AlHuda Seminar on Islamic Banking and Finance Dr. Muhammad Zubair Usmani

advertisement

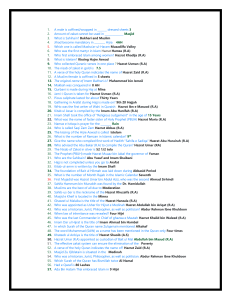

AlHuda Seminar on Islamic Banking and Finance Guest Speaker Dr. Muhammad Zubair Usmani Jamia Darul Uloom, Karachi Pakis1tan Sharia Advisor, MCB Islamic Banking “ Those who devour interest become like the one whom Satan has bewitched and maddened by his touch. They have been condemned to this condition because they say trade is just like interest, whereas Allah has made trade lawful and interest unlawful. Henceforth, if one abstains from taking interest after receiving this admonition from his Lord, no legal action will be taken against him regarding the interest he had devoured before; his case shall ultimately go to Allah. But if one repeats the same crime even after this, he shall go to Hell, where he shall abide forever”. “ O believers fear Allah and give up that interest which is still due to you if you are true believers; but if you do not do so then you are warned of the declaration of war against you by Allah and His Messenger. If, however, you repent even now (and forgo interest), you are entitled to your principal; do not wrong, and no wrong will be done to you”. 4. Hazrat Jabir Ibn-e-Abdullah () has reported the Prophet (]) to have cursed those who charge interest, those who pay it, those who write documents pertaining thereto, those who keep the accounts of such matters and those who sign as witness. He (]) said that they are all equal in this crime. 8. Hazrat Abu Hurairah () has reported the Prophet (]) to have said, “four categories of people are such that Allah has made it binding upon Himself to refuse them admission to the paradise or to let them enjoy is goodies. The first is the one who is a habitual drinker of alcoholic drinks. The second is the one who devours interest, the third is the one who devours the wealth belonging to an orphan, without any justification therefore, and the fourth is the one who is disobedient to his parents. This has been reported by Hakim on the authority of Ibrahim bin Khathim bin Irak and he (Ibrahim) reported it on the authority of his father (Khathim) and he (Khathim) reported it on the authority of Hazrat Abu Hurairah () Hakim has classified it as an authentic saying.” 13.It has been reported by Hazrat Hanzala bin Abdullah () (who was given a bath by the angels) that the Prophet (]) said, “Devouring a dirham of interest is worse than committing adultery 36 times, provided one is aware that he is utilizing money earned by way of interest”. This saying has been reported by Imam Ahmed and Tibrani. 19.Hazrat Ibn-e-Masood () reporting a saying of the Prophet (]) in which the Prophet (]) said, “When adultery and interest become common place in a people, then they have definitely asked for Allah’s punishment for themselves”. 25. According to Hazrat Abdullah bin Masood (), the Prophet (]) said, “whoever earns money/wealth through interest would find it reduced in the end”. This has been reported by Ibn-e-Majah and Hakim and they said that the reporting chain is authentic. Another version is that the Prophet (]) said, “Howsoever much the interest may appear to be in quantum, the end result is that it reduces (the wealth). Note: Abdul Razzaq, who is considered an authority on Hadith, has reported from Moammar that Moammar said to have heard that not 40 years lapse on business involving interest and it suffers a loss or an accident which causes a loss. ISLAMIC BANKING CLASSIFICATION OF RIBA Riba-un-Nasiyah or Riba-al-Jahiliya “that kind of loan where specified repayment period and an amount in excess of capital is predetermined” ( Imam Abu Bakr Hassas Razi) ISLAMIC BANKING CLASSIFICATION OF RIBA Riba-un-Nasiyah or Riba-al-Jahiliya “all loans that draw interest is riba”(Hadith quoted by Ali ibn Talib) “the loan that draws profit is one of the forms of riba”(definition from Sahabi Fazala Bin Obaid) ISLAMIC BANKING CLASSIFICATION OF RIBA Riba-un-Nasiyah or Riba-al-Jahiliya real and primary form of riba premium paid to the lender in return for his waiting giving or taking of every excess amount in exchange of a loan at an agreed rate irrespective of whether it is low or high ISLAMIC BANKING TYPES OF RIBA Tijarti Sood(Commercial interest) interest paid on loan taken for productive and profitable purpose Sarfi Sood (Usury) interest paid on loan taken for personal need and expenses Arguments given to Justify Commercial Interest Q. Commercial Interest is charged from wealthy persons whereas usury is charged from the poor. It does not exploit the poor while consumption interest or usury exploit the poor. Validity of a transaction is not based on the financial status of a party, like sale, leasing etc. Law does not differentiate between poor and wealthy in crimes like bribery, theft etc. Further, Commercial Interest also exploit the poor. Q. It was not in the prevalent modern shape in those days. When some thing is prohibited, it is not directed to a particular form of it but it covers every form which comes in its general sense, e.g. gambling and pork, liquor and adultery are as Haram now as they were in Jahiliyyah Q. The Commercial interest was not in vogue in Arab History shows that it was in vogue. Q. Doctrine of necessity and wisdom requires to allow it It does not, it is not at all a necessity in Shariah. Even from economic point of view, the modern interest has brought more harm to the humanity than the premature forms of usury. The Principles of Shariah are binding, even though their wisdom is not visible in a particular transaction. They are based on Illat. Islamic Rules Basic Rules of Islamic Financing Money is converted in to goods Possession of the goods Ownership of the goods Presence of the goods Identification of the goods Determination of price In case of credit sale, the period of repayment is known and fixed Islamic Alternatives of Conventional Banking Murabaha Ijara Musharaka Mudaraba Salam Istisna