Budget 101 - August 16, 2013 (.ppt)

advertisement

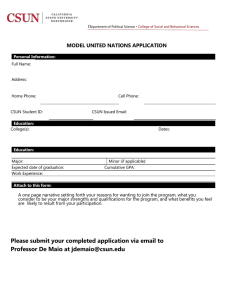

New Department Chair Orientation August 16, 2013 Diane Stephens, Associate Vice President Edith Winterhalter, Director of Academic Budget Management Department of Academic Resources and Planning California State University, Northridge Today’s Agenda • Introductions • Budget Cycles / Processes – State and CSU – Campus • Current Planning Environment • Fund Accounting • Budget Planning and Management • Best Practices and Tools • Discussion • Today’s slides: http://www.csun.edu/academic.resources/ BUDGET CYCLES AND PROCESSES State and CSU • CSU Board of Trustees presents budget request to Governor (September - December) • Governor issues budget request to legislature (January) • The fun begins! • Approved State budget by June 30 for July 1 implementation—sometimes! http://www.calstate.edu/budget/2005_06BudIndex/SupportBdgt_Book2/Budget_2.pdf State and CSU http://www.calstate.edu/budget/fybudget/2013-2014/documentation/budget-cycle-chart.shtml CSUN Budget Planning Process • Budget Process • FTES targets defined (early fall for following academic year) • University budget process (when new funds available) • Enrollment growth basis • Projects that support strategic priorities • University Planning and Budgeting Group (UPBG) • Timeline (fall through summer) CURRENT PLANNING ENVIRONMENT Current Planning Environment? University Budget News Website: http://www.csun.edu/presofc/campusbudgetnews-FAQs.html Shrinking State Resources for Higher Education http://www.calstate.edu/pa/BudgetCentral/stateallocation2013.pdf Shrinking State Resources for Higher Education http://www.calstate.edu/pa/BudgetCentral/edcompact2013.pdf CSUN General Fund Budget 2007/08 Fee Revenue 35% State Appropriations 65% Source: CSUN Office of Budget Planning and Management CSUN General Fund Budget 2013/14 State Appropriations 40% Fee Revenue 60% Source: CSUN Office of Budget Planning and Management Uncertainty: The New “Normal” • Transition between models but clinging to old model • 2013/14 CSU Budget • incorporates $125.1MM in new funding • includes $10MM for technology/online approaches • reinstates $125MM from last year’s budget cut FUND ACCOUNTING OVERVIEW Typical Funds in Academic Departments • Fees in Trust/General Fund (appropriations, allocations, and fee revenue) – 48501 • State Trust Fund (includes ExL MOU revenues, IRA, etc.) – 496XX, 44XXX,etc. • Lottery Funds – technically State Trust…but…! Typical Funds in Academic Departments • Auxiliary Funds (separate 501(c)(3) entities) – Corporation – Foundation – Others (not held in departments) • Campus Quality Fee – Course materials – Technology – Student support General Fund Reminder • Two major funding groups in the General Fund: – Base budget funding – One-time funding • Carry-forward balances?? CSUN AND ACADEMIC AFFAIRS PLANNING AND BUDGET MANAGEMENT CSUN Policy on Fiscal Responsibility Ensure that: – Expenditures don’t exceed available resources – Funds expended for intended purposes in appropriate time period – Use internal controls to protect from misuse – Correctly classify receipts and expenditures – Comply with campus policies http://www-admn.csun.edu/vp/policies/125_admn_fin/300/300-45.pdf The Decentralized Model Principles • Communication and Disclosure – ERC Recommendation – College Budget Model – Clarity of Business Practices – Facilitate Sharing of Information and Open Communication • Balanced Budgets • Meet FTES Targets • Continuity/Consistency of Practices • Defensible Systems (audit readiness) ERC Recommendation - 1999 • Open budget reporting and consultation process – Resources and allocations for all departments, centers, and programs • Contingency funds – Maintain – Communicate to department chairs New for 2013/14 • Twenty (20) centrally-funded tenuretrack faculty positions for 2014/15 • Ten (10) centrally-funded new staff positions • Continued scrutiny of staff hiring— Justification for Initiation of Search NEW FOR 2012/13 required What CAN We Control? Focus on savings: • Part-time faculty budgets (often controlled by deans’ offices) • Operating expenses—we can ALL do our part • Bulk purchasing (take advantage of scale economies) • Defer expenses • Eliminate unnecessary expenses (efficiency) • Share costs with others (“Let’s make a deal!”) Determination of College Budgets • Prior year base budget • Budget adjustments (attrition, new hires, FTES increase funding, planned reductions) • Salary increases • Non-General Fund resources • Lottery budget • Extended Learning partnerships • Grants and contracts College Budget Workbook • • • • • • Budget summary—all funds General Fund budget allocations (departments) Department General Fund operating expenses Salary worksheet Part-time faculty budget model Supplemental income from leaves and transfers Salary Worksheet Why It’s Important to Track Salary Costs: • Academic Affairs—Salaries make up about 88% of General Fund Expenditures • Eight Colleges: – Salaries make up 92% of General Fund expenditures overall – Salaries range from 85% to 96% of General Fund expenditures among the eight colleges • Salary costs fluctuate—A LOT! Department Budgeting • Part-time faculty costs • Supplemental income from leaves and transfers (if applicable—may be an offset for college allocation of PTF to departments) • Instructional support salaries (TA, GA, SA) • Operating expenses – – – – Supplies and services Equipment Travel/professional development Contingency BEST PRACTICES Generating and Using the Right Information Best Practices • • • • • • • Effective scheduling SOC worksheet Monthly reconciliation Line item budgeting at departmental level External funding Contingency planning “Wish list” Effective Scheduling • Effective use of physical, fiscal, and human resources – Effectively deploy tenured and tenure-track faculty in order to maximize enrollments using “fixed costs” – Minimize part-time faculty and other short-term salary costs--limit “variable” costs and reassigned time – Monitor/eliminate “low enrolled” sections – Space utilization with University growth Schedule of Classes (SOC) Worksheet • Schedule of Classes Worksheet – Both a PLANNING and REPORTING tool for Department Chairs – Combines data from multiple systems – Combines in worksheet that allows for: • Scenario-building (“What If…?”) • Determining cost of planned schedule • Analyze use of resources to achieve FTES target and support program priorities • Modeling new program costs – Users at multiple levels SOC Worksheet Subject Catalog Class Nbr CCU C/S # Room SubjectInstructor Class Nbr Catalog 100 10180 1 4 AC210 ART ART 100 ART 100L ART 100L ART 243 ART 244 ART 244 ART 245 ART 250 ART 250 ART 484 ART 484 10181 10186 10187 18097 18098 18099 18100 18148 18149 11304 11305 1 2 2 3 3 3 3 3 3 1 1 4 7 7 7 7 7 13 36 36 36 36 AC210 AC210 AC210 AC407 AC407 AC407 AC407 AC334 AC334 AC211 AC211 Days Hoban, James Curr. Enroll. Instructor Base Salary FTES Current WTU Current FTEF Current 2.7 1.0 0.07 $ 2,075 6 40 3.9 2.6 0.17 $ 4,894 6 35 4.3 2.6 0.17 $ 4,894 6 35 PTF Expenses Current Proj Enroll FTES WTUCurr. FTEF PTFProg Expenses Code Start Base Salary Fac CCU C/S # Room Days CurrentEnd Time Instructor Current Current Time$ 4,706 PCurrent MW 800 825 29 Wright, Frank Lloyd 1.9Enroll. 1.0 0.07 $ 1,882 6 35 MW TR F TR MW TR TR MW MW W M ART 100 Frank 10180 Wright, Lloyd1 ART 100 10181 1 Olmsted, Frederick ART 100L 10186 2 Wright, Frank Lloyd ART 100L 10187 2 Wright, Lloyd3 ART 243 Frank 18097 TOTALS: Start End Time Time 1100 825 900 1400 800 1100 800 1100 1400 1600 1600 1125 1005 1220 1645 1045 1345 1045 1345 1645 1650 1650 40 29 32 28 25 26 27 5 10 7 8 Olmsted, Frederick Wright, Frank Lloyd Fac Wright, Frank Lloyd Hoban, James Hunt, Richard M. Sullivan, Louis Lamb, William Van Alen, William Lamb, William Gilbert, Cass Van Alen, William AC210 $44,706 AC210 $45,188 7 AC210 $ 4,706 7 AC210 $74,706 AC407 266 $ 3,458 $ $ $ $ $ $ $ $ $ $ $ 5,188 4,706 4,706 3,458 2,757 3,550 3,822 7,451 3,822 4,000 5,285 MW 800 P 1.9 MW 1100 P 2.7 TR 825 P 3.9 F 900 P 4.3 TR 1400 F 5.6 P P P F F P P F P P F 8251.0 5.6 5.0 1125 5.2 1.0 1005 5.4 1.0 2.6 1220 2.0 0.5 2.6 1645 0.5 37.9 3.9 293.9 3.9 403.9 293.9 1.7 323.3 2.3 282.7 33 Wright, Frank 0.33 $ 2 30 0.07 $ - Lloyd 1,882 0.33 $ 2 20 Olmsted, Frederick 0.26 $ 2 20 0.07 $5,538 2,075 0.26 $ 5,962 3 35 Wright, Frank Lloyd 0.14 $ 4 15 0.17 $ 4,894 0.22 $ 5,096 4 25 Wright, Frank Lloyd 0.16 $ 3,733 1 15 0.17 $ 4,894 0.22 $ 1 5 Hoban, James 2.39 $ 34,076 310 0.33 $ - SOC Worksheet = Planning + Priorities Subject Catalog Title Class Nbr Proj Enroll PROJECTED Prog Code Program Priorities / Categories % Dept. PTF Exp $ 8,000 1 Required Grad. & U.D. Majors Courses 15.8% 38.1% $ 5,538 10.9% $ 5,962 2 Required L.D. Majors Courses 15.1% $ 12,740 3 Required Service Courses 0.0% $ 20.1% $ 13,746 4 High Priority Elective Courses - Majors 0.0% $ $ 45,986 LowerDESIGN Priority -20Majors ART 5244 GRAPHIC I Elective 18098 Courses 2 G.E. Courses ART 6244 GRAPHIC DESIGN I 18099 2 20 ART 7245 GRAPHIC 35 OtherDESIGN . . . I 18100 3 ART 250 PHOTOGRAPHY I 18148 4 15 TOTALS Prog Code Prog Code Program Priorities / Categories FTES % Dept. WTU % Dept. FTEF 1 Required MajorsART Courses 15.2%350.47 ARTGrad. 100& U.D. INTRO PROCESS 1 101803.0% 6 7 2 Required L.D. Majors Courses 14 31.3% 12 35.7% 0.91 ARTService 100 Courses INTRO ART PROCESS 7 10181 3 Required 15.7% 6 4 11.9%400.26 4 HighART Priority100L ElectiveART Courses - Majors LAB 8 10186 17.9% 613 15.2%350.97 PROCESS 5 Lower Priority Elective Courses - Majors 0 0.0% 0 0.0% 0.00 6 G.E. ART Courses100L ART PROCESS LAB 1410187 32.1% 6 7 22.0%350.48 7 Other . . . 243 INTRO TO TYPE 0 18097 0.0% 2 0 0.0%300.00 ART TOTALS 45 43 3.09 ART 250 PHOTOGRAPHY I ART 484 ART ED PORTFOLIO ART 484 ART ED PORTFOLIO 18149 11304 11305 4 25 1 15 1 5 % Dept. 17.4% 12.0% 13.0% 27.7% 0.0% 29.9% 0.0% Monthly Reconciliation • PeopleSoft Tools – nVision® Management Reports – General Ledger (GL) Inquiry Panels • Timely review of expenditures • Reconciliation training – University Financial Assistants (UFA) Line Item Budgeting at Departmental Level • Ability to track expenditures against budget by category using existing tools (PeopleSoft) with minimal effort • Comparison of original plan versus actual at fiscal year-end • Resources: – http://www-admn.csun.edu/fasrm/solar/ (See Chart of Accounts Reference Guide) – Most colleges and areas have a reference guide for most commonly used chartfield strings External Funding • Grant and contracts • Tracking and processing reimbursed time in timely manner • Emphasis on growing external funding as State support declines Best Practices • Contingency planning • “Wish list” Discussion and Questions Contact Information • Diane Stephens – diane.stephens@csun.edu – Ext. 5929 • Edith Winterhalter – edith.winterhalter@csun.edu – Ext. 4066 • For a copy of this presentation (next week): http://www.csun.edu/academic.resources/