IB1005 DEPOSITS AND FINANCING PRACTICES OF ISLAMIC FINANCIAL INSTITUTIONS

advertisement

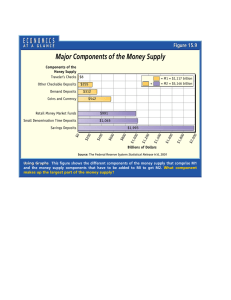

IB1005 DEPOSITS AND FINANCING PRACTICES OF ISLAMIC FINANCIAL INSTITUTIONS CHAPTER 2 : DEPOSITS 1 COMPILED BY HAMDAN HJ IDRIS, BSc Econs, MBA (Islamic Banking & Finance) Certified Professional Trainer (MIM) Industry Expert INCEIF PRESENTED BY HJ MAHMUD HJ BUNTAT, MBA (AUOL, UK), DBM (Swansea Inst., UK), CIL (UIA) Part-time Lecturer (INCEIF) Former Head of Islamic Banking Division, OCBC Bank (Malaysia) Bhd Chapter 2: Deposits 1 Rate of Return Framework In Malaysia, BNM introduced a framework for the rate of return (ROR) to standardize the methodology in the calculation of the various rates of return to depositors, in order to generate a mechanism for the distribution of profits between the bank and its customers. Islamic Financial System, 2003 (pp.191-2): The objectives of the framework included; Setting a minimum standard in calculating the rates of the return. Provide a standardized reference for IFI in deriving RORs. Provide BNM with ability performance of the IFIs. to measure the The objectives aim to assess whether the RORs accurately reflect the performance of the IFIs; permit BNM regulation and supervision in determining appropriate prudence and fairness in the distribution of profits to depositors. • Standardizing a ROR mechanism provides transparency in determining distributable funds, including the disclosure of income and expense items. The introduction of the framework supports the application of the mudharabah (profit-sharing) contract in IFI deposit activities. Conventional banking is based on the lenderborrower relationship, whereas the mudharabah contract is based on the investor-entrepreneur relationship whereby the depositor assumes the role of capital provider and the IFI assumes the role of entrepreneur. Any profit generated from the invested capital is shared, whereas any loss is borne by the depositor. Deposits The public places their money in bank deposits for two main purposes: The transaction purpose and the investment. To fulfill transactional purpose, Islamic banks offer al-wadiah yad damanah deposit means safe-keeping (wadiah) with guarantee (daman). In return for the safe-keeping and deposit protection services depositors allow the bank to use their money in its financing operations. But the bank has no legal obligation to pay depositors a fixed monetary return but may do so only on voluntary ground. There is no mention of any form of return in the contract. Prerogative to do so in the form of gifts (hibah). Providing hibah is necessary to motivate depositors to place their savings in Islamic banks. According to the Mejelle, hibah is giving the ownership of property to another without an equivalent counter value. Otherwise they will lose deposits to banks that pay interest. The al-wadiah yad dhamanh contract says that the bank will provide deposits protection and honor all withdrawals on call provided that it is allowed to use deposits to generate earnings. • Giving hibah on al-wadiah dhamanah deposits is necessary because there is no free lunch in business an Islamic bank cannot promise to give depositors a fixed contractual income as doing so runs against the principle al-wadiah yad dhamanah itself. Workflow of Wadiah Savings Account Wadiah concept (Guaranteed safe custody) Customer (Investor) Guardian (2) Profits (1) Invest Profit at the sole discretion of the Bank Financing Investments Projects • If a bank wishes to give away hibahs, it must be done voluntarily when it finds fitting to do so, especially when business is bullish. Have a good day May God bless you Thank you and Wassalam