Risk-FMEA.ppt

advertisement

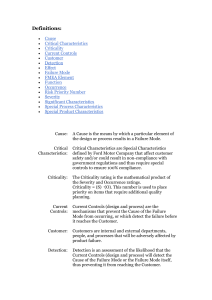

Risk! Paul Koza Vistakon – Quality Engineering Background Quality Engineer with Vistakon for 5 years BS in Business from The University of Tennessee MS in Mathematical Science from Clemson University Experience in transportation, pulp & paper, plastics, and medical device industries Risk approaches based upon collective writings of Peter Bernstein Why We Do The Things We Do Risk management Effective decision making Complex tools Catastrophic failures and breakdowns Far-reaching consequences “You want a valve that doesn’t leak and you try everything possible to develop one. But the real world provides you with a leaky valve. You have to determine how much leaking you can tolerate.” - Arthur Rudolph, Saturn 5 Rocket Scientist Contemporary Examples Amtrak derailment in Crescent City Enron Financial Collapse Domestic Anti-terrorism Procedures NFL Draft New Product Development (R&D) Product Marketing Strategy Find a New Job vs. Stay Put Conflict Management of a business is a process that constantly looks into the future. The future cannot be quantified because it is unknown. We can use numbers to quantify past events. To what degree should we rely on historic patterns to tell us about the future? What matters more – –The facts as we see them –Our subjective beliefs about what lies hidden in time Bottom Line The consequences of the choices we face should outweigh probabilities of the outcomes we expect. Decision makers have free will and make rational choices even when the future is uncertain. A Walk Down Memory Lane Approach #1 – Blaise Pascal Pascal spent his life alternating between casinos and fleshpots followed by intense religious periods. Religion won in the end. Pascal’s last days were spent at the monastery of Port-Royal. Pascal’s Wager – “God is, or is he not. Which way should we incline? Reason cannot answer.” Is an outcome in which ‘God is’ more valuable than an outcome where ‘God is not’? Our guess about the probability of God’s existence doesn’t help – we have no method to test the hypothesis. Suppose you act as though God exists and lead a life of virtue. Suppose you are wrong and God is not. You’ve passed up some fun, but gained some other rewards in the process. Now suppose you act like God is not. You enjoy life and place ‘me’ above all else. Suppose you are wrong. You enjoy goodies in your lifetime, but suffer eternal damnation. The value of the bet that God is, is infinitely greater than the value of the bet that God is not. The probability that God is or God is not is irrelevant. Business Application • Product launch in a new country with a growing market for this product type. • Probability of success is high but the market is competitive. • Price is dominant variable – product differentiation is difficult. • Given interest rate spreads and the exchange market’s optimistic outlook for this nation’s currency, you see no need to hedge the foreign currency at this time. • Do you hedge or not hedge? Suppose you hedge and you’re wrong: exchange rates are stable. Although you incur the cost of hedging, you can still price the product correctly for the market, regardless of the exchange rate. Suppose you agree with the optimistic exchange market and don’t hedge. But the currency depreciates and surprises the market. You will receive fewer $ for each unit sold in a market where raising the local currency price by even a little will put you out of business. You cannot afford to make this bet. The consequences of being wrong are too serious. Regardless of the exchange rates or the probabilities, maintaining a competitive local price is the single most important element in success. Approach #2 – Jacob Bernoulli The Bernoulli family was extraordinarily talented but also mean and nasty – even with one another. When one family member and his son competed for the same prize from the French Academy of Sciences for work on planetary orbits, and the son won, the father was so infuriated that he threw his son out of the house. Death and Taxes In a letter from Jacob Bernoulli to Gottfreid von Leibniz in 1703, Bernoulli wrote, “It is strange that we know the odds of throwing a seven instead of an eight with a pair of dice, but we do not know the probability that a man of 20 will outlive a man of 60.” Bernoulli wanted to conduct an experiment where he would compare a large number of pairs of men of various ages to see if he could deduce the probabilities from that evidence. Leibniz was not impressed. He replied to Bernoulli, “Nature has established patterns originating in the turn of events, but only for the most part.” We can never escape uncertainty. No mathematical model works perfectly. Statisticians are satisfied when a model works with only 5% probability that its results are due to chance. But that still leaves 5% that we do not understand, cannot model, and can cause all kinds of mischief if we mechanically make decisions based on the model. No event is without cause. Assigning a probability to chance is the same as assigning a number to ignorance. Patterns repeat themselves only for the most part. Use risk management tools and the art of survival when forecasts about the unknown future turn out to be wrong. In the earlier example, the currency did depreciate, even though the probabilities were against it. The other part matters every bit as much as the most part. Approach #3 – Stephen Jay Gould Gould is an American evolutionary biologist. He was informed in his twenties that he suffered from mesothelioma, a deadly form of cancer. The median life expectancy was eight months. Gould faced this diagnosis from his training in Darwinian evolution – a reality in which causes have effects but the variety of possible effects from any given cause is limitless. Consequently, the effects are not entirely predictable. “Variation stands as the fundamental reality and calculated averages become abstractions.” Focusing on the mean ignores the events in the tails 0 mo 8 mo Infinity Life Expectancy All of us depend too much on measures of central tendency – we focus on the hole rather than the donut. Our decisions are based on trends, correlation coefficients, normal distributions, and above all the mean. The essence of risk management is the recognition of variation. Losses do not stem from average results but rather from deviations from the mean – the outliers of distributions. Simplification lures us into a trap - it is impossible without measures of central tendency. Gould’s Darwinian models argues that diversity in nature is so great and every event could lead to a large variety of outcomes that there is no such thing in nature that we can identify as the norm. In risk management, normal is not a state of nature but a state of transition and trend is not destiny. The positive message here is that variety is the spice of life. Take away variety and nothing remains but averages with zero standard deviations and targets always on the mark. Remove variety and we remove uncertainty. Variety is the essence of survival. All ships don’t skink together, all stocks don’t go up or down at the same time, different assets have different cyclical patterns. Without variation, life would not only be boring, but life would be risky. Variation makes risk management possible. It means that there is more than one basket in which to carry eggs. Therefore, society is willing to assume more risk if there are additional baskets. Risk Management Tools Failure Modes and Effect Analysis (FMEA) Fault Tree Analysis Quality Function Deployment (QFD) – House of Quality Failure Mode Fail to Intent Effect Root Cause Consequence Analysis Mitigation Risk Assessment Action Plans Results Continuous Improvement Scope and Objective • • • • Design Control Risk Assessment Risk Management Trouble Shooting (Fault Finder) Top Down Failure Mode Type 1: Failure to perform specified function Type 2: Something you don’t want – something that is not supposed to be there Cause Man Machine Method Material Environment Effect Effect means consequence or impact • Immediate Consequence • Consequence of the consequence • Consequence of the consequence of the consequence • Cumulated Consequence = ∫Consequencen Effect Product Local Effect Process Local Effects Immediate effect – effect on reviewed item or local area Immediate effect – effect on local process area Next High Level Effect Downstream Process Effects Effects on surrounding parts or next high level subassembly, or all effects between local and end product End Effect Effect on system, or effect on end product user Effect on downstream process is we cannot correct the situation immediately and stop the problems End Effect Effect on entire system or end product user Mitigation Mitigation means: What are you going to do about the situation? 1st Line of Defense Avoid or eliminate failure causes 2nd Line of Defense Identify or detect the failure earlier 3rd Line of Defense Reduce the impacts/consequences of failure Risk Assessment Occurrence The likelihood that a failure occurs by a specified cause under current control Severity The impact(s) of failure Detection How early and effectively can we detect and correct the failure Risk Priority Number (RPN) The compounds of Occurrence, Severity, and Detection Reaction Plan Are you satisfied with the situation? If not, do something – mitigate again! 1. 2. 3. How can I prove it to myself that I don’t have the problem? Test plan – how good is this test plan? Can I find and correct the situation? (Second line of defense) Can I avoid it totally? First line of defense You bought the farm – How can I control the damage? Third line of defense Responsible Party Who is going to take action? When can they complete it? Types of FMEA’s • Product FMEA – also called Design FMEA (dFMEA) • Process FMEA – also called Manufacturing FMEA (pFMEA) • Application FMEA – also called User FMEA (aFMEA) • Supplier Quality FMEA – also called Material FMEA (mFEMA) • Service FMEA – also called Preventive Maintenance FMEA (sFMEA) • Equipment FMEA Bottom-Up Approach Residential Internal Painting System Primer Additives/Filler Adhesive Coating Color Pigment Vehicle/Carrier Resin Top-Down Approach Example – Paint • Homogeneous coverage for background • Compatible with coating and surface • Environmental resistance (5 years) • Easy to apply • Quick to dry • Color appearance (opaque) Common Mistakes and Traps “Fill in the blanks” only. Don’t understand the scope and objective of FMEA Day dreaming Didn’t go through the self-challenge process of design control Couldn’t separate Failure Mode, Cause, Effect Mixed everything together. Argument for the sake of argument. Common Mistakes and Traps Repeated itself Dog chases its own tail. Mitigation is not truly challenged Ranking criteria too loose Only identifying the problems but not the solutions. Or, couldn’t control it, even if there is a solution. Control plan not in place. Do once, then keep in file Leaving Document rather than Living Document Lack of consistency Thank you