HSBC Living Finance Young Financial Planner Competition 2011 St. Francis’ Canossian College Participants:

advertisement

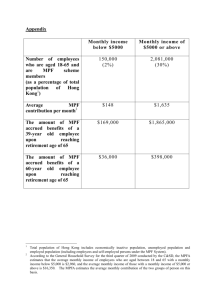

HSBC Living Finance Young Financial Planner Competition 2011 St. Francis’ Canossian College Participants: 5B – Doris Ko, Dorothy Choi, Winnie Hung, Sindy Chu, Tiffany Ng, Gigi Chan A. Financial Aims 1. Short term 2-year part-time Master’s degree course on professional business management (1-year tuition fee-42,000) Rent a flat in Tseung Kwan O ($10,000 per month) Marriage (traditional wedding-$200,000 +honeymoon-$60,000) Deliver a child (private hospital-$150,000) 2. Medium term Buy a car (a small sedan-$150,000+$6,000 per month to run) 3. Long term Education planning for the child (before starting kindergarten-$1,500 per month; after starting kindergarten-$2,000 per month; after starting primary school-$2,000+$1,000 for ECA per month) Insurance (life insurance plan-insured for $500,000) Investment ($250,000 in MPF account invested in capital preservation funds) B. Analysis of present financial condition 1. Stable monthly salary $32,000 (expect to increase 2% every year) 2. Small external burden Enrolled in a two- year part- time Master’s degree course on professional business management one year ago Set aside a joint saving account between Mr. Li Chi- keung and Miss Lam Siu- Lai (Mr. Li’s girlfriend) two year ago - $3,000 per month Buy a life insurance (insured for $50,000) two year ago - $4,000 per year 3. No high- valued property No personal cars No personal flats or house 4. Protected by insurance Buy a life insurance (insured for $50,000) two year ago by Mr. Li Chi- keung Provided a medical plan by Mr. Li Chi- keung’s Company 5. Mobile cash joint saving account between Mr. Li Chi- keung and Miss Lam Siu- lai (Mr. Li’s girlfriend) $144,000 (a) Mr. Li Chi- keung personal Hong Kong Dollar account - $300,000 (b) Cash - $35,000 (c) Credit card balance - $5,500 (d) (a) + (b) + (c) - (d) = $( 144,000 +300,000 + 35,000 – 5,500) = $473,500 6. Good overall performance C. Factors affecting financial status Financial status can be affected by: 1. Unemployment If Mr. Li is unemployed, income , capital 2. Part-time job If Mr. Li has a part-time job, income , capital 3. Illness If Mr. Li has serious illness, medical expenditure , capital 4. Time adjustment (getting married and buying a flat) If Mr. Li postpone his plan of marriage and buying of flat, he will have more savings for these purposes 5. Property price If property price is expected to rise, Mr. Li have to buy a flat with a higher price if he buy a flat later, capital 6. Interest rate If interest rate rises, Mr. Li can earn more from his savings account, capital 7. Returns from investment If Mr. Li receives higher returns from his investment, capital D. Assumptions We assume that, 1. Mr Li and his girlfriend, Miss Lam will have stable marriage. 2. Miss Lam will not give birth to twins and will only give birth to one baby 3. Their child will receive 12-year free education (e.g. not attending international school) 4. The firms they work in will not close down 5. Both Mr Li and Miss Lam will not be laid off by their firms. (they will enjoy stable employment and retire at 65 years old) 6. They will not recive any unexpected income (e.g. Lottery,mark six etc) 7. They paid credit card payment on time and will not bear any debt 8. They will not engage in any part-time job 9. They will receive stable interest from various investment. 10. Their property value will remain stable after they own them (e.g. their new flats/ cars). 11. The percentage of income to be allotted into the MPF remains unchanged every year 12. Li’s family including Miss Lam will not immigrate to other countries 13. The maximum MPF per month is $1,000 E. Forecast Li Chi keung’s Income Statement Year 0 Year 1 Year 2 Year 3 Year 5 441,462.5 459,297.6 $ Income Major income Salary 416,000 424,320 432,806.4 $ Expenditure Living expenses Life insurance 4,000 4,000 4,000 4,000 4,000 Education 42,000 42,000 8,000 8,000 8,000 Transportation 18,000 18,000 18,000 18,000 18,000 Books and Stationery 5,000 5,000 5,000 5,000 5,000 Salaries Tax 24,000 24,000 24,000 24,000 24,000 Entertainment 36,000 36,000 36,000 36,000 36,000 MPF 12,000 12,000 12,000 12,000 12,000 Holidays 15,000 15,000 15,000 15,000 15,000 Household expenditure 24,000 24,000 24,000 24,000 24,000 Joint savings account 36,000 48,000 48,000 48,000 48,000 Charitable donation 5,000 5,000 5,000 5,000 5,000 Other expenses 60,000 60,000 60,000 60,000 60,000 Wedding / / 200,000 / / Honeymoon / / 20,000 / / Sedan / / / 150,000 / Car cost / / / 72,000 72,000 Delivery cost / / / 150,000 / Child’s fee / / / 18,000 18,000 Rental cost / / 120,000 120,000 120,000 Surplus 135,000 131,320 -166,193.6 -327,537.5 -9,702.4 416,000 424,320 432,806.4 441,462.5 459,297.6 Li Chi keung’s Income Statement Year 7 Year 9 Income Year 10 Year 20 Year 30 618,154.1 753,526.4 $ Major income Salary 477,853.2 497,158.5 507,101.7 $ Expenditure Living expenses Life insurance 4,000 4,000 4,000 4,000 4,000 Education 8,000 8,000 8,000 8,000 8,000 Transportation 18,000 18,000 18,000 18,000 18,000 Books and Stationery 5,000 5,000 5,000 5,000 5,000 Salaries Tax 24,000 24,000 24,000 24,000 24,000 Entertainment 36,000 36,000 36,000 36,000 36,000 MPF 12,000 12,000 12,000 12,000 12,000 Holidays 15,000 15,000 15,000 15,000 15,000 Household expenditure 24,000 24,000 24,000 24,000 24,000 Joint savings account 48,000 48,000 48,000 48,000 48,000 Charitable donation 5,000 5,000 5,000 5,000 5,000 Other expenses 60,000 60,000 60,000 60,000 60,000 Wedding / / / / / Honeymoon / / / / / Sedan / / / / / Car cost 72,000 72,000 72,000 72,000 72,000 Delivery cost / / / / / Child’s fee 24,000 36,000 36,000 36,000 / Rental cost 120,000 120,000 120,000 120,000 120,000 Surplus 2,853.2 10,158.5 20,101.7 131,154.1 302,526.4 477,853.2 497,158.5 507,101.7 618,154.1 753,526.4 Year 3 Year 5 286,000 310,000 Li Chi keung Balance Sheet Year 0 Year 1 Year 2 $ Assets Investment MPF (capital and returns) 250,000 262,000 274,000 $ Current assets Joint savings account 144,000 240,024 336,057.6 432,100.8 624,677.0 Personal HKD account 300,000 435,043.5 566,646.7 300,483.1 272,127.9 Cash 35,000 35,000 35,000 35,000 35,000 729,000 972,067.5 1,211,704.3 1,153,593.9 1,042,639.9 $ Current liabilities Credit card balance 5,500 5,500 5,500 5,500 5,500 Net asset value 723,500 966,567.5 1,206,204.3 1,148,093.9 1,037,139.9 Li Chi keung Balance Sheet Year 7 Year 9 Year 10 Year 20 Year 30 490,000 610,000 2,075,152.0 3,048,195.1 $ Assets Investment MPF (capital and returns) 334,000 358,000 370,000 $ Current assets Joint savings account 817,445.9 Personal HKD account 62,756.7 75,174.5 85,341.5 781,012.5 2,915,803.8 Cash 35,000 35,000 35,000 35,000 35,000 3,381,164.5 6,608,998.9 1,249,202.6 1,010,407.6 1,106,960.8 1,478,582.1 1,597,302.3 $ Current liabilities Credit card balance 5,500 5,500 5,500 5,500 5,500 Net asset value 1,243,702.6 1,473082.1 1,591,802.3 3,375,664.5 6,603,498.9 F. Suggestions We suggest Mr. Li to: 1. buy a second-hand car ($29,800) instead of a new car 2. rent a flat from year 2 to year 6 then buy a flat in year 7. consider a mortgage plan at a loan to valuation ratio of 70% with a tenor of 20 years down payment can be withdrew from joint savings account 3. choose schools located in Cheung Kwan O for his child to save transportation cost 4. put his savings in Dah Sing Bank for higher interest (below $500,000: 0.01% per year, above $500,000: 0.05% per year) 5. buy education funding for his son in year 7 ($39,748.8 a year until year 22) which assist him in paying the education fee when he enters the university 6. choose MPF of equity funds outside Hong Kong (e.g. Greater China) due of asset diversification which is with a higher risk and returns 7. buy bonds (HSBC bank PLC) with $100,000 (coupon rate: 6.75%, redemption date: after 3.5 years) 8. put $15,000 cash into the personal savings account in year 11 to year 12 to avoid negative savings G. Budget Li Chi keung’s Income Statement Year 0 Year 1 Year 2 Year 3 Year 5 $ Income Major income Salary 416,000 424,320 432,806.4 441,462.5 459,297.6 Bonds (capital + / / / / / returns) $ Expenditure Living expenses Life insurance 4,000 4,000 4,000 4,000 4,000 Education 42,000 42,000 8,000 8,000 8,000 Transportation 18,000 18,000 18,000 18,000 18,000 Books and Stationery 5,000 5,000 5,000 5,000 5,000 Salaries Tax 24,000 24,000 24,000 24,000 24,000 Entertainment 36,000 36,000 36,000 36,000 36,000 MPF 12,000 12,000 12,000 12,000 12,000 Bonds / / 100,000 / / Holidays 15,000 15,000 15,000 15,000 15,000 Household expenditure 24,000 24,000 24,000 24,000 24,000 Joint savings account 36,000 48,000 48,000 48,000 48,000 Charitable donation 5,000 5,000 5,000 5,000 5,000 Other expenses 60,000 60,000 60,000 60,000 60,000 Wedding / / 200,000 / / Honeymoon / / 20,000 / / Sedan / / / / / Second hand car / / / 29,800 / Car cost / / / 72,000 72,000 Delivery cost / / / 150,000 / Child’s fee / / / 18,000 18,000 Rental cost / / 120,000 120,000 120,000 Annual mortgage / / / / / / / / / / 135,000 131,320 -266,193.6 -207,337.5 -9,702.4 416,000 424,320 432,806.4 441,462.5 459,297.6 repayment Annual premium for education funding Surplus Li Chi keung’s Income Statement Year 7 Year 9 Income Year 10 Year 20 Year 30 $ Major income Salary 477,853.2 497,158.5 507,101.7 618,154.1 753,526.4 Bonds (capital + 126,156.2 / / / / returns) $ Expenditure Living expenses Life insurance 4,000 4,000 4,000 4,000 4,000 Education 8,000 8,000 8,000 8,000 8,000 Transportation 18,000 18,000 18,000 18,000 18,000 Books and Stationery 5,000 5,000 5,000 5,000 5,000 Salaries Tax 24,000 24,000 24,000 24,000 24,000 Entertainment 36,000 36,000 36,000 36,000 36,000 MPF 12,000 12,000 12,000 12,000 12,000 Holidays 15,000 15,000 15,000 15,000 15,000 Household expenditure 24,000 24,000 24,000 24,000 24,000 Joint savings account 48,000 48,000 48,000 48,000 48,000 Charitable donation 5,000 5,000 5,000 5,000 5,000 Other expenses 60,000 60,000 60,000 60,000 60,000 Wedding / / / / / Honeymoon / / / / / Sedan / / / / / Second hand car / / / / / Car cost 72,000 72,000 72,000 72,000 72,000 Delivery cost / / / / / Child’s fee 24,000 36,000 36,000 36,000 / Rental cost / / / / / Annual mortgage 133,308 133,308 133,308 133,308 / 39,748.8 39,748.8 39,748.8 39,748.8 / 75,952.6 -42,898.3 -32,955.1 78,097.3 422,526.4 604,009.4 497,158.5 507,101.7 618,154.1 753,526.4 Year 3 Year 5 286,000 310,000 repayment Annual premium for education fund Surplus Li Chi keung Balance Sheet Year 0 Year 1 Year 2 $ Assets Investment MPF (capital and returns) 250,000 262,000 274,000 $ Current assets Joint savings account 144,000 240,024 336,057.6 432,100.8 624,677.0 Personal HKD account 300,000 435,043.5 566,646.7 300,483.1 74,454.1 Cash 35,000 35,000 35,000 35,000 35,000 729,000 972,067.5 1,212,604.3 1,153,754.1 1,044,131.1 $ Current liabilities Credit card balance 5,500 5,500 5,500 5,500 5,500 Net asset value 723,500 966,567.5 1,207,104.3 1,148,254.1 1,038,631.1 Li Chi keung Balance Sheet Year 7 Year 9 Year 10 Year 20 Year 30 490,000 610,000 $ Assets Investment MPF (capital and returns) 334,000 358,000 370,000 $ Current assets Joint savings account 317,069.0 509,364.9 605,667.6 1,571,346.7 2,541,865.1 Personal HKD account 64,248.2 99,579.1 56,686.5 238,815.6 2,445,265.8 Cash 35,000 35,000 35,000 35,000 35,000 750,317.2 1,001,944 1,067,354.1 2,335,162.3 5,632,130.9 $ Current liabilities Credit card balance 5,500 5,500 5,500 5,500 5,500 Net asset value 744,817.2 996,444 1,061,854.1 2,329,662.3 5,626,630.9 H. Conclusion: For the advantages, Mr. Li is now able to buy a residential unit in year 7 that costs about $3,000,000 and buy a sedan in year 6 that costs around $30,000 For his children, we have chosen to buy an education fund, in order to get a sum of money to alleviate the school fee, when his children go to primary school in the future We suggested Mr. Li to buy bonds as investment and he will get an extra return of about $20,000 All these advices help to improve Mr. Li quality of life and satisfy his aims. For the disadvantages, Some of the data such as salary tax and MPF returns are inaccurate as the information is not enough and unclear In our budget, there is still negative numbers in some years, however these deficit have been alleviated later Number of statements such as cash and transportation cost need to be kept constant and may cause error in the plan as there may be changes among them These cons may cause inaccuracy in the financial plan and lead to unexpected error Appendix 1. Mortgage https://www.hsbc.com.hk/1/PA_1_3_S5/content/hongkongpws/mortgages/pdf/mortgage_repayment_t able.pdf 2. Investment: Bonds https://www.hsbc.com.hk/1/2/hk/investments/bonds/bonds-detail?prodNum=HKHBAPBOND%20%2 0%20%20%20%20%20%20%20%20%20133079&prodClsCde=P&ES_STATE_RESET=ES_STATE_RESET 3. Education Funding http://www.prudential.com.hk/PruServlet?type=iPC&module=product&purpose=viewProdDetail&pr od_cat_id=EF&prod_type=L&prod_cd=GLI →download brochure 4. Second Hand Car http://www.28car.com/sell_dsp.php?h_vid=131009401&h_vw=y 5. Banking Interest http://www.dahsing.com/en/html/program/hong_kong_dollar_deposit_rate.html 6. MPF: Equity Funds http://www.hkifa.org.hk/eng/download/fundinfo/mpf/MPF_PerformanceMonthly.pdf →page 6