Trade and Investment Issues for Chile (Kana)

advertisement

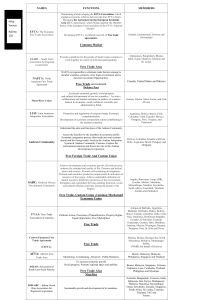

Trade and Investment The Experience of Chile Rome, 2007 Foreign Direct Investment in Chile (DL 600) Total 1974-2006: US$63,517 millions Switzerland 2% France 2% Others 11% USA 25% Netherlands 2% Italy 3% Japan 3% Foreign Direct Investment from Chile to other countries Total 1990-2006: US$38,300 millions Uruguay 1% Venezuela 1% Cayman Islands 3% Spain 1% Others 8% Argentina 36% Panama 3% USA 4% Australia 5% UK 9% Spain 22% Canada 16% Colombia 12% Peru 14% Source: Foreign Investment Committee (www.cinver.cl) and Direcon (www.direcon.cl) Brazil 17% Foreign Trade Policy Elements Open economy Dependent on international trade Small country Transparent Chile = Free Trade Domestics policies • Sound distribution of resources • No subsidies • Simple tax system • State – Subsidiary role – Regulator, not owner • Independent Central Bank Foreign trade policy • Looking outward (exports) • Unilateral openness (6%) • Welcome to Foreign Investment: – Open pre & post – Strong protection Options Multilateralism Plurilateralism or regionalism Bilateralism “All of them” Multilateralism GATT (1948)/WTO Active participants Tokyo round Uruguay round Doha round (Round of the development) Regionalism FTAA (“momentum”) APEC Bilateralism- FTA Canada Mexico C. America (5) EU (27) Korea USA EFTA (4) Venezuela Colombia* Ecuador Peru* Mercosur (4) Bolivia Panama* * Not in force • N. Zealand, Singapore, Brunei • India (partial trade agreement) • China • Japan 18 Agreements 56 countries 88% of actual trade Chile and the World 30 27 25 EU 25 L.America 20 18 USA 15 10 Mx,Cnd, Kor 9 Japan 8 Rusia 5 0,2 0 Duties on International Commerce Year Percentage of total tax revenue 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 11.9 10.9 10.3 9.2 8.3 7.0 5.7 3.9 2.9 2.6 Projected Fiscal income 1: With Free Trade Agreements and VAT 19% 2003 2004 2005 2006 8,140.6 8,458.0 9,022.7 9,499.3 16.3% 16.5% 16.5% Net Revenue Income Tax burden 16.5% Source: Budget and Tokman (2004) Projected Fiscal income 2: Without Free Trade Agreements and VAT 18% 2003 2004 2005 2006 8,236.3 8,546.4 9,128.8 9,623.4 16.5% 16.7% 16.7% Net Revenue Income Tax burden 16.7% Source: Budget and Tokman (2004) Protection of Foreign Investment Agreements 5 Asia Pacific region 20 in Europe 14 in Americas Investment regime National treatment DL 600 Chilean Double Taxation Treaties In Force Before Congress Negotiation concluded Argentina Brazil Ecuador Mexico Peru Ireland Malaysia Portugal Paraguay South Africa Colombia (signed) Canada Poland Croatia Spain Denmark Sweden France S. Korea Norway UK New Zealand Russia Thailand What are your objectives ? Investment In out Technology Chile's future.... R B B B