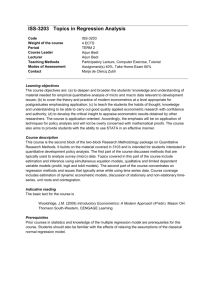

SYLLABUS: ECONOMICS 141 (Section 1) INTRODUCTION TO ECONOMETRICS FALL 2014

advertisement

SYLLABUS: ECONOMICS 141 (Section 1) INTRODUCTION TO ECONOMETRICS FALL 2014 INSTRUCTOR: OFFICE: PHONE: CLASS HOURS: E-MAIL: OFFICE HOURS: WEB SITE: Professor Craig Gallet Tahoe 3024 278-6099; 278-5768 (Fax) W 5:30-8:20pm (AMD 240) cgallet@csus.edu T 4:30-5:00 pm; W 3:00-5:30 pm http://www.csus.edu/indiv/g/galletc/ PREREQUISITES: Introductory Macroeconomics and Microeconomics (i.e., ECON 1A and 1B, or their equivalents), Quantitative Economic Analysis (i.e., ECON 140 or its equivalent), and either Intermediate Macroeconomics or Microeconomics (i.e., ECON 100A or 100B, or an equivalent) TEXTS: Required: Using Econometrics: A Practical Guide, 6th Edition (2011), by Studenmund. Required: Transparencies to Accompany Lectures Recommended: Gretl (http://gretl.sourceforge.net/) This is a data-intensive class, and so you need an econometric software package. Gretl is a perfect fit, since it’s free and does everything you will need for this course. However, you can use whatever software package you like, provided it does the various calculations needed. Regarding other possible software, Excel can be used to perform many of the calculations we will do throughout the semester. However, it is tedious to use and will not be able to perform calculations related to topics discussed later in the term. The university does hold site licenses for Stata, as well as Eviews, if you want to use either of them. GRADING: Percentage of Course Grade Three equally-weighted exams Several homework exercises Several group/individual activities 70% 25% 5% The following expected grade scale will be used in this class: Percentage of Weighted Points Possible 90-100 80-89 70-79 60-69 < 60 Grade Range A’s (A, A-) B’s (B-, B, B+) C’s (C-, C, C+) D’s (D-, D, D+) F’s Note: If scores are below expectations, the instructor reserves the right to “adjust the curve” accordingly. Also, this class will adhere to all CSUS policies regarding academic behavior. Exams will consist of problems you will analyze using the tools learned in the course. Make sure to always have a non-programmable calculator available. Many of the homework exercises will utilize Excel data files that you will download from my website and analyze. Exams and homework exercises are graded on a 100-point scale, while group/individual activities are graded on a plus (+), check (), or minus (-) system [As long as you receive a plus or a check, you will receive full credit on the group/individual activities. However, a minus will give you no credit.]. No late homework’s will be accepted. Note: Some topics I will discuss are not in the book. As such, it is expected that all students will attend each class meeting. Indeed, several (if not all) of the group/individual activities will occur during class; and for every two group/individual activities missed, without prior permission, in addition to foregoing points associated with those activities, your weighted point total for the course will be reduced 5 percent. And so, for example, let’s say there were 10 individual/group activities throughout the term and you missed all 10 without prior permission. Accordingly, you would have missed 5% of the weighted points possible due to missing those activities, and coupled with the 25% penalty for missing the 10 in-class assignments, at best you could hope for a C- in the course (assuming you receive 100% of the points possible on the exams and homework exercises, which is highly unlikely). Note: We will use the computer lab in Mariposa 1011 at some point this term to show you how to use Gretl. The date will be determined later. IMPORTANT DATES: CALCULATOR: Exam 1: Exam 2: Exam 3: No Class: October 1 November 5 Finals Week (December 15 - 19) November 26 Make sure to bring a non-programmable calculator on exam days. PURPOSE AND OBJECTIVES: The purpose of this course is to introduce you to the fundamentals of econometrics (i.e., regression analysis applied to economic issues). Regression is a powerful statistical tool used by many decision-makers to assess the relationships between various factors. Accordingly, the course objectives are: To develop an understanding of the process followed when building an econometric model. To apply econometric tools to data utilizing statistical software. To develop an understanding of diagnostic tools. LECTURE OUTLINE I. Introduction (Chapter 1) Applications of econometrics Dependent vs. independent variables Types of data Descriptive vs. inferential statistics Regression equation II. Simple Regression (Chapter 2) Descriptive measures Ordinary least squares Measures of fit III. Multiple Regression (Chapter 2) Multiple regression equation R-squared versus adjusted R-squared IV. Data Issues (Chapter 3 and Chapter 7, Section 7.4) Data transformations Missing observations and proxy variables Intercept dummy variables V. Steps in Applied Regression (Chapter 3) Six steps in applied regression analysis VI. Review of Probability (Chapter 17) Probability Random variables and probability distributions Measures of central tendency and dispersion Key continuous probability density functions VII. The Classical Model (Chapter 4) Assumptions of the classical linear regression model VIII. Estimation (Chapter 4 and Chapter 17) Sampling distribution of β-hat Unbiasedness, efficiency, consistency Gauss-Markov theorem IX. Hypothesis Testing (Chapter 5 (including appendix) and Chapter 17) Null and alternative hypothesis Type I and type II errors Test statistic procedure Applications to regression X. Model Specification: The Independent Variables (Chapter 6) Omitted relevant variables Included irrelevant variables Stepwise regression XI. Model Specification: The Functional Form (Chapter 7) Implications of incorrect functional form Linear form Double-log form and elasticities Semi-log form Polynomial form Inverse form Interactive terms and slope dummy variables XII. Multicollinearity (Chapter 8) Consequences of multicollinearity How to detect multicollinearity What to do about multicollinearity XIII. Serial Correlation (Chapter 9) First-order serial correlation Consequences of serial correlation How to detect serial correlation What to do about serial correlation XIV. Heteroskedasticity (Chapter 10) Consequences of heteroskedasticity How to detect heteroskedasticity What to do about heteroskedasticity XV. Qualitative Dependent Variables (Chapter 13) Implications Probit procedure XVI. You want more? Time series techniques (Chapter 12) and Simultaneous equations techniques (Chapter 14)