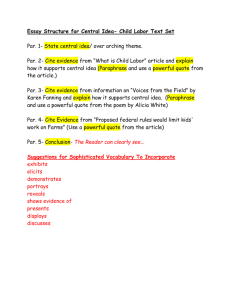

Spring 2015-16 PAR Training

advertisement

Effort Reporting Training Presented by Costing Andy McManus & Anne Hager 1 Welcome to Effort Reporting Training (Short) Please Take Your PARs and Sign In 2 Effort Reporting Policy Federal Regulations– Allows the University to meet the requirements of (OMB Uniform Guidance Subpart E 200.430 Cost Principles) http://www.ecfr.gov/cgi-bin/text-idx?node=2:1.1.2.2.1&rgn=div5 Purdue Effort Reporting Policy (II.C.1) : This policy established effort reporting procedures which documents the effort expended on sponsored projects. http://www.purdue.edu/policies/business-finance/iic1.html 3 Effort Reporting Key Facts Monthly paid staff who expended effort on a Sponsored Program or Federal Appropriation during the semester must certify their effort on a PAR. PARs are distributed to the employee’s home department. If a monthly paid person expended effort on a Sponsored Program or Federal Appropriation during the semester but did not receive a PAR, complete a blank PAR form from the Costing Website. Personnel Activity Report (PAR) Reminder - CD% is the current cost distribution before effort is certified or revised. 4 Effort Reporting Key Facts The Effort Reporting Quick Reference Guide (QRG) outlines • • • • • 5 important policy reminders and responsibilities for PIs/faculty, and is printed on the back of each PAR. The business office should meet with the PI (Principal Investigator) or someone with direct knowledge of the work to review the PAR. The PAR must be signed by the employee or someone having direct knowledge of the work. Faculty/PIs should sign their own PARs. If they are unavailable, a person with direct knowledge of their work may sign for them. PIs sign PARs for the Graduate Students Confirm with individual if certifying 100% effort on Sponsored Projects that no departmental responsibilities, proposal writing to other sponsors or participation in any other unrelated activities were performed during the reporting period. Effort Reporting Key Facts Administrative Supplements are defined as a part of the base pay by the University and are included on the PARs. Overloads and other special payments are not considered part of base pay and are not included on the PARs. • Summer months or other period not included in the base salary period will be determined for each faculty member at a rate not in excess of the base salary divided by the period to which the base salary relates 6 Wage Types that would be included in a PAR Wage Type Wage Group 1000-Salary 2. 1001-Salary Non-Eligible 3. 1003-NRA Salary 4. 1015-Administrative Adjustment 5. 1016-Temp/Short Term Admin Adjustment 6. 1315-Summer Pay 7. 1320-Sababatical Leave 8. 1501-NRA Salary Non-Eligible 9. 1515-NRA Administrative Adjustment 10. 1815-NRA Summer Pay 11. 1820-NRA Sabbatical Leave 1. 7 1 1 1 1 1 2 1 1 1 2 1 Effort Reporting Key Facts Return the signed PARs to the Costing Office to be entered When the Costing Office enters the PAR, IT27 for each month in the semester will change to match the PAR unless the difference is less than 5% All PARs (original and revised) requesting a less than 5% change require explanations and approval from the Costing Office/Comptroller. 8 Effort Reporting Key Facts Certification must equal 100% per PERNR per wage group. It is recommended that known changes to cost distribution are corrected in IT27 before the last payroll run of the semester, so that the distribution printed on the PARs is as accurate as possible. The keying deadline was April 20, 2016—if you changed cost distribution for this semester after that date, those changes will not be reflected on the PAR. Watch Business@Purdue for keying deadline reminders. Something must be written in the Effort % column. Writing the word “SAME” in the Effort % column is acceptable if the effort that is being certified is the same as the existing distribution that is reflected in the CD % column of the PAR. Certify in whole percentages whenever possible. 9 EXAMPLES OF HOW TO USE THE WORD SAME This par will cause no change to cost distribution. Everything will remain the same. If there is more than one job and you put the word same on both of the jobs nothing will update. 10 EXAMPLES OF HOW TO USE THE WORD SAME PAR EXAMPLE: • The numbers that we would key for this par WG 1 would be 50%/50%. This would make each months cost distribution 50%/50%. There is nothing to tell the system that it should do anything else. • If you want the cost distribution to be anything else a par calculator would be necessary to tell the system how exactly you want the cost distribution to look. • If you have more than one job on a par it is a good idea to get into the habit of making a par calculator for the unchanged job as well making the change that are needed. 11 Effort Reporting Key Facts %CD printed on the PAR is calculated using the amount of Salary on each account for the entire par period. Effort certification is based on % Effort and not on salary. When you change one account by more than 5%, all accounts will update in IT27 for each month in the PAR period 12 Less than 5% Changes Less than 5% changes always require an explanation and approval from the Costing Office/Comptroller. Less than 5% changes on a Revised PAR or Post PAR are VERY RARELY approved. The following are examples of when a less than 5% change may be approved when CLEARLY REQUESTED AND DOCUMENTED: • 13 A less than 5% adjustment will be permitted to clear an over drafted account. A less than 5% adjustment will be allowable to remove post-term charges from an account. A less than 5% adjustment will be allowable if an employee is paid from a separately certified project but reports zero effort on the PAR. A less than 5% adjustment is acceptable if, when coupled with committed cost sharing or a memo match on the PAR, the adjustment is equal to or greater than 1%. If there is a signed contract that is approved by the Comptroller that requires tracking less than 5% adjustments. HOW TO DETERMINE IF A LESS THAN 5% ADJUSTMENT IS NEEDED • IS THE DIFFERENCE BETWEEN %CD AND % EFFORT ON ANY ONE LINE GREATER THAN 5%? IF YES– YOU DO NOT NEED THE LESS THAN 5% ADJUSTMENT. THE SYSTEM WILL MAKE THE CHANGES THAT ARE REQUESTED. IF NO—THEN A LESS THAN 5% ADJUSTMENT IS NEEDED. THIS WILL FORCE THE SYSTEM TO MAKE THE CHANGES THAT YOU ARE REQUESTING WHEN IT WOULD NORMALLY NOT MAKE THOSE CHANGES DUE TO A LESS THAN 5% CHANGE. THE 5% DIFFERENCE IS NOT BASED ON A COMBINATION OF LINES. 14 ADDITIONAL NOTE • On an original PAR, if an individual is not going to certify all his/her effort incurred on a sponsored program for the period and instead elects to report part of that effort on an unrestricted fund, this should be documented in the comment section of the PAR. • Documentation should include the percent of effort not being reported on the sponsored program and the reason why. • The benefit would be less scrutiny on a revised PAR, should one be necessary, resulting from the prior notification on the original PAR. 15 Additional Notes Sick Leave and Paid Parental Leave are allowable direct costs that should be prorated on the basis of the projects or accounts the individual is working on at the time the leave is taken. 16 Additional Notes Review the Sponsored vs Non-sponsored activities charts https://sp2010.itap.purdue.edu/businessservices/b stc/courselist/Documents/BPARS%20Sponsored %20Non-Sponsored%20Activities%20Chart.pdf Example: Proposal writing must be supported by general funds, gift funds etc... Writing proposals is only allowable on a sponsored project if it is for the continuation or renewal of that sponsored project. 17 When to Use a PAR Calculator C The PAR effort calculator is on the costing website: http://www.purdue.edu/business/mas/costing/Effort_Re porting/index.html • Salary dollars are different in at least one month during the par period • Or when a grant expires some time during the par period • And when a greater than 5% change is needed 18 PAR Calculator Demo the PAR Calculator 19 Effort Report Demo T-Code S_P7H_77000175 Actual Effort Certification By Employee 20 Spring Effort Reporting Timeline • 04/30/2016 – PAR period ends • 05/06/2016– Business Offices receive PARs at training • 06/06/2016 – Certified PARs are due to the Costing Office • 06/07/2016 – Post PAR period begins. Explanations and appropriate signatures are required. • Keying of PARs will begin in the Costing office as soon as PARs are received. Adjustments will appear after the May or June payroll runs depending on when the PARs are keyed by costing. • Note: The cost distribution deadline for May payroll is the 18th and June deadline is the 21st. 21 SPRING PAY DATES 01/01/2016 – 04/30/2016 January 2016 1/01/2016 – 1/31/2016 February 2016 2/1/2016 – 2/29/2016 March 2016 3/1/2016 – 3/31/2016 April 2016 4/01/2016 – 4/30/2016 22 Post PAR Procedures PARs that are received after the June 6th deadline but DO NOT change cost distribution are considered late and require an explanation as to why the PAR is late. PARs that are received after the June 6th deadline that change cost distribution are considered post PAR and require both an explanation AND pre-auditor signature. All revised PARs require an explanation and pre-auditor signature, regardless of when they are received. 23 PAR Timeline Dates 2 weeks after the end of PAR period PAR Training completed and all PARs distributed 30 days after PARs are distributed PARs are due to the costing office 60 days after PARs are distributed Bus. Managers receive a listing of outstanding PARs with a memo from Dir. of Bus. Managers and/or the Associate Comptroller with a copy to the Dir. of Fin. Affairs or the Director of Accounting at the Regional Campus. 90 days after PARs are distributed Bus. Managers receive a listing of outstanding PARs with a memo from Comptroller with a copy to the Dir. Of Fin. Affairs and the Dir. of Bus. Managers or the Regional Campus Comptroller 120 days after PARs are distributed Dir. Of Fin. Affairs receive a listing of outstanding PARs with a memo from Vice President of Business Services and Assistant Treasurer with a copy to the Dean, Dir. of Bus. Managers or the Regional Campus Comptroller Questions 25 CONTACTS Have Questions or Need Help? CONTACT Costing@purdue.edu – this email address contacts all costing representatives Anne Hager Phone: 49-44894 Email: ahager@purdue.edu 26 Thank You for Attending! 27 Welcome to Effort Reporting Training (Extended) Present by Costing Andy McManus & Anne Hager 28 What is Effort Reporting? The process by which Purdue University documents the compensated Effort expended on Sponsored Projects during each Effort Reporting Period. 29 Effort Reporting Policies/Requirements Purdue Effort Reporting Policy (II.C.1) : This policy established effort reporting procedures which documents the effort expended on sponsored projects. http://www.purdue.edu/policies/business-finance/iic1.html Federal Regulations - Allows the University to meet the requirements of OMB Uniform Guidance Subpart E 200.430 - Cost Principles http://www.ecfr.gov/cgi-bin/text-idx?node=2:1.1.2.2.1&rgn=div5 30 OMB UNIFORM GUIDANCE- 200.430 200.430 (h) (8) (i) (I) (viii) (c) The non-Federal entity’s system of internal controls includes processes to review after-the-fact interim charges made to a Federal awards based on budget estimates. All necessary adjustment must be made such that the final amount charged to the Federal award is accurate, allowable, and properly allocated. 200.430 (h) (8) (i) (1) Standards for Documentation of Personnel Expenses -Charges to Federal awards for salaries and wages must be based on records that accurately reflect the work performed. These records must: (i) 31 Be supported by a system of internal control which provides reasonable assurance that the charges are accurate, allowable, and properly allocated; OMB UNIFORM GUIDANCE- 200.430 (iii) Reasonably reflect the total activity for which the employee is compensated by the non-Federal entity, not exceeding 100% of compensated activities (iiii) by the non-Federal entity, on an integrated basis, but may include the use of subsidiary records a defined in the non-Federal entity’s written policy. 200.430 (h) (8) (i) (1) (iii) (b) Significant changes in the corresponding work activities are identified and entered into the records in a timely manner. 200.430 (h) (8) (i) (1) (viii) Budget estimates (i.e., estimates determined before the services are performed) alone do not qualify as support for charges to Federal awards, but may be used for interim accounting purposes 32 OMB UNIFORM GUIDANCE- 200.430 200.430 (h) (2) Salary basis. In no event will charges to Federal awards, irrespective of the basis of computation, exceed the proportionate share of the Institutional Base Salary for that period. 200.430 (h) (5) Periods outside the academic year. -- Charges for work performed by faculty members on Federal awards during periods not included in the base salary period will be at a rate not in excess of the Institutional Base Salary. 200.430 (h) (8) (i) (3) Charges for the salaries and wages of nonexempt employees, in addition to the supporting documentation described in this section, must also be supported by records indicating the total number of hours worked each day. 33 Personnel Activity Report (PAR) • The Personnel Activity Report (PAR) form: • Documents the effort devoted to sponsored projects expressed as a percentage of total effort worked during the effort reporting period • Supports the final distribution of payroll charges to sponsored program and other accounts • There are three reporting periods to correspond with each academic semester. These periods are defined as: • • • 34 Fall: September 1 to December 31 Spring: January 1 to April 30 Summer: May 1 to August 31 PAR Procedures PARs are distributed to employee’s home department. The PAR must be signed by the employee or someone having direct knowledge of the work. The business office acts as a liaison to Faculty/PI, they should not complete the PAR. The person signing the form should be the one filling it out. Faculty/PIs should sign their own PARs. If they are unavailable, a person with direct knowledge of their work may sign for them. PIs sign PARs for the Graduate Students. 35 Effort Reporting Key Facts The Effort Reporting Quick Reference Guide (QRG) outlines • • • • • 36 important policy reminders and responsibilities for PIs/faculty, and is printed on the back of each PAR. The business office should meet with the PI (Principal Investigator) or someone with direct knowledge of the work to review the PAR. The PAR must be signed by the employee or someone having direct knowledge of the work. Faculty/PIs should sign their own PARs. If they are unavailable, a person with direct knowledge of their work may sign for them. PIs sign PARs for the Graduate Students Confirm with individual if certifying 100% effort on Sponsored Projects that no departmental responsibilities, proposal writing to other sponsors or participation in any other unrelated activities were performed during the reporting period. Effort Reporting Key Facts Monthly paid staff who expended effort on a Sponsored Program or Federal Appropriation during the semester must certify their effort on a PAR. PARs are distributed to the employee’s home department. If a monthly paid person expended effort on a Sponsored Program or Federal Appropriation during the semester but did not receive a PAR, complete a blank PAR form from the Costing Website. Personnel Activity Report (PAR) Reminder - CD% is the current cost distribution before effort is certified or revised. 37 Effort Reporting Key Facts • Each employee (Person ID) receives ONE PAR that is sent to their HOME department • Charges for work performed by Professional Staff during the academic year will be based on the individual’s base pay regardless of the number of hours worked • All monthly-paid staff who have effort on a Sponsored Program or Federal Appropriation during the semester needs a PAR. All effort during the semester related to their base pay must be certified. 38 Effort Reporting Key Facts Certification must equal 100% per PERNR per wage group. It is recommended that known changes to cost distribution are corrected in IT27 before the last payroll run of the semester, so that the distribution printed on the PARs is as accurate as possible. The keying deadline was April 20, 2016—if you changed cost distribution for this semester after that date, those changes will not be reflected on the PAR. Watch Business@Purdue for keying deadline reminders. Something must be written in the Effort % column. Writing the word “SAME” in the Effort % column is acceptable if the effort that is being certified is the same as the existing distribution that is reflected in the CD % column of the PAR. Certify in whole percentages whenever possible. 39 Effort Reporting Key Facts Administrative Supplements are defined as a part of the base pay by the University and are included on the PARs. Overloads and other special payments are not considered part of base pay and are not included on the PARs. • Summer months or other period not included in the base salary period will be determined for each faculty member at a rate not in excess of the base salary divided by the period to which the base salary relates 40 Effort Reporting Key Facts • Summer months or other period not included in the base salary period will be determined for each faculty member at a rate not in excess of the base salary divided by the period to which the base salary relates 41 Effort Reporting Key Facts The PAR may be divided into multiple Personnel Numbers (PERNRs) and may have two wage groups (Summer Pay and Academic Pay). Certification must equal 100% per PERNR per wage group. If an employee has multiple appointments the home department must coordinate with all other departments to make sure that effort is certified correctly. The Effort Reporting Quick Reference Guide (QRG) printed on the back of the PAR outlines important policy reminders and responsibilities for PIs/faculty. 42 Effort Reporting Key Facts • What If I Didn’t Receive a PAR for someone that Needs One? • Complete a blank PAR form from the Costing Website, and submit it with all other PARs. • Personnel Activity Report (SAP) • Note: The newest revision of the form is on the Costing website. • What about Bi-weekly staff who are paid on Sponsored Programs? • Bi-weekly staff are not included in the PAR process. Their effort is certified on their time cards. The cost distribution should match the effort expended during the period. 43 Important PAR Facts %CD printed on the PAR is calculated using the amount of Salary on each account Effort certification is based on % Effort and NOT on Salary. When you change one account by more than 5%, all accounts will update in IT27 for each month in the PAR period PAR Effort Calculator is on the Costing Website under the following link: http://www.purdue.edu/business/mas/costing/Effort_Reporti ng/index.html 44 PAR Procedures Something must be written in the Effort % column. Writing the word “SAME” in the Effort % column is acceptable if the effort that is being certified is the same as the existing distribution. Certify in whole percentages whenever possible When a PAR with changes is keyed by the Costing Department, IT27 for each month in the semester will change to match the PAR unless the difference is less than 5%, or a PAR calculator is attached to show varying monthly distribution. 45 EXAMPLES OF HOW TO USE THE WORD SAME This par will cause no change to cost distribution. Everything will remain the same. If there is more than one job and you put the word same on both of the jobs nothing will update. 46 EXAMPLES OF HOW TO USE THE WORD SAME PAR EXAMPLE: • The numbers that we would key for this par WG 1 would be 50%/50%. This would make each months cost distribution 50%/50%. There is nothing to tell the system that it should do anything else. • If you want the cost distribution to anything else a par calculator would be necessary to tell the system how exactly you want the cost distribution to look. • If you have more than one job on a par it is a good idea to get into the habit of making a par calculator for the unchanged job as well making the change that are needed. 47 When Do I Use a CD-01? Use a CD-01 to document a cost distribution change needed after payroll has been posted: For any Bi-Weekly employee paid on Sponsored Program Funds or Federal Appropriations Monthly and biweekly Personnel paid from all other funds will only require a CD-01 form to completed if the changes are for periods prior to July 1 of the previous calendar year. You DO NOT need a CD01 when submitting a Revised PAR 48 EXAMPLES OF ACTIVITIES SPONSORED VS NON-SPONSORED 49 DEFINING PAR FIELDS 50 DEFINING PAR FIELDS 51 DEFINING PAR FIELDS 52 DEMO -Example 1 : Simple PAR Certify whole percentages whenever possible. Certification must equal 100% per PERNR per Wage Group. If change is less than 5%, IT27 will NOT change. If no change is necessary, the word “same” can be written in the Effort Column (DO NOT LEAVE IT BLANK). 53 SIMPLE PAR 54 WHEN TO USE CALCULATOR (PAR Effort Calculator) If a grant expires during the PAR period, costing has to manually key each month to enter the certified PAR if it includes changes to distribution. When using a PAR calculator, use the exact figures shown at the bottom of the form. Certification must equal 100% per PERNR per Wage Group. IT 27 will update for ALL lines if the change is greater than 5% in any given line One employee may have more than 1 PERNR If necessary, coordinate with other departments to make sure that certification is accurate and complete. More than one person can sign as authorized administrator if necessary. Please note: All employees paid on sponsored programs (grants) with concurrent appointments must be certified on ALL appointments, even if only one of the concurrent appointments is sponsored. 55 DEMO-EXAMPLE 2: PAR WITH CALCULATOR Demo the PAR Calculator 41120000 7.5% 7.5% 7.5% 7.5% 56 DEMO- Example 1 : PAR Without Calculator DIFFERENCE BETWEEN HAVING A CALCULATOR AND NOT CALCULATOR This is how cost distribution will look if no par calculator is sent along with the par. Cost Center 4027013000 57 Order Fund May June July August 8000055682 41120000 7.5% 7.5% 7.5% 7.5% 8000041497 41100000 80% 80% 80% 80% 21010000 12.5% 12.5% 12.5% 12.5% DEMO-EXAMPLE 2: PAR WITH CALCULATOR Bottom Box— %Effort that should be entered on the PAR: 58 Use the numbers in the bottom box to be written on the face of the par. *Note* The total on the bottom must be exactly 100%. THIS IS THE COST DISTRIBUTION WOULD LOOK IF KEYED ACCORDING TO THE CALCULATOR. Cost Center 4027013000 59 Order Fund May June July 8000055682 41120000 10% 10% 10% 8000041497 41100000 90% 90% 90% 21010000 August 50% 50% Post PAR Procedures PARs that are received after the June 6th deadline but DO NOT change cost distribution are considered late and require an explanation as to why the PAR is late. PARs that are received after the June 6th deadline that change cost distribution are considered post PAR and require both an explanation AND pre-auditor signature. All revised PARs require an explanation and pre-auditor signature, regardless of when they are received. 60 Explanations Explanations must be clearly and carefully worded so that regardless of the passage of time, a person unfamiliar with the situation can fully understand why and how the error occurred, understanding the corrective action and find it appropriate 61 EXPLANATIONS Your explanation on both PARs or a CD-01 should include: Why is the correction proper and necessary? Explain what is being corrected. Include person and PAR period, and how the necessary change was discovered. Explain the change being made- include account, % before change, % being changed to, and project period for SPS and AG funds. If document is not timely, explain why the document is late. PAR explanation refers ONLY to effort. Do not mention salary. 62 Less than 5% Changes In very rare situations an adjustment of less than 5% will be allowed. Request for a less than 5% change requires an explanation and approval from the Costing Office /Comptroller. Less than 5% changes on a Revised PAR or Post PAR are VERY RARELY approved. The following are examples of when a less than 5% change may be approved when CLEARLY REQUESTED AND DOCUMENTED: 63 Less than 5% Changes • A less than 5% adjustment will be permitted to clear an over drafted account. A less than 5% adjustment will be allowable to remove postterm charges from an account. A less than 5% adjustment will be allowable if an employee is paid from a separately certified project but reports zero effort on the PAR. A less than 5% adjustment is acceptable if, when coupled with committed cost sharing or a memo match on the PAR, the adjustment is equal to or greater than 1%. If there is a signed contract that is approved by the Comptroller that requires tracking less than 5% adjustments. 64 REASONS BEHIND THE POLICY/PROCEDURE WHY DO WE DISCOURAGE CHANGES OF LESS THAN 5%? • Federal government realizes that measuring effort cannot be precise at all times. • Process is based on an after the fact estimation of how the individual spent his/her time • Purdue University negotiated the threshold of 5% with DHHS 65 HOW TO DETERMINE IF A LESS THAN 5% ADJUSTMENT IS NEEDED • IS THE DIFFERENCE BETWEEN %CD AND % EFFORT ON ANY ONE LINE GREATER THAN 5%? IF YES– YOU DO NOT NEED THE LESS THAN 5% ADJUSTMENT. THE SYSTEM WILL MAKE THE CHANGES THAT ARE REQUESTED. IF NO—THEN A LESS THAN 5% ADJUSTMENT IS NEEDED. THIS WILL FORCE THE SYSTEM TO MAKE THE CHANGES THAT YOU ARE REQUESTING WHEN IT WOULD NORMALLY NOT MAKE THOSE CHANGES DUE TO A LESS THAN 5% CHANGE. THE 5% DIFFERENCE IS NOT BASED ON A COMBINATION OF LINES. 66 Useful T-Codes S_P7H_77000175 Actual Certification by Employee ZHR_PAY_POSTING Shows Salary Distribution by Pay Period PA20 Info type 27 Displays Cost Distribution PA20 Info type 15 STY 1315 Displays Summer Payments 67 Demo of Useful T-Codes 68 Effort Reporting Escalation Process The Effort Reporting Period is to be closed within 60 days after the end of the reporting period in order to satisfy federal reporting requirements. This is a follow-up process designed to identify unresolved issues for the period. An email with the outstanding PAR list will be sent to the departments business manager and DFA beginning the week before PARs are due to the Costing Office, and will continue until all PARs are returned. 69 PAR Timeline Dates 2 weeks after the end of PAR period PAR Training completed and all PARs distributed 30 days after PARs are distributed PARs are due to the costing office 60 days after PARs are distributed Bus. Managers receive a listing of outstanding PARs with a memo from Dir. of Bus. Managers and/or the Associate Comptroller with a copy to the Dir. of Fin. Affairs or the Director of Accounting at the Regional Campus. 90 days after PARs are distributed Bus. Managers receive a listing of outstanding PARs with a memo from Comptroller with a copy to the Dir. Of Fin. Affairs and the Dir. of Bus. Managers or the Regional Campus Comptroller 120 days after PARs are distributed Dir. Of Fin. Affairs receive a listing of outstanding PARs with a memo from Vice President of Business Services and Assistant Treasurer with a copy to the Dean, Dir. of Bus. Managers or the Regional Campus Comptroller Spring Effort Reporting Timeline • 12/31/2016 – PAR period ends • 05/06/2016 – Business Offices Receive PARs at Training • 06/06/2016 – Certified PARs are due to the Costing Office • 06/07/2016 – Post PAR begins. Explanations and appropriate signatures are required • Keying of PARs will begin in the Costing office as soon as PARs are received. Adjustments will appear after the May or June payroll run, depending on when they are keyed. • Note: The cost distribution deadline for May payroll is the 18th & June deadline is the 21st. . 71 SPRING PAY DATES JANURAY 1, 2016 – APRIL 30, 2016 January 2016 1/01/2016 – 1/31/2016 February 2016 2/01/2016 – 2/291/2016 March 2016 3/01/2016 – 3/31/2016 April 2016 4/01/2016 – 4/30/2016 72 Questions 73 Have Questions or Need Help? CONTACT Costing@purdue.edu – this email address contacts all Costing Representatives Anne Hager Phone: 49-44894 Email: ahager@purdue.edu 74 Thank You for Attending! 75