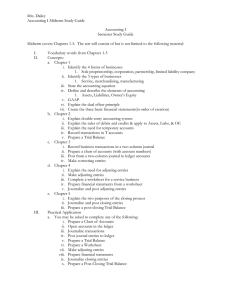

A Review of the Accounting Cycle Chapter 2

advertisement

StIce | StIce |Skousen A Review of the Accounting Cycle Chapter 2 Intermediate Accounting COPYRIGHT © 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. Learning Objectives 1. Identify and explain the basic steps in the accounting process (accounting cycle). 2. Analyze transactions and make and post journal entries. 3. Make adjusting entries produce financial statements, and close nominal accounts. 4. Distinguish between accrual and cash basis accounting. 5. Discuss the importance and expanding role of computers to the accounting process. Double Entry Accounting • Each transaction/ business event is recorded to maintain the equality of: The basic accounting equation • The accepted system for recording accounting data. Assets = Liabilities + Owners’ Equity Journalizing Transactions • Transactions are events that have an economic impact on a business. • Business documents are records that are evidence of transactions. • A journal is an accounting record in which business transactions are entered in chronological order. Journal Entry Process Every journal entry involves a 3-step process: 1. Identify the accounts involved with an event or transaction. 2. Determine whether each account increased or decreased. 3. Determine the amount by which each account was affected. Debits and Credits • A debit is an entry on the left side of an account. • A credit is an entry on the right side. General Journal Entry Format Date Debit Entry.................................. xx Credit Entry............................. xx Explanation • Debits and credits affect accounts differently. Types of Journals • The general journal is used to record all transactions. • A special journal is used to record a particular type of frequently recurring transaction. – Sales, Purchases, Cash Disbursements, Cash Receipts Posting to the Ledger Accounts • Posting is the process of transferring amounts from the journal to the general ledger. • A ledger is a collection of accounts in which data from transactions recorded in the journals are posted, classified, and summarized. • A chart of accounts lists all accounts used by the company. Reporting Phase 4. A trial balance is prepared. 5. Adjusting entries are recorded. 6. Financial statements are prepared. 7. Closing entries are made. 8. A post-closing trial balance is prepared (optional). Preparing a Trial Balance Determine the account balance for each T-Account. • A trial balance is a list of all accounts and their balances. • It provides a means to assure that debits equal credits. • Preparing Adjusting Entries • Adjusting entries are required at the end of each accounting period prior to preparing the financial statements. • The purpose for adjusting entries are to: • bring balance sheet accounts current. • reflect proper amounts of revenues, costs, and expenses on the income statement. Tips for Adjusting Entries Adjusting entries always incorporate a balance sheet account and an income statement account. Adjusting entries never involve a cash account. You can not memorize adjusting entries. Most Common Adjusting Entries • Unrecorded Revenues -Revenues that have been earned but not yet recorded. • Unearned Revenues -Revenues that have been recorded but not yet earned. • Unrecorded Expenses-Expenses that have been incurred but not yet recorded. • Prepaid Expenses-Expenses that have been recorded but not yet incurred. Three Step Process for Adjusting Entries 1. Identify the original entries that were made, if any. • Original entries are only made for unearned revenues and prepaid expenses. 2. Determine what the correct balances should be at this point in time. 3. Make the adjustments needed to bring the balances to the desired amounts. Perpetual Inventory System When a perpetual inventory system is When maintained, a a sale takes place, the sale is separate Purchases recorded account is not used. similar to The cost of the the periodic merchandise is inventory system. recorded by a debit to Cost of Goods Sold and a credit to Inventory. The Closing Process • Real accounts or permanent accounts • Not closed to a zero balance at the end of the accounting period. • Carried forward to the next period. • Nominal accounts or temporary accounts • Closed to a zero balance at the end of each accounting period. • All Income statement accounts & Dividend Account. • Closing entries reduce all nominal accounts to a zero balance. Post Closing Trial Balance • Provides a listing of all real account balances at the end of the closing balance. • The trial balance assures that total debits equal total credits prior to the beginning of the new accounting period. • Only real accounts will have a balance at this time. Summary of the Accounting Cycle 1. Analyze transactions and business documents. 2. Journalize transactions. 3. Post journal entries to accounts. 4. Determine account balances and prepare a trial balance. 5. Journalize and post adjusting entries. 6. Prepare financial statements. 7. Journalize and post closing entries. 8. Prepare a post-closing trial balance. Accrual Accounting • Recognizes revenues as they are earned, not necessarily when cash is received. • Recognizes expenses as they are incurred, not necessarily when cash is paid. • Provides a better basis for financial reports, according to the FASB. Cash Basis Accounting • Cash-basis accounting is focused on cash receipts and cash disbursements. • Typically used by service businesses, such as CPAs, dentists, and engineers. • AICPA holds that it is appropriate for small companies. Computers and Accounting • Many steps of the accounting cycle are performed using computers. • Typical computerized functions include, generating reports and computational analysis. • But it will never replace a good accountant!