Course Notes - Part 1 - Summer 2004 (WORD format)

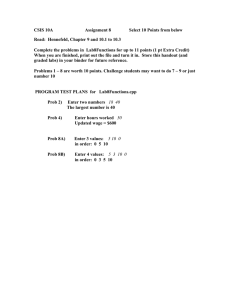

advertisement