ACCY 111 - Jensen

advertisement

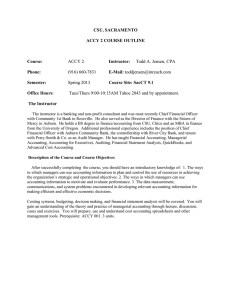

CSU, SACRAMENTO ACCY 111 COURSE OUTLINE Course: Phone: Semester: Office Hours: ACCY 111 (916) 660-7831 Spring 2013 Instructor: Todd A. Jensen, CPA E-Mail: toddjensen@inreach.com Course Site: SacCT 9.1 and www.mhhe.com/spiceland7e , and CONNECT! TR 9:00 to 10:15AM Tahoe 2043, and by appointment. The Instructor The instructor is a banking and non-profit consultant and adjunct faculty. He holds a BS degree in finance/accounting from CSU, Chico and an MBA in finance from the University of Oregon. Professional experience includes the position of Director of Finance with the Sisters of Mercy, Chief Financial Officer with Community 1st and Auburn Community Bank, the controllership with River City Bank, and tenure with Perry-Smith & Co. as an Audit Manager. He has taught Financial Accounting, Managerial Accounting, Intermediate Financial Accounting, Accounting for Executives, and Auditing. Description of the Course and Course Objectives This course will focus on intermediate financial accounting theory and practice. You will develop an in-depth knowledge of how financial information provides information about a company including it’s economic resources, obligations, and owner's equity; income and its components; and cash flows. Topics include the development and application of basic assumptions, principles and constraints underlying financial statements; the use of information derived from financial statements and the limitations of the information; and the use of accounting information to evaluate a company's return on investment, risk, financial, flexibility, liquidity, and operational capability. Students learn how to prepare financial statements. Required Text and Supplements Intermediate Accounting, 7e, Spiceland et al, McGraw-Hill, including access to CONNECT! 1 Attendance, Homework, and Grading It is expected that you will attend all class sessions and come to class with all assignments prepared to the best of your ability. Homework will be reviewed at selective sessions. Late homework will not be accepted. All Add/Drop forms must be initiated by the student. Grading will be based on the following: Examinations (Makeup exams are not provided without advance notification.) CONNECT! Online homework, weekly assignment sets. A B C D F 90% or better 80% to 90% 70% to 80% 60% to 70% Below 60% 400 (80%) 100 (20%) (>=900 points) (800 to 899 points) (700 to 799 points) (600 to 699 points) Plusses and minuses will be assigned within the above rankings. Assignments An outline of weekly chapter assignments follows. I will determine assignments as we proceed. You are responsible for obtaining assignments each week in class. ACCY 111 CLASS ASSIGNMENTS Week 1 Date Jan 29 Chapter 1 Topic Theory of Financial Accounting Assignment 2 Feb 5 1, 2 Accounting Process CONNECT! #1 3 Feb 12 2 Accounting Process CONNECT! #2 4 Feb 19 Review and Exam 1 (Ch 1, 2) on Feb 21st 5 Feb 26 3 Balance Sheet 6 Mar 5 3,4 Balance Sheet/Income Stmt CONNECT! #3 7 Mar 12 4 Income Statement CONNECT! #4 8 Mar 19 Review and Exam II (Ch 3 and 4) on Mar 21st Mar 26 Spring Break 2 ACCY 111 CLASS ASSIGNMENTS Week Date Chapter Topic 9 Apr 2 6 Time Value of Monet 10 Apr 9 6, 7 Cash and Equivalents CONNECT! #5 11 Apr 16 7 Cash and Equivalents CONNECT! #6 12 Apr 23 Review and Exam III (Ch 6 and 7) on Apr 25th 13 Apr 30 8 Inventory 14 May 7 8, 9 Inventory CONNECT! #7 15 May 14 9 Inventory: Additional Issues CONNECT! #8 16 May23 No Class 21st Exam IV (Ch 9 and 10) on May 23 8AM to 10:00AM 3 Assignment