INDUSTRY ANALYSIS: One Industry GREAT FEATURE: the Glossary.

advertisement

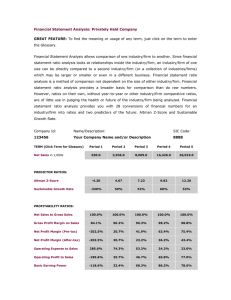

INDUSTRY ANALYSIS: One Industry GREAT FEATURE: To find the meaning or usage of any term, just click on the term to enter the Glossary. Industry analysis ratios allow comparison of one time period to another within the industry or to another industry or company.. Since industry analysis ratios look at relationships inside the industry, an industry of one size can be directly compared to a second industry (or a collection of industries) which may be larger or smaller or even in a different business. Industry Analysis is a method of comparison not dependent on the size of the industry. Financial Ratios provide a broader basis for comparison than do raw numbers. However, financial analysis ratios on their own, without year-to-year or other industry comparative ratios, are of little use in judging the health or future of the industry being analyzed. Your Industry Financial Analysis provides you with 28 conversions of financial numbers for an industry into ratios and two predictors of the future: Altman Z-Score and Sustainable Growth Rate. Industry Analysis: SIC Code 3571: ELECTRONIC COMPUTERS 3571 TERM(Click Term for Glossary) Net Sales in $M Last Year 3571 3571 3571 3571 Last Year - 1 Last Year - 2 Last Year - 3 Last Year - 4 3,906.3 3,297.9 3,329.3 3,587.4 3,464.5 Altman Z-Score 2.41 2.03 2.85 4.49 4.04 Sustainable Growth Rate 19% 6% 15% 22% 27% 15.7 85.2 29.1 40.3 28.7 27.6% 24.7% 27.1% 26.1% 27.1% Net Profit Margin (Pre-tax) 8.6% 4.9% 7.1% 9.8% 12.0% Net Profit Margin (After-tax) 5.5% 0.9% 4.7% 6.6% 7.5% Operating Expense to Sales 85.2% 96.3% 94.0% 92.4% 90.1% Operating Profit to Sales 14.8% 3.7% 6.0% 7.6% 9.9% Basic Earning Power 9.6% 5.1% 7.7% 11.3% 14.1% Return on Assets (After-tax) 6.1% 2.3% 5.4% 7.5% 8.8% 19.2% 7.4% 15.9% 22.5% 27.1% PREDICTOR RATIOS: PROFITABILITY RATIOS: P/E Ratio Gross Profit Margin on Sales Return on Equity ASSET MANAGEMENT RATIOS: Collection Period (Period Average) 75.1 85.3 90.3 85.9 82.9 Collection Period (Period End) 77.9 85.6 84.2 89.5 85.2 Inventory Turns (Period Average) 28.0 20.8 15.9 16.7 16.9 Inventory Turns (Period End) 28.0 24.5 17.7 15.8 16.8 Days Inventory 13.1 17.6 23.0 21.9 21.6 Working Capital Turnover 10.5 8.7 8.4 8.2 10.1 Fixed Asset Turnover 8.7 7.5 6.7 6.9 6.8 Total Asset Turnover 1.1 1.0 1.1 1.2 1.2 Current Ratio 1.3 1.3 1.3 1.4 1.3 Quick Ratio 1.2 1.2 1.2 1.2 1.2 Sales/Receivables 4.7 4.3 4.3 4.1 4.3 28.3% 34.9% 28.7% 31.6% 28.9% 59.4 27.2 27.7 29.0 38.1 3.1 3.3 2.9 3.0 3.1 0.40 0.45 0.47 0.49 0.53 Debt Ratio 0.7 0.7 0.7 0.7 0.7 Debt to Equity 2.1 2.3 1.9 2.0 2.1 Long-term-debt to Equity 0.4 0.5 0.4 0.5 0.4 56.7% 53.9% 58.9% 59.7% 63.0% LIQUIDITY RATIOS: Gearing Ratio DEBT MANAGEMENT RATIOS: Times Interest Earned Equity Multiplier Fixed Assets (net)/Net Worth Current-debt to Total Debt N/A: Data unavailable in order to calculate ratio Z: Data equals zero in ratio denominator