Whether Asset Backed or Asset Based Wan Abdul Rahim Kamil

advertisement

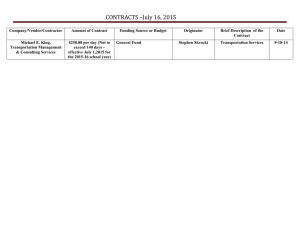

Whether Asset Backed or Asset Based Wan Abdul Rahim Kamil Consultant, Islamic Capital Market Securities Commission Malaysia Introduction The uniqueness of Sukuk al Ijarah is that it is normally facilitated by a Special Purpose Vehicle. The SPV: Acts for and on behalf of the investors by as per the Trust Deed Holds the ijarah asset in trust for the Investors However it is to be noted that not all structures having an SPV is an Asset Backed Securitisation Asset Backed Securitisation 4. Delivery of completed assets. Progress payments against progress deliveries Equipment Suppliers Assets 1.(a) Order for assets by SPV. Istisna’ Contract Originator 1. Negotiations for lease of assets to be procured 6. Ijarah Rental Payments $ 5. Ijarah of assets to Originator; now assuming role as Obligor 8. Upon termination of Ijarah, asset sold to Originator Sukuk al Ijarah Rental s Admin. Account SPV for Sukuk Al Ijarah 2. Issuance of Sukuk to raise fund for procurement of asset 3. $ Sukuk Sukuk Sukuk Assets 3. Subscriptions $ 7. Distribution of Profits and final settlement to Investors QUALIFIED INVESTORS Under this structure, the assets are not purchased by the Originator but by a third party supplier. This is a true sale. Asset-backed securitisation thus is an asset-based transaction in which the funding for the acquisition of the asset is derived from investments evidenced by the sukuk issued by the SPV. The asset is purchased from the originator under a true sale arrangement The true sale isolates the asset completely from the originator and at the same time all rights and obligations in the said asset are thus transferred to the SPV However, all obligations on the sukuk i.e. the income stream attached to it shall rest upon the originator who now plays the role as servicer i.e. the entity that is undertaking to administer the assets or perform such other services on behalf of the SPV as may be required in the said securitisation transaction. 4 1.(a) Sale of assets owned by Originator to the SPV Originator 1. Negotiations for lease of assets to be procured 6. Ijarah Rental Payments $ 5. Ijarah of assets to Originator; now assuming role as Obligor 8. Upon termination of Ijarah, asset sold to Originator Sukuk al Ijarah Rental s Admin. Account Asset Based Securitisation Assets SPV for Sukuk Al Ijarah 2. Issuance of Sukuk to raise fund for procurement of asset 3. $ Sukuk Sukuk Sukuk Assets 3. Subscriptions $ 7. Distribution of Profits and final settlement to Investors QUALIFIED INVESTORS Under this structure, the assets are purchased from the Originator . It is in form, a Sale and Leaseback followed by a buy-back upon termination of the Ijarah. The structure thus is not a true sale. Please note that even though the purchase is followed by a transfer of legal title; it fails the True Sale because of the Sale and Leaseback followed by the PU to buy back. wark06@gmail.com rahim@seccom.com.my