The Revenue/Receivables/Cash Cycle Chapter 7

advertisement

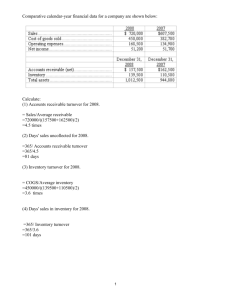

StIce | StIce |Skousen The Revenue/Receivables/Cash Cycle Chapter 7 Intermediate Accounting 16E Prepared by: Sarita Sheth | Santa Monica College COPYRIGHT © 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. Learning Objectives 1. Explain the normal operating cycle of a business. 2. Prepare journal entries to record sales revenue, including the accounting for bad debts and warranties for service or replacement. 3. Analyze accounts receivable to measure how efficiently a firm is using this operating asset. 4. Discuss the composition, management, and control of cash including the bank reconciliation. 5. Recognize appropriate disclosures for presenting sales and receivables in the financial statements. Learning Objectives- Expanded Material 6. Explain how receivables may be used as a source of cash through secured borrowing or sale. 7. Describe proper accounting and valuation of notes receivable. 8. Understand the impact of uncollectible accounts on the statement of cash flows. Types of Receivables • Trade receivables – most significant category resulting from everyday credit sales of goods/services to customers. • Notes receivables- trade receivables with a formal written promise to pay. • Nontrade receivables- all other types of receivables that arise from a variety of transactions. Accounting for Sales Revenue • While earning sales revenue and accounts receivables, other issues develop: • Discounts- offered at the time of sale or the time of payment. • Sales Returns and Allowances- occur subsequent to the sale and can occur before or after payment has been made. • Bad Debts- must be estimated in the period when credit sales are made or A/R is outstanding. • Warranties for Service/Replacement- after a sale is made, the warranty period may still be in place. Discounts • Trade discount- reduces the list sales price to the net sales price charged to the customer. • Cash discount- can only be taken if the customer makes the payment within a specified time period. There are two methods to account for this: – Gross method – Net Method Sales Returns and Allowances Chocolate Cake costing $6 are sold for $10. When delivered, it was determined that the cakes should have been lemon. The customer agrees to keep the merchandise for a $2 reduction in price. Sales entry: Accounts Receivable Sales 10 Cost of Goods Sold 6 Inventory Sales allowance entry: Sales Returns and Allowances Accounts Receivable 10 6 2 2 Sales Returns and Allowances Suppose that instead of the allowance, the customer elects to return the cakes. Sales return entries: Sales Returns and Allowances Accounts Receivable Inventory Cost of Goods Sold 10 6 10 6 Sales Discounts and Sales Returns and Allowances Income Statement Sales $5,000 Less: Sales discounts $250 Sales returns and allowances 400 (650) Net sales $4,350 Accounting for Bad Debts • Occur when customers do not pay for items or services purchased on credit. • Bad debts are uncollectible accounts receivable. • Bad Debt Expense is reported as a selling or general and administrative expense. • Accounts receivable are reported on the balance sheet at their net realizable value. Accounting for Warranties Rony Video & Sound sells number of a twoDVDThe players with systems sold inPast year warranty. 2004 and 2005 experience indicates that was 5,000 and 10% of all systems will 6,000, respectively. need repairs incosts the first Actual repair year and$12,500 20% will were in need repairs in the second 2004 and $55,000 year. The average repair in 2005. cost is $50 per system. Accounting for Warranties 2004 To record estimated warranty expense: Warranty Expense 75,000 Estimated Liability for Warranties 75,000 To record the actual cost of doing repairs: (5,000 x 0.30) x $50 Estimated Liability for Warranties 12,500 Cash 12,500 Accounting for Warranties 2005 To record estimated warranty expense: Warranty Expense 90,000 Estimated Liability for Warranties 90,000 (6000 x 0.30) x $50 To record estimated warranty expense based on DVD players sold. Monitoring Accounts Receivable • Average Collection Period- The average number of days that lapse between the time that a sale is made and the time that cash is collected. • It is calculated by dividing the average daily sales by the average receivables outstanding. Monitoring Accounts Receivable Janosonic Corporation had average receivables of $354,250 and average daily sales of $1,650,000. The average collection period can be calculated as follows: Average Collection Period: Average receivable Average daily sales $354,250 ($1,650,000/365) Average collection period = 78 days Monitoring Accounts Receivable • Accounts receivable turnoverdetermined by dividing net sales by the average trade accounts receivable outstanding during the year. For Janasonic Company, A/R turnover will be: Accounts Receivable Turnover: Net sales $1,650,000 Average net receivables $354.250 Accounts Receivable Turnover = 4.7 days Items Classified as Cash • • • • • • Coins and currency not yet deposited Demand Deposits Petty Cash Funds Cashier’s Checks Personal Checks Short term interest-earning securities A credit balance in the cash account is known as a cash overdraft and should be reported as a current liability. Cash Controls and Management 1. 2. 3. 4. 5. 6. Specifically assigned responsibilities for handling cash receipts. Separation of handling and recording receipts. Daily deposits of all cash received. Voucher system to control cash payments. Internal audits at irregular intervals. Double record of cash—bank and books, with reconciliation performed by someone outside the accounting function. Bank Reconciliation • Bank reconciliation- A comparison of the bank balance with the book’s balance. • Common causes for differences between the two records: – Deposits in transit. – Outstanding checks. – Bank debits for items such as service charges and NSF checks. – Bank credits for items such as the bank collecting a note for the depositor. – Accounting errors. Example Bank Reconciliation Svendsen, Inc. Bank Reconciliation November 30, 2005 Balance per bank.... $2,979.72 Balance per books............. $2,952.49 Additions to bank Additions to bank balance: balance: Deposits in transit.... 658.50 Interest earned...............…. 98.50 Error by bank 12.50 Error by depositor.........…. 18.00 Total................... $3,650.72 Total............................ $3,068.99 Deductions from bank balance: Outstanding checks: Listed individually (703.83) Corrected bank bal. $2,946.89 Deductions from book balance: Service charge.............. NSF check.................... Corrected book bal. $ ( 3.16 ) (118.94 ) $2,946.89 Presentation of Receivables in the Financial Statements • Current receivables may be grouped in the balance sheet in the following classes: 1. Notes receivable- trade debtors 2. Accounts receivable- trade debtors 3. Other receivables. • • It is possible to combine trade notes and accounts receivable into a single amount. Restrictions on any receivables should be disclosed. Receivables as a Source of Cash • Receivables may be converted to cash: 1. As a sale (either with or without recourse). 2. As a secured borrowing. Receivables as a Source of Cash • FASB Statement No. 140 conditions for receivables to be accounted for as a sale: 1. The transferred assets have been isolated from the transferor and its creditors cannot access the assets. 2. The transferee has the right to pledge or exchange the transferred assets. 3. The transferor does not maintain effective control over the assets through either (a) an agreement to repurchase them before their maturity or (b) the ability to cause the transferee to return specific assets. Sale of Receivables Without Recourse • Also known as factoring: 1. Close sold receivables 2. Close accompanying Allowance for Bad Debts 3. Expense any factoring charges 4. Establish a receivable for any sales price withheld by the factor 5. Debit Cash for net proceeds of the sale 6. Recognize a gain or loss from factoring Sale of Receivables with Recourse • Purchaser (bank or finance company) advances cash in return for receivables, but retains the right to collect from the seller if debtors fail to make payment. • Sale of receivables with recourse is different from factoring, since factoring is normally sold on a nonrecourse basis. Secured Borrowing • Assignment of Accounts Receivable – There are no special accounting problems involved. – Simply record the loan. • Specific Assignment: – Specified accounts receivable pledged. – Accounts receivable reclassified on balance sheet. – Footnote disclosure of loan provisions required. Notes Receivable • • • Promissory note - an unconditional written promise to pay a certain sum of money at a specified time. Initially recorded at present value. Two types: 1. Interest-bearing: Interest rate is on the note. 2. Noninterest-bearing: Interest is implied in the face amount of the note Discounting Notes Receivables • Discount Rate- The interest rate charged by the financial institution for buying a note receivable. • Discount Period- The time between the date a note is sold to a financial institution and its maturity date. Formulas for Discounting Interest = face amount x interest rate x interest period Maturity value = face amount + interest Discount = maturity value x discount period x discount rate Proceeds = maturity value - discount Special Valuation Problems • When a note is exchanged for cash: – It should be recorded at its face amount – Any difference face and cash proceeds- record as premium or discount on the note. • When a note is exchanged for property, goods, or services: – The present value of the note is found in the terms of the note or supporting documents. – If there is no current market price for the property, goods, or services, or the note, then use an imputed interest rate. Impact of Uncollectible Accounts on Cash Flows • A decrease in receivables can occur from: – Customers pay. – Customers never pay and the account is written off. • To find the net cash provided by operations: – Adjust for a change in accounts receivable, and – Adjust for changes in the allowance for bad debts account.