Tanya Bodell

advertisement

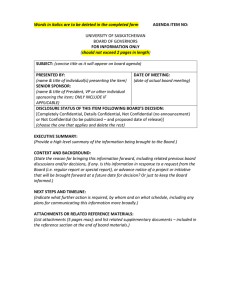

A Brief Review of New Institutions and Structures in the Electricity Industry GEMI Power Conference Houston, Texas 29 June 2006 Agenda • Overview • Wholesale Markets • Retail Markets • Financial Institutions • Energy Trading • Conclusion Private & Confidential Overview Key questions • Who will develop an IGCC unit with a positive NPV over a 20-year horizon if investors have only a 5-year horizon? • Where do you build a new transmission line if costs cannot be recovered through regulated rates? • What good are smart meters if you still have dumb prices? • Why do we need new institutions and structures? Private & Confidential A structure defined Structure (struk' chər) 1. Manner of building, constructing, or organizing 2. Something built or constructed, as a building or dam 3. The arrangement or interrelation of all the parts of a whole 4. Something composed of interrelated parts forming an organism or an organization Source: New World Dictionary What Whatorganizations buildings are are people people organizing? building? Private & Confidential IGCC financing requires mitigation of uncertainty 10 Natural Gas Price Breakeven ($/MMBtu) 9 Coal prevails – PC and IGCC are near parity 8 IGCC with sequestration prevails 7 6 Point where sequestration becomes economic 5 IGCC Breakeven 4 NGCC Wins 3 2 1 0 0 5 10 15 20 25 30 Emissions Price ($/ton CO2) 35 40 Notes: 10% Cost of Equity Gas Prices can move to $6.8/MMBtu if the cost of sequestration is ~$25/ton We do not exactly hit $25 ton because IGCC must pay for 10% of CO2 it does not capture Chart not show “grey area” where site-specific factors determine the winner Privatedoes & Confidential Assumes no value for the CO2 sequestered 45 50 Merchant Transcos (no rate base) are becoming bolder Western Interconnect Private & Confidential Eastern Interconnect Recent studies support TOU meters/dynamic prices Energy Demand Under Variable Pricing (California pilot program results) 0.90 0.80 Point where sequestration becomes economic Peak Price ($/kWh) 0.70 0.60 Average Critical Price = $0.58 IGCC Breakeven 0.50 NGCC Wins 0.40 0.30 Average Normal Weekday Price = $0.22 0.20 Average Control Price = $0.13 0.10 0.00 1.00 1.05 1.08 1.10 1.15 1.18 1.20 Peak Period (kWh/hour) Source: Ahmad Faruqui and Robert Earle, “Demand Response and Advanced Metering,” Regulation, Spring 2006. Private & Confidential 1.22 1.25 Wholesale Markets Growing realization energy-only markets may not suffice DPeak Clearing Price Capped & Mitigated Price The “missing money” = lost contributions to fixed costs for every plant Price set by demand Price set by supply offer caps Peaker Intermediate Baseload Quantity Private & Confidential Out-of-Market Actions Resource adequacy solutions • Proposed / Implemented Capacity Markets – – – – – New England New York PJM Spain (structure similar to NE) Netherlands (structure similar to NE) • Some type of Resource Adequacy Construct under discussion – Texas – California • Public Power Authorities – California (proposed, established and retired) – Ontario (proposed, established and operating) – Connecticut (proposed) • Other Market Designs Private & Confidential Retail Markets State electricity restructuring appears to be stalled Source: Energy Information Administration Private & Confidential Industrial and commercial customers continue to purchase from energy-only providers 600 Transportation Sector * Other Sector * Commercial Sector Industrial Sector Residential Sector Sales by Energy-Only Providers (Million Megawatt-hours) 500 400 300 200 100 1996 1997 1998 1999 Source: EIA http://www.eia.doe.gov/cneaf/electricity/epa/sales_state.xls Private & Confidential 2000 2001 2002 2003 2004 Utilities offer green products in addition to their standard regulated offerings Private & Confidential New distribution channels for energy efficiency services Private & Confidential Financial Institutions Financial services firms provide credit support “I’d say we spend as much time structuring credit as we do structuring energy” - Catherine Flax, JP Morgan "There are investors in this space, principally hedge funds, that will happily take the risk if the spread is attractive enough and if they're convinced that the underlying story is favourable." - Elad Shraga, Deutsche Bank Source: Duncan Wood, Risk Magazine, "Putting energy into credit," Dec. 2005 (Volume 18, No. 12). Private & Confidential Financial services firms dominate top-rated dealers 2005 Rankings of Top Dealers Source: www.energyrisk.com, Rankings compiled by Glenn Leihner-Guarin, 2005 Data based on the results of a survey sent to more than 2,000 banks, brokers, energy users and traders worldwide. Voters were asked to nominate their top three counterparty dealers and top two brokers based on criteria that included keen pricing, flexibility, market making, reliability, integrity and speed of transactions. Private & Confidential Private equity firms have more than $135 B in capital Private Equity Private Equity Tenaska Invenergy KKR American Securities Riverstone Company ArcLight Capital Partners First Reserve One Equity Fortress Group Apollo Advisors Blackstone Madison Dearborn Texas Pacific Group Warburg Pincus Private Energy Market Fund, L.P. 0 5,000 10,000 15,000 Size ($ Million) Source: CRA Research, best estimates of size as of June 2006 Private & Confidential 20,000 25,000 30,000 More than 300 hedge funds in energy provide liquidity Selected Hedge Funds Fund Asset Size ($ Million) Appaloosa $4,000 Caxton-Iseman $2,000 Cerberus $16,000 Citadel Investment Group LLC $12,000 DE Shaw $20,000 MatlinPatterson $4,000 Och-Ziff Capital $15,000 Vega $12,000 Source: CRA Research, best estimates of size as of June 2006 Private & Confidential Energy Trading Regulatory oversight focused on market manipulation FERC and CFTC Memorandum of Understanding (October 12, 2005) to coordinate requests and share proprietary information New CFTC focus FERC compliance – Prohibition of Market Manipulation refines Market Behavior Rules – New regulations focused on fraud and scienter – Must maintain 5year trading records – Proposed legislation - CEA Reauthorization - Oil and Gas Traders Oversight – Natural Gas Price Transparency – Marketers must keep and provide records, even for exchanges exempt from regulation TRADER Stiffer penalties Private & Confidential – Penalties: $1 million per day per violation – Felony vs. misdemeanor – Eliminates Principal/Agent defense Existing trading structures drive compliance strategies NonDiscretionary Discretionary Rational Trader Model Process Model Rock Star Model Benchmark Model Ad-Hoc Private & Confidential Systematic Current compliance models cannot identify market manipulation very easily Typical Mid-Office Compliance Model Define Acceptable Trading / Marketing activities via Corporate Policy Execute Trades Review Trading / Marketing results for evidence of non-compliance Take appropriate action as dictated by policy • Costly: Tens of millions of dollars • Questionable: Most traders believe they can stay ahead of the game -- this oversight does nothing to prevent them from executing an improper trade and very little to detect one after the fact • Incentives: Sets up a contest between highly motivated traders vs. intelligent mid-office staff • Potential for Failure: Most notable “blow-ups” have occurred in organizations touting “best in class” capabilities in compliance Private & Confidential Alternative compliance models create a systematic approach to trading to preclude market manipulation “Systematic” Mid-Office Compliance Model Define & Analyze possible Trading Protocols “Acceptable Basis for Trading” Guidelines Capital / Risk Allocation Guidelines Execution Discretion Guidelines Approve Trading Protocols for Execution Generate Trading Guidance for Execution Execute Trades Compare Trades to Execution Guidance / Discretion Guidelines Take appropriate action as dictated by policy Private & Confidential Large industry players are adopting systematic trading Private & Confidential Black box trading -- thinking inside the box Silent dealers set deadly pace in derivatives trade By Martin Waller There is a phenomenon outside the industry called 'black box' trading, carried out by computer programs devised by brilliant mathematic minds TODAY marks the start of International Derivatives Week, at which participants from exchanges all over the world will gather in London. Yet traders accounting for more than half those markets’ volume will not be there. They will be at their desks as usual. These are not the overpaid and overworked dealers in derivatives. They are the algorithmic dealing programs that clinch bargains on exchanges . . . without any human input whatsoever. Source: Business Time Online, June 2006, http://business.timesonline.co.uk/article/0%2C%2C8210-2231867%2C00.html Private & Confidential Conclusion What’s Hot What’s Not – In Electricity HOT NOT • IGCCs in regulated rates • NGCCs on market rates • Smart meters • Dumb prices • PPAs (Public Power Authorities) • PPAs (Power Purchase Agreements) • LICAPs • Price caps • Of course we do financing • You need recourse financing • Credit-rating renegades • Credit-rating downgrades • MOUs on data exchanges • Unregulated exchanges • Market Manipulation Tools • Market Behavior Rules Private & Confidential One Final Caveat “It must be remembered that there is nothing more difficult to plan, more doubtful of success, nor more dangerous to manage, than the creation of a new system. For the initiator has the enmity of all who would profit by the preservation of the old institutions and merely lukewarm defenders in those who would gain by the new ones.” – Machiavelli Private & Confidential Tanya Bodell’s consulting practice focuses on various aspects of the energy industry, including the effects of government regulation on profit opportunities, particularly in the areas of competitive markets and environmental policy. Her work in trading and risk management spans all energy-related commodities, including tradebook valuation, portfolio optimization, and regulatory compliance. Her work in electricity includes design and implementation of competitive wholesale and retail markets, as well as strategic advice to the participants in those markets. She has also been extensively involved in the analysis and determination of damages in liability cases pertaining to the energy industry, including breach of contract, product liability, fraudulent conveyance, and bankruptcy proceedings. Ms. Bodell has a B.A. in Mathematical Economics from Pomona College and an M.A. in Public Policy from the University of Chicago. Tanya Bodell 200 Clarendon Street, T-33 Boston, MA 617-425-3364 tbodell@crai.com