrect Fin 462 Number correct Number incorrect 15 17 16 13 17 18 16 18 17 13 17 17 17 14 17 15 17 17 17 15 17 14 17 21 5 3 4 7 3 2 4 2 3 4 3 3 3 6 3 5 3 3 3 5 3 6 7 3 Number correct Number incorrect Percent incorrect Percent correct 23 24 22 19 4 3 5 8 14.8% 11.1% 18.5% 29.6% 85.2% 88.9% 81.5% 70.4% 25.0% 15.0% 20.0% 35.0% 15.0% 10.0% 20.0% 10.0% 15.0% 20.0% 15.0% 15.0% 15.0% 30.0% 15.0% 25.0% 15.0% 15.0% 15.0% 25.0% 15.0% 30.0% 29.2% 12.5% Fin 315 Fin 461/462 Combined Percent correct Number correct Number incorrect Percent incorrect Percent correct Number correct Number incorrect Percent incorrect Percent correct 75.0% 85.0% 80.0% 65.0% 85.0% 90.0% 80.0% 90.0% 85.0% 65.0% 85.0% 85.0% 85.0% 70.0% 85.0% 75.0% 85.0% 85.0% 85.0% 75.0% 85.0% 70.0% 70.8% 87.5% 18 20 18 21 19 19 17 19 17 14 17 21 19 6 4 6 3 5 5 7 5 7 10 7 3 5 25.0% 16.7% 25.0% 12.5% 20.8% 20.8% 29.2% 20.8% 29.2% 41.7% 29.2% 12.5% 20.8% 75.0% 83.3% 75.0% 87.5% 79.2% 79.2% 70.8% 79.2% 70.8% 58.3% 70.8% 87.5% 79.2% 33 37 34 34 36 37 33 37 34 27 34 38 36 11 7 10 10 8 7 11 7 10 14 10 6 8 75.0% 84.1% 77.3% 77.3% 81.8% 84.1% 75.0% 84.1% 77.3% 65.9% 77.3% 86.4% 81.8% 25.0% 15.9% 22.7% 22.7% 18.2% 15.9% 25.0% 15.9% 22.7% 34.1% 22.7% 13.6% 18.2% 17 7 29.2% 70.8% 34 10 77.3% 22.7% 22 20 21 17 13 13 2 4 3 7 11 11 8.3% 16.7% 12.5% 29.2% 45.8% 45.8% 91.7% 83.3% 87.5% 70.8% 54.2% 54.2% 39 37 38 32 30 27 5 7 6 12 14 17 88.6% 84.1% 86.4% 72.7% 68.2% 61.4% 11.4% 15.9% 13.6% 27.3% 31.8% 38.6% Student 29 Student 30 Student 31 Student 32 Student 33 Student 34 Student 35 Student 36 Student 37 Student 38 Student 39 Student 40 Student 41 Student 42 Student 43 Student 44 Student 45 Student 46 Student 47 Student 48 Student 49 Student 50 Student 51 Student 52 Student 53 Student 54 Student 55 25 21 23 21 21 24 23 17 21 26 20 23 24 24 24 20 15 20 24 17 22 24 18 19 15 23 24 2 6 4 6 6 3 4 10 6 1 7 4 3 3 3 7 12 7 3 10 5 3 9 8 12 4 3 7.4% 22.2% 14.8% 22.2% 22.2% 11.1% 14.8% 37.0% 22.2% 3.7% 25.9% 14.8% 11.1% 11.1% 11.1% 25.9% 44.4% 25.9% 11.1% 37.0% 18.5% 11.1% 33.3% 29.6% 44.4% 14.8% 11.1% 92.6% 77.8% 85.2% 77.8% 77.8% 88.9% 85.2% 63.0% 77.8% 96.3% 74.1% 85.2% 88.9% 88.9% 88.9% 74.1% 55.6% 74.1% 88.9% 63.0% 81.5% 88.9% 66.7% 70.4% 55.6% 85.2% 88.9%