4.Ch3AssignSol

advertisement

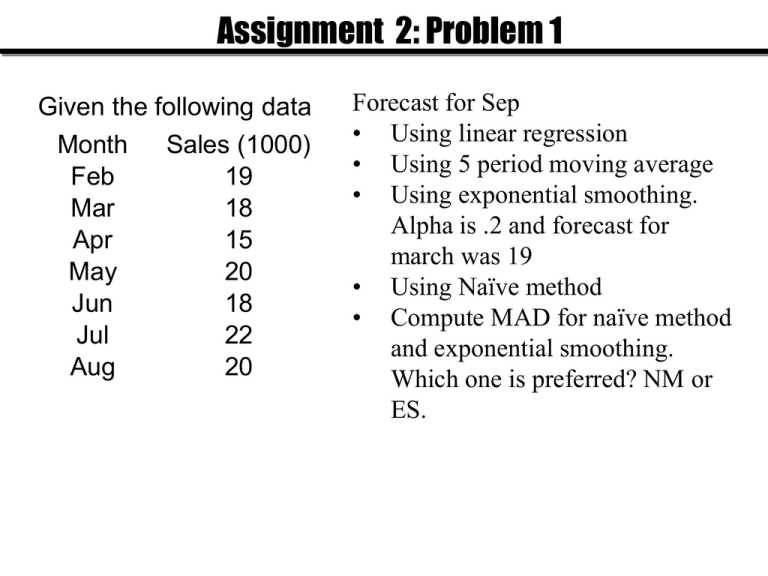

Assignment 2: Problem 1 Given the following data Month Sales (1000) Feb 19 Mar 18 Apr 15 May 20 Jun 18 Jul 22 Aug 20 Forecast for Sep • Using linear regression • Using 5 period moving average • Using exponential smoothing. Alpha is .2 and forecast for march was 19 • Using Naïve method • Compute MAD for naïve method and exponential smoothing. Which one is preferred? NM or ES. (a) Plot the Data Sales (1000) 19 18 15 20 18 22 20 Monthly Sales 25 Sale (1000) 1 2 3 4 5 6 7 Month Feb Mar Apr May Jun Jul Aug 20 15 Monthly Sales 10 5 0 0 2 4 Month 6 8 (b-2)Forecast for Sep Using 5 Period Moving Average t 1 2 3 4 5 6 7 At 19 18 15 20 18 22 20 F8 =MA7= (A7+A6+A5+A4+A3)/5 = (20+22+18+20+15)/5 F8 =MA7= 19 (b-2)Forecast Using 5 Period Moving Average for All Periods t 1 2 3 4 5 6 7 At 19 18 15 20 18 22 20 Moving Average MAt Ft 18 18.6 19 18 18.6 19 (b-3)Forecast for Sep Using Exponential Smoothing α =.2 and F(Mar) = 19 t 1 2 3 4 5 6 7 At 19 18 15 20 18 22 20 F3 = (1-α)F2 + α A2 F3 = (.8)19+ .2(18) F3 = 18.8 March is period 2 (b-3)Forecast for Sep Using α =.2 and F(Mar) = 19 Using the same formula, we compute F4, F5, F6, F7, and finally F8 which is the demand for Sep. 1 2 3 4 5 6 7 At 19 18 15 20 18 22 20 Ft 19 18.80 18.04 18.43 18.35 19.08 19.26 (b-4)Forecast for Sep Using Naïve Method F8 =A7 F(t +1) =At F8 = 20 Forecast for all periods using Naïve Method t 1 2 3 4 5 6 7 At 19 18 15 20 18 22 20 Ft 19 18 15 20 18 22 20 (c) Which Technique ? When comparing several methods using MAD, we need to use the same time horizon for all methods. We need to have actual as well as forecasts for all methods for all periods of MAD computations Here we have Actual for periods 1 to 7; that is 7 periods. Regression can provide us with forecast for periods 1 to ∞ On the other hand, five period moving average can only provide us with forecast for periods 6 and 7; that is 2 periods Therefore, to compare all these methods, we can compute MAD only over 2 periods. But two period is not enough (c) Naïve Method or Exponential Smoothing ? Naïve method forecasts for periods 2 to 7; That is 6 periods Exponential Smoothing for periods 2 to 7; That is 6 periods We can compare NM and ES over 6 periods. We may also ignore period 2 because in exponential smoothing forecast for period 2 is just the same as actual demand for period 1 and that is the same for naïve method. Here we compare NM and ES over a 5 period time horizon. From period 3 to period 7 (c) Naïve Method or Exponential Smoothing ? Period Actual Naïve Method Expo. Smoothing 3 4 5 6 7 15 20 18 22 20 18 15 20 18 22 18.80 18.04 18.43 18.35 19.08 (c) Naïve Method or Exponential Smoothing ? Period Actual Naïve Method Expo. Smoothing NM ES 3 4 5 6 7 15 20 18 22 20 18 15 20 18 22 18.80 18.04 18.43 18.35 19.08 3 5 2 4 2 3.80 1.96 0.43 3.65 0.92 (c) Which Technique ? Period Actual Naïve Method Expo. Smoothing NM ES 3 4 5 6 7 15 20 18 22 20 18 15 20 18 22 18.80 18.04 18.43 18.35 19.08 3 5 2 4 2 3.2 3.80 1.96 0.43 3.65 0.92 2.15 Better However, we need to keep all methods, because we need more actual data. A MAD computed just 5 periods is not a reliable measure. It is better to have all methods for say 10-20 more periods, and then identify the best method Regression t 1 2 3 4 5 6 7 At 19 18 15 20 18 22 20 Ft 16.86 0.5t SUMMARY OUTPUT Regression Statistics Multiple R 0.492518281 R Square 0.242574257 Adjusted R Square 0.091089109 Standard Error 2.090796157 Observations 7 Forecast using simple regression ANOVA df Regression Residual Total Intercept X Variable 1 SS 1 5 6 MS F 7 7 21.85714286 4.371428571 28.85714286 Coefficients Standard Error t Stat 16.85714286 1.767045268 9.539734585 0.5 0.395123334 1.265427671 Significance F 1.60130719 0.261481287 P-value 0.000214193 0.261481287 Lower 95% Upper 95% 12.31480839 21.39947732 -0.515696865 1.515696865 Assignment 2: Problem 2(a) Exponential smoothing is being used to forecast demand. The previous forecast of 66 turned out to be 5 units larger than actual demand. The next forecast is 65. Compute ? F(t+1) = Ft + (At-Ft) 65 66 65 = 66 + (-5) 5=1 = 0.2 -+5 5 Assignment 2: Problem 2(b) The 5-period moving average in month 6 was 150 units. Actual demand in month 7 is 180 units. What is 6 period moving average in month 7? MA56 = (A6+A5+A4+A3+A2)/5 MA67 = (A7+A6+A5+A4+A3+A2)/6 MA56 = (A6+A5+A4+A3+A2)/5 = 150 A6+A5+A4+A3+A2 = 750 A7 = 180 MA67 = (A7+A6+A5+A4+A3+A2)/6 MA68 = (180+750)/6 = 155 Assignment 2: Problem 2(c) Tickets numbered from 100 to 200 have been sold. Using the random number rand() = 0.35 identify the winner. If the random number is 0 it must become 100. The only way to transform 0 into a positive number is by addition. It is not possible by multiplication X = 100 +R But R is greater than or equal to 0 and less than or equal to 1. Therefore X here is between 100 1nd 101. That is not what we want X= 100+100R and round it.