12644891_TASA SAANZ Brisbane 2012 Explaining funeral debt.ppt (1.221Mb)

advertisement

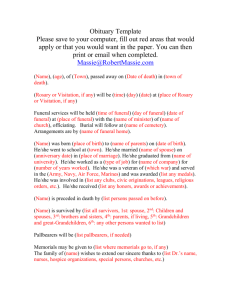

Explaining funeral debt: an examination of socio-economic and emotional dimensions of funeral arranging. Dr Ruth McManus University of Canterbury Christchurch NZ Why study funeral debt • What’s the issue? • What’s involved? Limitation of literature on funeral debt • Dualism of emotion and reason – focussed on emotions – focussed on condemning cost of funerals – focussed on non-Western societies • Methodological limitations – Presumptions rather than understandings – Inherent difficulties in examining emotions – Mono-methods Cartoon of Jessica Mitford, author “ American way of Death‘” The study • Mixed methods study – Survey – Interviews – Analytical strategy The research question “How do the conventions of what we are supposed to feel when arranging a funeral articulate with the stratification of access to resources to achieve the successful arrangement of a funeral - especially when this involves going into funeral debt?” Emotions and decision-making Fulfilling conventions “ … and I got a lot of release from the bereavement by that happening and so I’m very conscience… I don’t know if I’m going off the topic … but I’m very, very conscientious and my main priority in my work is because of my experience is to make sure that we’d listen to the families and that the organisation goes well on the day and there are no unexpected hiccups. And if anything ever goes wrong at a funeral I’m absolutely gutted by it and I’m always… when I do funerals…a nervous wreck … ‘cause I just want everything to be perfect ‘cause my experience was perfect and the, the sense of relief and the sense of, um, help I got from it being perfect I know as a bereaved person meant a lot to me. Um, and but to do that you have to have systems in place and so when I started working there apart from just dealing with the families and that sorta thing I also put into place accounting packages, wages packages, um, changed the banks, changed lawyers, ah, changed accountants… you know, just to get the whole system, um, working”(Funeral director employee, female, mid 40s). From affects to emotions • The sudden pressure you feel, as well as the devastation from losing a loved one, there is the sudden sick feeling about how to pay. Especially when the funeral director sits there telling you how much everything is going to cost and asking what type of casket you would like and then shows you pictures with the prices written under each one. The guilt is hard as well because you feel like you really want to do the best for the person and don't want to skimp on anything • feelings of responsibility Strategies to arrange funerals mediated by responsibility When funerary and financial conventions are accepted ( majority) • Expanded responsibility and defrayed costs • Informal contributions (whip round) • Formal contributions (grants & “ the book-keeper”) • Help in kind • Individualised responsibility for shouldering costs • Pre-plan • Debt When funerary and financial conventions are rejected ( minority) • Refusing the funerary conventions • Donating to science • Refusing financial conventions – No funeral – Bad debt • Expanded responsibility Informal contributions (whip round) – It was informal... There was people that were just ringing up and saying “oh if you need money we’ll give you some money”… But the thing is most of their friends were poor… … so it’s all, you know, people …they were living on their bones of their arses…is what you call it, yeah. They were all poor people so just everyone, you know, even if it was ten bucks from a mate it’s still $10, you know… • Formal contributions – grants ( funeral grant, RSA grant) – “ the book-keeper” - ‘Actually we didn’t really suffer with my parents because, um, all the, um, mats and money that were actually collected…paid for, um, like Dad back in 1978, I think we collected something like $15,000. Now that’s a lot of money back then. And that paid for, um, his… all his funeral expenses, paid off in cash. It paid off all the, um, expenses in terms of food and that and what money was left over paid, um, like ‘cause what they used to do is they used to put all the bills… pay all the bills and bring it right down to zero so all the phone bills are paid off, all the, all the power bill was paid off. Any other expenses were paid off. So that the widow would actually start with a nil balance. And whatever money was left went to the widow.’ • Help in kind – Interviewee 3, a middle aged Pakeha woman from a rural background explained ‘I think our expectations are, well perhaps I am odd, but for instance we borrowed a nice clean white builders van, we could have hired one, we didn’t use a hearse at any point. Um why do we have to have a shiny black car with a chauffeur, when a family member could put it in the back of a van?’ Individualised responsibility • Temporal stretching • Pre-pay – Individuals choose their institutions, however they choose them in circumstances not of their own making. In the contemporary setting I will have to pre-plan and pay my funeral as if I do not then my family will be left with debt burden unless my estate is wealthy to handle the cost after the sale of my assets. In it's current status my estate does not include any assets which could pay for a funeral and cover my existing debt burdens and obligations. ( Respondent 18) – The older generation can put a lot of pressure onto the younger ones with their wishes for a funeral and this could mean those younger ones pay far more than what they can afford. I feel if everyone pre paid for what the wanted , or had life insurance it would take a lot of strain off the family at an awful time. (respondent 32) Individualised responsibility – debt • Debt Being a student it wouldn’t take me much to get into debt. But hey, what’s another thousand dollars or so on top of an already large (and ever increasing) student loan!! I imagine being in a situation like this would be extremely stressful....especially having this on top of grieving as well ( respondent 6) People can go into debt over a wide screen tv if they so wish. They should be allowed to choose the appropriate service and hence the cost” ( respondent 25) There's debt - which you solve with a bank trip - and there's guilt which can stick forever. We have obligations to the dead. (respondent 8) Temporal stretching • Temporal stretching - staggering the completion of commitment to fulfil the obligations associated with both sets of conventions. • Pre-pay • Personal Debt When funerary and financial norms are rejected • Refusing the funerary conventions – Donating to science • ‘One other thing, which I think is really relevant. I was talking to someone about our thing this afternoon. Who told me she used to be the manager of the Morgue here. And she said that there were quite a high number of people that did not want, would donating their bodies to medicine, and that was their reason, they had said, they did not have the money for a funeral, so they would donate their bodies so they didn’t have to pay. So I mean that is pretty horrible’. (Pakeha woman, mid 40s ) • Refusing the financial conventions – Bad debt • Um, no I would say the working class would be the honest ones, who wouldn’t want to have anything too over the top or too elaborate. They would have your normal $5000 funeral and they would find the money to pay for it. It would be people probably in Maori Hill or Remuera, or Cashmere, that is a terrible generalisation. They would say ‘Oh yes don’t worry just um, get the caterers in”... I remember one we paid $3000 for the caterers, it took us a year to get that money out, $3000 catering bill alone… For 400 people. But it was over catered, it was absolutely terrible, I shouldn’t, I have learnt my lesson on that one. (a funeral home proprietor (male, Pakeha, mid 50s) ) Do you think say funeral directors should be able to call in debt collectors? • Ok, because they have had the funeral. The Funeral Director has done all the work and you have agreed to it, and therefore now it is your responsibility. You have agreed to it. I know you are under all this pressure to do it but you have still agreed to it. (respondent C, interview) Demographics of responsibility vs financial strategy Those in clerical and manual occupations, who are under the age of 46, with no experience of organising a funeral can seem themselves and can accept others going into debt for a funeral. Conversely, those in professional and service occupations and those who are retired, are over the age of 55, with experience of fully organising a funeral do not tend to think it is appropriate for themselves or others to go into debt. Inverse relationship between personal responsibility and mitigating costs Internalised responsibility Externalised responsibility Demographics of responsibility vs financial strategy Those who are least able to afford it are more likely to take on debt. They are prompted to do so because, conforming to the culturally authorised response, they articulate intense feelings of personal responsibility that, because they are experienced alongside limited financial resources, cannot be mitigated effectively. Since taking out a loan is the most accessible and individualised resolution of this responsibility, it is more readily made use even in the face of its long-term consequences. Those with a higher soci-economic profile are able to defray and deflect feelings of responsibility that are individualising and personalising in preference for feelings of responsibility that are dispersed and externalised. These feelings mobilise much as they can