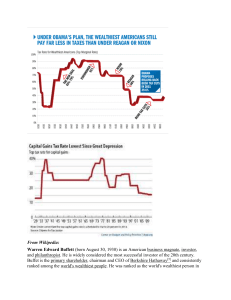

T6- Buffettology

advertisement

Buffettology Chapter 1: How to Look at the Stock Market the Warren Buffett Way Buffettology 101 The Wisdom of Warren Buffett As far as I am concerned, the stock market doesn’t exist. It is there only as a reference to see if anybody is offering to do anything foolish. Buffettology 101 The Wisdom of Warren Buffett “Investing is often described as the process of laying out money now in the expectation of receiving more money in the future. At Berkshire we take a more demanding approach, defining investing as the transfer to others of purchasing power now with the reasoned expectation of receiving more purchasing power – after taxes have been paid on nominal gains – in the future.” -Warren Buffett (2011 Annual Report) 6/28/2016 Professor Kuhle 6 Buffettology 101 The Wisdom of Warren Buffett 1. All we want is to be in businesses that we understand, run by people whom we like, and priced attractively relative to their future prospects. 2. I buy businesses, not stocks, businesses I would be willing to own forever. 3. Invest within your circle of competence. It’s not how big the circle is that counts, it’s how well you define the parameters. 4. When management with an excellent reputation meets a business with a poor reputation, it is usually the business’s reputation that remains intact. 6/28/2016 Professor Kuhle 7 Understanding the Influence of Ben Graham on Warren Buffett Through the Story of Mr. Market Long ago Ben Graham described the mental attitude toward market fluctuations that I believe to be most conducive to investment success. He said that you should imagine market quotations coming from a remarkably accommodating fellow named Mr. Market who is your partner in a private business. Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his. Even though the business that the two of you own may have economic characteristics that are stable, Mr. Market’s quotations will be anything but stable. For, it is sad to say, Mr. Market is a fellow who has incurable emotional problems. At times he falls euphoric and can see only the favorable factors effecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead for both the business and the world. On these occasions he will name a very low price, since he is terrified that you will unload your interest on him. Ben Graham and Mr. Market Continued: Mr. Market has another endearing characteristic: He doesn’t mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow. Transactions are strictly at your option. Under these conditions, the more manic-depressive his behavior, the better for you. But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up someday in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren’t certain that you understand and can value your business far better than Mr. Market, you don’t belong in the game. As they say in poker, “If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.” 6/28/2016 Professor Kuhle 9 Good News! The Market is Dropping Practice a selective contrarian investment strategy. This is one in which the investor is motivated to invest by a falling stock price. Contrarians invest in what the market finds unattractive. Recognize that the majority of investors play the short-term investment game. People sell on bad news. Companies that have a franchise product and thus a competitive advantage, have the economic power to weather most bad-news storms. Always invest in companies with a long-term durable competitive advantage, which we call a franchise product. A product characterized by few or no substitutes, a product in demand by many, little or no government regulation. Market Volatility – Your Best Friend! 6/28/2016 Professor Kuhle 11 The driving force of Warren Buffett’s investment strategy is the rational allocation of capital. Determining how to allocate a company’s earnings is the most important decision a manager will make. Rationality is the quality Buffett most admires. Buffett’s success has depended as much on eliminating those things you can get wrong, which are many (i.e. predicting markets, economies, and stock prices), as on getting things right, which are few and simple (valuing a business). There are two simple variables Buffett focuses on: the price of the business and the value of that business. 1. Turn off the stock market. Remember that the stock market is manic-depressive. Wildly excited sometimes or unreasonably depressed. This behavior creates opportunities, but you do not allow the market to dictate your actions. 2. Don’t worry about the economy. Buy a business that has the opportunity to profit in any economy. 3. Buy a business, not a stock. Change your perspective to that of a business owner and learn as much as possible about the business and industry. 4. Manage a portfolio of businesses. Don’t diversify for diversification’s sake. Chapter 2: Concepts Every Investor Should Know Interest Rates When interest rates rise, business becomes more difficult and vulnerable. This is due to the high cost of borrowing money to invest in the business. When interest rates decrease, it is easier to borrow capital and therefore expand capacity and activity. Hence, interest rates are the price of borrowing capital to the business. In Finance 101 you should have already covered the before and after-tax cost of borrowing capital. The Federal reserve determines interest rates in three different ways, all of which you should be familiar with. The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislature. The inflation tax has a fantastic ability to simply consume capital. It makes no difference to a widow with her savings in a 5% passbook account whether she pays 100% income tax on her interest income during a period of zero inflation, or pays no income taxes during years of 5% inflation. Either way, she is “taxed” in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 120% Common Stock as an Inflation Hedge: S&P Last 10: 13.8% Last 20: 14.6% Last 30: 10.7% Last 40: 10.8% Last 50: 11.9% LT Bonds 11.3% 10.6% 8.2% 6.8% 5.8% LT Gov’t Bonds 11.9% 10.4% 7.9% 6.4% 5.3% T. Bills CPI 5.6% 7.3% 6.7% 5.7% 5.7% 3.5% 5.2% 5.4% 4.5% 4.4% Source: Ibbotson and Sinquefield, “Stocks, Bonds, Bills and Inflation 2014 yearbook,” Chicago. Bonds A Bond Example: Par Value $1,000 Term 30 Years Coupon Rate 5% What happens when interest rates change? Rates go to 3%; What is the value of the bond? Rates go to 7%; What is the value of the bond? Chapter Summary 6/28/2016 Low Interest Rates High Interest Rates Low Inflation Stocks Bonds High Inflation Stocks Stocks Professor Kuhle 19 Chapter 3: a Brief Introduction to Financial Statements Income Statement for AAPL Three Years Ended December 25, 2010 (In Millions, Except Per Share Data) 2012 Net revenue 156,508 Cost of sales 87,846 Gross margin 68,662 Research and development 3,381 Selling , general and administrative 10,040 Restructuring and asset impairment charges0 Amortization of acquisition-related intangibles 0 Operating expenses 13,421 Operating income (EBIT) 55,241 Other Income 522 Income before taxes 55,763 Provision for taxes 14,030 Net income 41,733 Earnings per common share 6.31 2013 170,910 106,606 64,304 4,475 10,830 0 0 15,305 48,999 1,156 50,155 13,118 37,037 2014 182,795 112,258 70,537 6,041 11,993 0 0 18,034 52,503 980 53,483 13,973 39,510 5.66 6.49 Balance Sheet for AAPL Three Years Ended September 29, 2014 (In Millions, Except Par Value) Assets Current Assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowances Inventories Deferred tax assets Vendor non trade receivables Other current assets 10,746 18,383 10,930 791 2,583 7,762 6,458 19% 32% 19% 1% 3% 13% 11% 14,259 26,287 13,102 1,764 3,453 7,539 6,882 19% 36% 18% 2% 3% 10% 9% 13,844 11,233 17,460 2,111 4,318 9,759 9,806 20% 16% 25% 3% 3% 14% 14% Total current assets Long term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other long-term assets 57,653 92,122 15,452 1,135 4,224 5,478 33% 52% 9% 1% 2% 3% 73,286 106,215 16,597 1,577 4,179 5,146 35% 51% 8% 1% 2% 2% 68,531 130,162 20,624 4,616 4,142 3,764 30% 56% 9% 2% 2% 2% Total assets 176,064 207,000 231,839 21,175 11,414 5,953 0 38,542 2,648 0 16,664 57,854 22,367 13,856 7,435 0 43,658 2,625 16,960 20,208 83,451 30,196 18,453 8,491 6,308 63,448 3,031 28,987 24,826 120,292 16,422 499 101,289 118,210 176,064 19,764 (471) 104,256 123,549 207,000 23,313 1,082 87,152 111,547 231,839 Liabilities and stockholders' equity Current Liabilities Accounts payable Accrued expenses Deferred revenue Commercial paper Total current liabilities Defered revenue- non-current Long-term debt Other non-current liabilities Total Liabilities Stockholders' equity: Common stock and additional paid-in capital Accumulated other comprehensive income Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 2012 2013 2014 AAPL RATIOS 2012 2013 2014 1.496 1.475 0.865 0.496 1.679 1.638 1.024 0.679 1.080 1.047 0.461 0.080 25.141 197.860 14.319 10.129 0.889 27.598 98.888 13.045 10.298 0.826 34.386 86.592 10.469 8.863 0.789 Financial Leverage ratios Total Debt Ratio (TD/TA) 0.329 0.403 Debt/Equity 0.489 0.675 Equity Ratio (TE/TA) 0.671 0.597 Long-term Debt Ratio (LTD/TA) 0.000 0.082 Times Interest Earned Ratio (EBIT/TI) there are 0.000 no interest payments0.000 0.519 1.078 0.481 0.125 0.000 Short term solvency ratios Current Ratio Quick Ratio Cash Ratio Net Working Capital to Current Liabilities Asset Utilization or Turnover ratios Average Collection Period Inventory Turnover Ratios Receivable Turnover Fixed Asset Turnover Total Asset Turnover Profitability ratios Gross Profit Margin 0.439 Net Profit Margin 0.267 ROA (NI/TA) 0.237 ROE (NI/TE) 0.353 ROEWGW (NI/TEWGW): This accounts for Goodwill 0.337 Market value ratios Price/Earnings Ratio 12.000 0.376 0.217 0.179 0.300 0.288 0.386 0.216 0.170 0.354 0.343 12.300 13.000 Basic Report Terminology • 10K ( Annual Report): These are the annual accounts that are filed for all major businesses conducted in the last year. Every corporation must file their annual report within sixty to 90 days after the fiscal year ends, depending on their size. • 10 Q (Quarterly Report): These reports are similar to the 10K but they only cover financial activities for the last quarter (three months). • 8Q (Current Report Filing): This report is filed whenever any major event occurs that could have an effect on the company’s financial position. Keep it simple Chapter 4: Principles and Rules of Value Investing 6/28/2016 Professor Kuhle 27 The basic ideas of investing are to 1) look at stocks as businesses, 2) use market fluctuations to your advantage, and 3) seek a margin of safety. That’s what Ben Graham taught us. A hundred years from now they will still be the cornerstones of investing. The Warren Buffett Way - his Tenets Business Tenets 1. Is the business simple and easy to understand? 2. Does the business have a consistent operating history? 3. Does the business have favorable long-term prospects? Management Tenets 1. Is management rational? 2. Is management candid with its shareholders? 3. Does management resist the institutional imperative? Financial Tenets 1. Focus on return on equity, not earnings per share. 2. Calculate shareholders “intrinsic value.” 3. Look for companies with high profit margins. 4. Make sure the “value added” is greater than 1. Market Tenets 1. What is the “intrinsic value” of the business? 2. Can the business be purchased at a discount to it’s market value? The Warren Buffett Way: Business Tenets Is the business simple and understandable? Does the business have a consistent operating history? Does the business have favorable long-term prospects? Is the business simple and understandable. Does the company have an identifiable durable competitive advantage? Does the business have an identifiable consumer monopoly or franchise product? What is the chance the product will become obsolete in the next 20 years? The Warren Buffett Way: Business Tenets Is the business simple and understandable? What does this mean? Does the business make a product(s) that is simple or complex for the average investor to understand? An example would be See’s Candy. Everyone can relate to See’s Candy, especially on special occasions. It doesn’t take a lot of new technology to continue to make the product and it is relatively insulated from increasing prices. Compare this to an Intel, whose products may lead the market but it does take a lot of reinvestment of capital to maintain a competitive edge. The Warren Buffett Way: Business Tenets Does the business have a consistent operating history? Apple Inc Value Line Data Symbol: AAPL Sales per share Cash flow per share Earnings per share Dividends per share Capital Spending per share Book value per share Common Shares Outstanding (Mill) Average annual P/E ratio Average price to earnings ratio Average annual dividend yield Sales ($mill) Operating margin Depreciation ($Mill) Net profit ($Mill) Income tax rate (%) Net profit margin (%) Working Capital ($Mill) Long-term Debt ($Mill) Shareholder equity ($Mill) Return on equity Average return on equity ACRR 40.0% 51.3% 48.3% 36.6% 55.4% 33.9% Beta: 0.85 Price: $125.86 2009 2010 2011 2012 2013 2014 $5.80 $1.02 $0.90 $0.00 $0.18 $4.42 $10.17 $2.35 $2.16 $0.00 $0.31 $7.45 $16.64 $4.26 $3.95 $0.00 $0.65 $11.78 $23.81 $6.85 $6.31 $0.38 $1.26 $17.98 $27.15 $6.96 $5.66 $1.63 $1.30 $19.63 $31.16 $8.09 $6.45 $1.81 $1.63 $19.02 6298.6 19.2 6411.8 15.2 6504.9 12.4 6574.5 12.0 6294.5 12.3 5866.0 13.0 0.0% $36,537 22.9% $703.0 $5,704.0 28.6% 21.5% $16,983.0 $0.0 $27,832.0 20.49% 0.0% $65,225 29.8% $1,027.0 $14,013.0 24.4% 22.5% $20,956.0 $0.0 $47,791.0 29.32% 0.0% $108,249 32.9% $1,814.0 $25,922.0 24.2% 23.9% $17,018.0 $0.0 $76,615.0 33.83% 0.5% $156,508 37.4% $3,277.0 $41,733.0 25.2% 26.7% $19,111.0 $0.0 $118,210.0 35.30% 2.3% $170,910 32.6% $6,757.0 $37,037.0 26.2% 21.7% $29,628.0 $16,960.0 $123,549.0 29.98% 2.2% $182,795 33.1% $7,946.0 $39,510.0 26.1% 21.6% $5,083.0 $28,987.0 $111,547.0 35.42% 0% 0% 0% 6% 29% 28% 14.0 38.0% 7.6% 47.3% 0.1% 32.0% 30.73% ACRR = AVERAGE Compounded Rate of Return Dividend payout ratio Minimum P/E Ratio 12.0 Maximum P/E Ratio 19.2 Calculations 2009 2010 2011 2012 2013 2014 ACGR Price per share Owners cash flow Annual cash flow growth rate 5 year average cash flow growth Annual sales growth 5 year average sales growth VALUE ADDED Average value added Owners cash flow per share SHARE PRICE/BOOK VALUE 48.4% $17.28 $5,273.24 $32.83 $13,052.35 147.52% $48.98 $23,507.79 80.10% $75.72 $36,726.18 56.23% $69.62 $35,611.16 -3.04% $83.85 $37,894.42 6.41% 78.49% 66.00% 44.62% 9.17% 6.96% $7.26 $4.17 $4.29 ($1.61) $1.36 $2.04 4.41 $3.61 4.16 $5.59 4.21 $5.66 3.55 $6.46 4.41 57.4% 41.0% $3.09 $0.84 3.91 The Warren Buffett Way: An investor needs to do very few things right as long as he or she avoids big mistakes. We like stocks that generate high returns on invested capital where there is a strong likelihood that it will continue to do so. I look at long-term competitive advantage and whether that’s something that’s enduring. The Warren Buffett Way: Management Tenets Is management rational? Is management candid with its shareholders? Does management resist the institutional imperative? The Warren Buffett Way: When you have able managers of high character running businesses about which they are passionate, you can have a dozen or more reporting to you and still have time for an afternoon nap. In evaluating people, you look for three qualities: integrity, intelligence, and energy. If they don’t have the first, the other two will kill you. In the long run, of course, trouble awaits managements that paper over operating problems with accounting maneuvers. 6/28/2016 Professor Kuhle 35 The Warren Buffett Way: The Institutional Imperative This is defined as the “lemming like” tendency of corporate management to imitate the behavior of other managers, no matter how silly or irrational that behavior may be. The institutional Imperative is responsible for several serious conditions: 1. the organization resists any change in its current direction 2. just as work expands to fill available time, corporate projects or acquisitions will materialize to soak up available funds. 3. any business craving of the leader, however foolish, will quickly be supported by detailed rate-of-return and strategic studies prepared by his troops. 4. the behavior of peer companies, whether they are expanding, acquiring, setting executive compensation or whatever, will be mindlessly imitated. 6/28/2016 Professor Kuhle 36 The Warren Buffett Way: Financial Tenets What is the return on equity? What are the company’s “owner cash flows” What are the profit margins? Has the company created at least one dollar of market value for every dollar retained (value added)? Does the Company have less than 30% debt? Apple Inc Value Line Data Symbol: AAPL Sales per share Cash flow per share Earnings per share Dividends per share Capital Spending per share Book value per share Common Shares Outstanding (Mill) Average annual P/E ratio Average price to earnings ratio Average annual dividend yield Sales ($mill) Operating margin Depreciation ($Mill) Net profit ($Mill) Income tax rate (%) Net profit margin (%) Working Capital ($Mill) Long-term Debt ($Mill) Shareholder equity ($Mill) Return on equity Average return on equity ACRR 40.0% 51.3% 48.3% 36.6% 55.4% 33.9% Beta: 0.85 Price: $125.86 2009 2010 2011 2012 2013 2014 $5.80 $1.02 $0.90 $0.00 $0.18 $4.42 $10.17 $2.35 $2.16 $0.00 $0.31 $7.45 $16.64 $4.26 $3.95 $0.00 $0.65 $11.78 $23.81 $6.85 $6.31 $0.38 $1.26 $17.98 $27.15 $6.96 $5.66 $1.63 $1.30 $19.63 $31.16 $8.09 $6.45 $1.81 $1.63 $19.02 6298.6 19.2 6411.8 15.2 6504.9 12.4 6574.5 12.0 6294.5 12.3 5866.0 13.0 0.0% $36,537 22.9% $703.0 $5,704.0 28.6% 21.5% $16,983.0 $0.0 $27,832.0 20.49% 0.0% $65,225 29.8% $1,027.0 $14,013.0 24.4% 22.5% $20,956.0 $0.0 $47,791.0 29.32% 0.0% $108,249 32.9% $1,814.0 $25,922.0 24.2% 23.9% $17,018.0 $0.0 $76,615.0 33.83% 0.5% $156,508 37.4% $3,277.0 $41,733.0 25.2% 26.7% $19,111.0 $0.0 $118,210.0 35.30% 2.3% $170,910 32.6% $6,757.0 $37,037.0 26.2% 21.7% $29,628.0 $16,960.0 $123,549.0 29.98% 2.2% $182,795 33.1% $7,946.0 $39,510.0 26.1% 21.6% $5,083.0 $28,987.0 $111,547.0 35.42% 0% 0% 0% 6% 29% 28% 14.0 38.0% 7.6% 47.3% 0.1% 32.0% 30.73% ACRR = AVERAGE Compounded Rate of Return Dividend payout ratio Minimum P/E Ratio Maximum P/E Ratio 12.0 19.2 Calculations 2009 2010 2011 2012 2013 2014 ACGR Price per share Owners cash flow Annual cash flow growth rate 5 year average cash flow growth Annual sales growth 5 year average sales growth VALUE ADDED Average value added Owners cash flow per share SHARE PRICE/BOOK VALUE 48.4% $17.28 $5,273.24 $32.83 $13,052.35 147.52% $48.98 $23,507.79 80.10% $75.72 $36,726.18 56.23% $69.62 $35,611.16 -3.04% $83.85 $37,894.42 6.41% 78.49% 66.00% 44.62% 9.17% 6.96% $7.26 $4.17 $4.29 ($1.61) $1.36 $2.04 4.41 $3.61 4.16 $5.59 4.21 $5.66 3.55 $6.46 4.41 57.4% 41.0% $3.09 $0.84 3.91 The Warren Buffett Way: Value Tenets What is the business value of the company – that is the “intrinsic” value? Can the shares be purchased at a significant discount (roughly 50%) to its current trading price? Professor Kuhle 39 Value Tenets INTRINSIC VALUATION MODEL - TWO-STAGE EARNINGS GROWTH PROJECTIONS 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 282,335 Prior year cash flows (mil) 37,894 47,368 59,210 74,013 92,516 115,645 144,556 180,695 225,868 10-year growth rate (.00) 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% Cash flow 47,368 59,210 74,013 92,516 115,645 144,556 180,695 225,868 282,335 352,919 Discount Rate (.00) Discount Factor (mult.) Discounted value per annum Sum of present value of cash flows 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.15 0.869565 0.756144 0.657516 0.571753 0.497177 0.432328 0.375937 0.326902 0.284262 0.247185 41,190 44,771 48,664 52,896 57,496 62,495 67,930 73,837 80,257 87,236 $616,773 Residual value Cash flow in year 10 $352,919 Growth rate (.00) (g) 0.04 Cash flow in year 11 $367,036 Capitalization rate (k-g) 0.11 Value at end of year 10 $3,336,691 Discount factor year 10 0.24718 Present value of residual $824,779 Total Intrinsic Value (mil) $1,441,552 Number of shares (mil) Intrinsic value per share Intrinsic / Market 5,866 245.75 1.95 Input discount & growth rates First 10 year growth rate Growth Rate Year 11 in perpetuity Discount rate Owners cash flow (mil) 25.00% 0.04 0.15 $37,894.42 This page is all pre-determined by the information from the Value Line page. The only thing you may have to change is the growth rate for the three different scenarios. Buffett’s Four Principles of Investing 1. 2. 3. 4. The company must have capable and vigilant leaders. The company must have long-term prospects . Is the stock stable and understandable? A company must be undervalued so you can make a “good buy.” Principle 1 – Vigilant Leaders 1. Rule 1 – Low debt. A D/E < .5 and a D/TA < .3 2. Rule 2 – High Current Ratio. CR > 1.5 3. Rule 3 – Strong and consistent ROE. Buffett requires 8% average over a 10 year period. Kuhle likes to see an average of 15%. 4. Appropriate management incentives. AAPL RATIOS 2012 2013 2014 1.496 1.475 0.865 0.496 1.679 1.638 1.024 0.679 1.080 1.047 0.461 0.080 25.141 197.860 14.319 10.129 0.889 27.598 98.888 13.045 10.298 0.826 34.386 86.592 10.469 8.863 0.789 Financial Leverage ratios Total Debt Ratio (TD/TA) 0.329 0.403 Debt/Equity 0.489 0.675 Equity Ratio (TE/TA) 0.671 0.597 Long-term Debt Ratio (LTD/TA) 0.000 0.082 Times Interest Earned Ratio (EBIT/TI) there are 0.000 no interest payments0.000 0.519 1.078 0.481 0.125 0.000 Short term solvency ratios Current Ratio Quick Ratio Cash Ratio Net Working Capital to Current Liabilities Asset Utilization or Turnover ratios Average Collection Period Inventory Turnover Ratios Receivable Turnover Fixed Asset Turnover Total Asset Turnover Profitability ratios Gross Profit Margin 0.439 Net Profit Margin 0.267 ROA (NI/TA) 0.237 ROE (NI/TE) 0.353 ROEWGW (NI/TEWGW): This accounts for Goodwill 0.337 Market value ratios Price/Earnings Ratio 12.000 0.376 0.217 0.179 0.300 0.288 0.386 0.216 0.170 0.354 0.343 12.300 13.000 Vigilant Leaders When you have able managers of high character running businesses about which they are passionate, you can have a dozen or more reporting to you and still have time for an afternoon nap. In evaluating people, you look for three qualities: integrity, intelligence, and energy. If you don’t have the first, the other two will kill you. In the long run, of course, trouble awaits managements that paper over operating problems with accounting maneuvers. Principle 2 – Long term Prospects Rule #1 – Persistent or Durable Product(s) The kind of business to invest in is one which is Durable (franchise product) meaning that the business must be able to keep its advantage well into the future without having to expend great sums of capital to maintain it. A low-cost competitive advantage is important for two reasons: First, is the predictability of the future earning power. Second, it improves the chances the business can expand shareholders’ fortunes rather than having to expend capital. The Franchise Product has (is): 1. A Durable Product with a Competitive Advantage that is sustainable over the long-run (5-10 years). 2. In high demand by a large segment of the market. 3. Little or no close substitutes. 4. Little or no Government regulation. Franchise Product The example used in the book is a good one. While Apple is a consistently high performer, they must stay ahead of the curve by investing in R&D and coming out with new products that may replace major products already in the market. This doesn’t mean that Apple won’t be profitable in the future, it means that there will always be more uncertainty attached to their products. Graham always told us that speculation on the future was no way to invest. A steady-eddy like Coke already has a record for a solid long-term success with it’s current franchise products. Franchise Product When considering a new investment you should aim to determine whether changing technology will have a significant effect on the demand for that product in the future, this is what establishes a long-term competitive advantage. You must be able to ascertain the feasibility of a franchise product at least 10 years into the future. When Buffett says he “doesn’t understand” a business he means he knows how it works but doesn’t know what their future looks like. Again, it comes down to the simplicity of the business and the investing story. Mr. Buffett says that “the chance of being way wrong about Coke (where he does own shares) are probably less than being way wrong in Apple or Google.” Ultimately, he says, “I just don’t know how to value them.” vs. $336,375 vs. $42,956 According to Buffett, what causes Risk? 1. 2. 3. Excessive Debt: Buffett never considers a company that has a Debt/Total Asset ratio greater than 30%. Overpaying for an investment. The price you pay for a stock should have a potential of at least a 50% premium. That is for every dollar you spend for an asset, you should get at least $1.50 in intrinsic value. Not knowing what you are doing. That is, not knowing the company and what they do. 6/28/2016 Professor Kuhle 53 Sayings of Warren Buffett 1. 2. 3. 4. 5. 6. 7. 8. I’ve never swung at a ball while it’s still in the pitcher’s glove. Never ask the barber if you need a haircut. Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway. When you combine ignorance and borrowed money, the consequences can get interesting. Most of our shareholders have to pay their bills in U.S. dollars. When I was 20, I invested well over half of my net worth in GEICO. Do a lot of reading. If you have to go through too much investigation, something is wrong. 6/28/2016 Professor Kuhle 54 Sayings of Warren Buffett 9. 10. 11. 12. 13. 14. 15. I can’t be involved in 50 or 75 things. That’s a Noah’s Ark way of investing-you end up with a portfolio that resembles a zoo. We’re looking for 747’s, not model airplanes. Read Ben Graham and Phil Fisher, real annual reports, but don’t do equations with Greek letters in them. In reference to quantitative analysis: Every priesthood does it. How could you be on top if no one is on the bottom? The funny thing is, better shows don’t cost that much more than lousy shows. Anything that can’t go on forever will end. It’s an old principle. You don’t have to make it back the way you lost it. 6/28/2016 Professor Kuhle 55 Sayings of Warren Buffett 16. 17. 18. 19. 20. 21. You need a moat in business to protect you from the guy who is going to come along and offer it (your product) for a penny cheaper. Owning Snow White (the movie) is like owning an oil field. You pump it out and sell it and then it seeps back in again. It’s far better to own a portion of the Hope diamond than 100 percent of a rhinestone. Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing. Buffett says he’s a Rip Van Winkle investor. What does he mean and why? I don’t try to jump over 7-foot bars: I look around for 1-foot bars that I can step over. 6/28/2016 Professor Kuhle 56 Sayings of Warren Buffett 22. 23. 24. 25. 26. 27. 28. 29. Like Wayne Gretzky says, go where the puck is going, not where it is. To swim a fast 100 meters, it’s better to swim with the tide than to work on your stroke. I’d be a bum on the street with a tin cup if the markets were always efficient. You can’t get rich with a weather vane. I like to buy stocks when the bears are giving them away. Berkshire buys when the lemmings are heading the other way. Happily, there’s more than one way to get to financial heaven. I call it the cigar-butt theory of investing. You find these well-smoked, downto-the-nub cigars, but they’re free. You pick them up and get one free puff out of them. 6/28/2016 Professor Kuhle 57 Sayings of Warren Buffett 30. 31. 32. 33. 34. 35. Good jockeys will do well on good horses, but not on broken-down nags. We don’t tell 400 hitters how to hit. Of Wall Street maxims the most foolish may be “you can’t go broke taking a profit.” If you expect to be a net investor for the next five years, should you hope for a higher or lower stock market during the period? Explain. Grahamites should probably endow chairs to ensure the perpetual teaching of EMT. In their hunger for a single statistic to measure risk, academics forget a fundamental principle: it is better to be approximately right than precisely wrong. 6/28/2016 Professor Kuhle 58 36. 37. 38. 39. 40. 41. 42. We think that the very term “value investing” is redundant. Business growth, per se, tells us little about value. An intelligent investor in common stocks will do better in the secondary market than he will do buying new issues. Why does Berkshire prefer to use cash vs. Berkshire stock to buy companies? Bull markets can obscure mathematical laws, but they can’t repeal them. Charlie and I have found that making silk purses out of silk is the best that we can do; with sow’s ears, we fail. There seems to be some perverse human characteristic that likes to make easy things difficult. 6/28/2016 Professor Kuhle 59 43. 44. 45. 46. 47. 48. With enough inside information and a million dollars, you can go broke in a year. If the true value of a company doesn’t just scream at you, it’s too close. In investments, there’s no such thing as a called strike. I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years. There seems to be some perverse human characteristic that likes to make easy things difficult. “In the business world, the rearview mirror is always clearer than the windshield.” 6/28/2016 Professor Kuhle 60 49. “Only when the tide goes out do you discover who's been swimming naked” 50. “If past history was all there was to the game, the richest people would be librarians” 51. “When a management team with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.” 52. “Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years.” 53. “Time is the friend of the wonderful company, the enemy of the mediocre.” 54. “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” 6/28/2016 Professor Kuhle 61 55. The Golden Rule works in business too. 56. Healthy cultures create wealth; toxic cultures destroy it. 57. To create long-lasting wealth, don’t lose money. 58. Aiding investors’ analysis builds investor trust. 59. Failed discipline will lead to a poorhouse, not an economic powerhouse. 60. A conclusion about the economy does not tell us if the stock market will rise or fall. 61. Great CEO’s need to be disciplined capital allocators. 62. Price is what you pay; value is what you get. 63. A chain of folly will always end badly. 64. What looks safe may be unsafe; challenge assumptions and be open to new facts. 65. Remember that large, unfathomable derivatives are still financial weapons of mass destruction. 66. Indecipherable disclosures tell us which emperors are naked. 6/28/2016 Professor Kuhle 62 67. Live beneath your means. 68. Betting on tortoises can create long-lasting wealth. 69. Invest with CEO’S who explain important risks. 70. Recovery depends on choosing to restore our social compact and to reset our moral compasses. 6/28/2016 Professor Kuhle 63 It’s been a Wonderful life End of Buffettology 6/28/2016 Professor Kuhle 64