Stephanie Chan Kristy Ho

advertisement

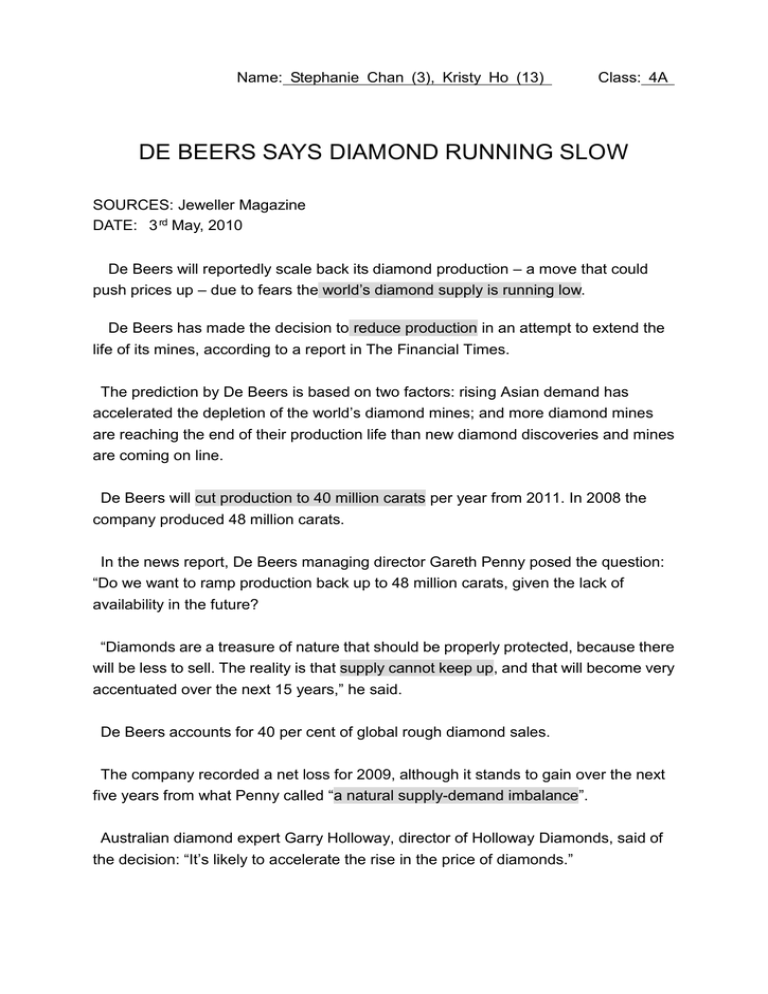

Name: Stephanie Chan (3), Kristy Ho (13) Class: 4A DE BEERS SAYS DIAMOND RUNNING SLOW SOURCES: Jeweller Magazine DATE: 3 rd May, 2010 De Beers will reportedly scale back its diamond production – a move that could push prices up – due to fears the world’s diamond supply is running low. De Beers has made the decision to reduce production in an attempt to extend the life of its mines, according to a report in The Financial Times. The prediction by De Beers is based on two factors: rising Asian demand has accelerated the depletion of the world’s diamond mines; and more diamond mines are reaching the end of their production life than new diamond discoveries and mines are coming on line. De Beers will cut production to 40 million carats per year from 2011. In 2008 the company produced 48 million carats. In the news report, De Beers managing director Gareth Penny posed the question: “Do we want to ramp production back up to 48 million carats, given the lack of availability in the future? “Diamonds are a treasure of nature that should be properly protected, because there will be less to sell. The reality is that supply cannot keep up, and that will become very accentuated over the next 15 years,” he said. De Beers accounts for 40 per cent of global rough diamond sales. The company recorded a net loss for 2009, although it stands to gain over the next five years from what Penny called “a natural supply-demand imbalance”. Australian diamond expert Garry Holloway, director of Holloway Diamonds, said of the decision: “It’s likely to accelerate the rise in the price of diamonds.” According to Holloway, the move by De Beers is simply a clever marketing strategy designed to ensure it achieves higher prices for its diamonds. “When there’s a downturn in the market, De Beers has traditionally withheld diamonds from the market until the price goes up,” he said. Despite the price rise, he said the move was a good sign, signalling De Beers expected the diamond market to strengthen in the near future. “This is a ‘good times’ strategy,” Holloway said. “De Beers is saying that demand from America and Asia will be stronger in three years than it is now. “So if demand is going to go up, why not keep your diamonds in the ground and bring them up when demand is peaking? “It makes sense,” he said. Reports suggest De Beers plans to become a publicly listed company next year, and that the recent decision might be designed to make the company a more attractive investment. Name: Stephanie Chan (3), Kristy Ho (13) Class: 4A Diagram: Summary of the issue: De Beers is the largest diamond supplier in the world. As it accounts for 40 per cent of global rough diamond sales and announced that it would cut its rough diamond production in order to extend the lives of the diamond mines, diamond experts believe that there will be a rise in price in diamond. They believe that the withholding of diamonds by De Beers due to the financial downturn will result in incapable of maximizing the profit of De Beers. Explanation of the issue: Diamonds are economic goods because their quantities are not sufficient to satisfy our wants for it. More of them are preferred. People are willing to pay a price or forego something for it. Hence, there is a positive cost of getting it. Supply of diamond is inelastic as its supply is nearly fixed. As De Beers reduce its production of diamond, supply of diamond decreased (S1S2). Meanwhile, there were a large demand in Asia and America, the demand for diamond increased (D1D2). The price of diamond will rise (P1P2). Fall in supply is greater than rise in demand. Quantity transacted decreased (Q1Q2). The increase in price is greater than the decrease in quantity transacted. Gain in total revenue is larger than loss in total revenue. Therefore, total revenue of De Beers increases. Besides, De Beers is a monopolist which has only one seller. It does not face direct competition. However, it faces indirect competition. It has to compete with sellers of substitutes (e.g. other jewelleries). Hence, it has to advertise to attract customers and to build up a good image (i.e. non-price competition). Moreover, De Beers plans to become a listed company (public limited company) since listed company can issue shares or bonds to raise capital. As number of shareholders is unlimited, it will have wider source of capital for investment. A limited company has a separate legal status. If the limited company breaks the law, the shareholders are not liable for the debt because assets of the company are not the assets of the shareholders. The liability of shareholders is limited to the capital they have invested in the company. Their personal properties will not be used to pay off any further debt of the company.