Managing Business Risks-Engineering

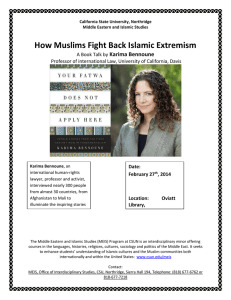

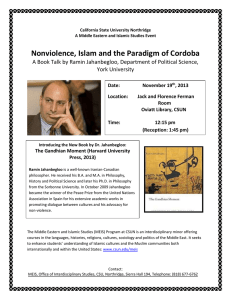

advertisement

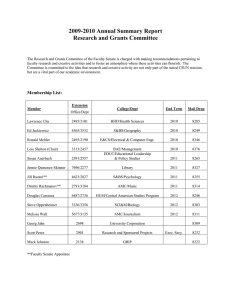

MANAGING BUSINESS RISKS AN OVERVIEW CSU, Northridge January, 2004 Chris Brady University Risk Manager WHAT IS RISK MANAGEMENT? Risk: The organization’s exposure to accidental loss. Management: Planning, organizing, Leading and controlling. “Everyone on campus must be a risk manager.” Classic risk management is no longer adequate IN ORDER TO MANAGE RISK EFFECTIVELY YOU MUST……… Understand risks associated with your objective. Understand your role as a part of the CSUN Risk Management Team. Expand your knowledge base of risk management principles. Take an active role in the risk management effort at CSUN. Seek creative solutions to risk management issues. Why Managing Risk Is Important Accountability Raises Awareness Financial impacts Program cuts Premiums Deductibles Claims CSUN Insurance Contributions (Premiums) 2000000 1800000 1600000 1400000 1200000 1000000 800000 600000 400000 200000 0 Liability Work Comp IDL, NDI, UI Athletic Property 1997/98 1998/99 1999/00 2000/01 2001/02 2002/03 CSUN Insurance Contributions (Premiums) $4,169,434 Benefits of Hands-On Risk Management Increases awareness of objectives Puts focus on mission critical objectives Clear understanding of responsibility & accountability Improves cross-functional communication Creates a sense of TEAM-OWNERSHIP Early identification of risks can result in mitigation activity that significantly reduces exposure SIX STEPS OF RISK MANAGEMENT 1. Identify and Analyze Exposures 2. Analyze Feasibility of Alternative Techniques 3. Select Method of Risk Control 4. Implement Chosen Techniques 5. Monitor Results 6. Modify Techniques STEP 1 – Identify & Analyze Exposures Identification Tools: Loss History Program Outlines Annual Budget Meeting Agendas Purchase Agreements Inspection and Maintenance Records Contracts and Leases STEP 2: Feasibility of Alternative Techniques Avoidance Transfer of Risk Retention of Risk Reduce Risk through Loss Reduction Efforts Finance Retained Risk Define Meaningful Standards and Expectations STEP 3 Evaluate Loss Potential Evaluation Techniques Frequency/Severity of Claims Publications/Periodicals/Other Universities Political/Litigation Climate Anticipate MITIGATION OPTIONS Control It (prevention & detection techniques) Share It (co-source; warrants; guarantees) Transfer It (insurance; hold harmless contracts) Avoid It (process re-design; eliminate process) Accept It (cost/benefit analysis) Residual Risk (Opportunity To Manage) STEP 4 – Implement Chosen Technique Management Support Documentation and Notification Governing Board Approval for Major Actions Develop Policies and Procedures STEP 5 – Monitor Results Compare Actual Results to Anticipated Results Consider Environmental Changes Keep Records/Documents STEP 6 – Modify Techniques to Reflect experience Document Decision Making Process Maintain a Safety/Loss Control Program Continue to Monitor Results Start over at Step 1 !!! CURRENT CHALLENGES •Changing environment – remodel •Budget issues – Circumvent procedures/taking shortcuts •Policies & Procedures – Clearly defined •Safety environment – Constant changes •Communication – Sharing of information •Equipment – Purchasing & Insurance requirements Maintain a teamwork philosophy, share information, focus on the objective of the college and the impact to future programs. RISK RELATED ACTIVITIES • • • • • Lab Environment Project design & testing Competitions Internships Field Trips Proper planning, training and supervision for these types of activities will significantly reduce the risk of loss, damage or injury. For Assistance With: •Insurance Issues •Risk Assessments •Ergonomic Assessments •Compliance Monitoring •Claim Management •Training & Staff Development Insurance & Risk Management at ext. 2401 Questions & Answers