HSBC Living Finance

advertisement

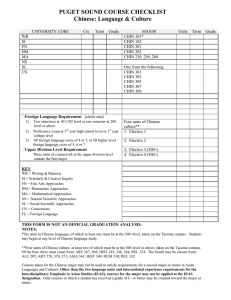

St. Francis’ Canossian College St. Francis’ Canossian College Financial Planner Specially Prepared for: Mr. & Mrs. Chin Case 1 16 July, 2008 Form Four Jody Wu Sarah Tong Rubie Fong Claudia Yuen Vegas Cheung HSBC Young Financial Planner Competition 2008 1 St. Francis’ Canossian College 1.) Financial Objectives Goal Time Save HK$200000 on average per Every year Amount Required (HK$) $200000 per year year Mr Chin takes up Chinese Yr 1-5 $85000 Yr 1-27 $9600 per year Go on a tour once a year Every year $30000 per year Mr Chin retires at 60 Yr 8 --- Mrs Chin retires at 65 Yr 22 --- Put aside $180000 for each of Yr 6 & 12 $360000 medicine course Mrs Chin takes up Dancing course their kid’s university fee HSBC Young Financial Planner Competition 2008 2 St. Francis’ Canossian College 2.) Present financial situation Current situation Mr. Chin: 52 years old Mrs. Chin: 43 years old Two sons: 12 years old and 8 years old, studying in Hong Kong Total income (per year) Salary (Mr. Chin + Mrs. Chin):$982000 Stocks:$125000 Bank interest:$3000 Sub Total:$110000 Total expenses (per year) Living expenses: $597000 Provident fund + MPF contribution:$42350 Insurance:$40000 Mortgage on property:$150000 Sub total:$829350 Income Surplus (year 0) $280650 Assets Liquid assets:$6337000 Non-liquid assets:$700000 Sub total:$7037000 Risk Tolerate Level Moderate HSBC Young Financial Planner Competition 2008 3 St. Francis’ Canossian College Mr. Chin has stable income ($56000/month) Mrs. Chin’s income may fluctuate Investments not diversify, mainly focus on stocks With insurance protection (Life insurance, accident insurance and medical insurance) Low cash deposit (< six month expenses) High-valued assets (self-owned property, car) Reasonable liabilities Can save more than $ 200000 in year 0 (income surplus of year 0= $280650) Income 3000, 0% 125000, 11% Mr Chin(Salary) Mrs Chin (basic salary) Mrs Chin(commision) 250000, 23% 672000, 61% Stocks Interest Bank Interest 60000, 5% HSBC Young Financial Planner Competition 2008 4 St. Francis’ Canossian College Expenses 150000, 18% 150000, 18% 5000, 1% 30000, 4% 40000, 5% 8750, 1% 33600, 4% 120000, 14% 100000, 12% 48000, 6% 108000, 13% 36000, 4% food and meal insurance motor expenses transportation utility bills salary tax entertainment provident fund contribution MPF contribution travelling textbook and stationery mortgage on property HSBC Young Financial Planner Competition 2008 5 St. Francis’ Canossian College Assets 300000, 4% 400000, 6% 40000, 1% 47000, 1% 1250000, 18% 5000000, 70% Self-owned property Provident fund MPF Car Stocks Saving accounts Deposits HSBC Young Financial Planner Competition 2008 6 St. Francis’ Canossian College 3.) Factors which may affect the financial status: Unemployment Diseases at old age Investment return Interest rate Tuition fee(for son’s further education) Accidents Marriage Death HSBC Young Financial Planner Competition 2008 7 St. Francis’ Canossian College 4.) Assumption The Chins’ income and expenses are stable; there is no accident which may affect the income and expenses. No divorce Pay rises at an annual compound rate of 2% Mr. & Mrs Chin will not take up any other interest course Bank interest rate keeps constant (1%) MPF contribution remains at $8750 Their children study 4 years of university only. Textbook and stationery fees only apply when their children is studying. Mrs. Chin keeps on dancing until she reaches 70 years old Since the commission Mrs Chin earns every year is uncertain, we assume the commission range is from $150000 to $200000. So the average commission every year is ($250000/0.05-60000)=$115000 Mr. Chin can live until 80, while Mrs. Chin can live until 86. (appendix #1) Mr. and Mrs. Chin’s medical expenses start at their elderly years(65) (appendix #3) Average medical expenses every year per person is $3800 (appendix #2) Son moves out right after graduation and all expenses reduce in half Their sons can afford their own expense at 22, since they have graduated moreover each son will give an average of $4000 house keeping allowance to his parents per month insurance contribution for 5 years($40000 per year) The life insurance is for 2 person, when Mr Chin pass away, his family can get back $3000000/2 = $1500000 The interest rate of bond is assumed to be 6% per year and that of stocks will be 15% per year. The return of monthly retire plan will be 5 % compounded per year. HSBC Young Financial Planner Competition 2008 8 St. Francis’ Canossian College 5.) Foreseen financial situation - Unable to save $200000 per year - The Chins often have negative cash flow (income unable to cover large expenses) - Unable to afford high medical expenses in their elderly years - The Chin family is not under sufficient insurance protection - The growth of their saving is small and unproductive - The return of stock is small HSBC Young Financial Planner Competition 2008 9 St. Francis’ Canossian College 6.) Financial Planning Cash & Credit Management We suggest Mr. and Mrs. Chin to pay off all their current liabilities in year 1 (credit card balance & outstanding utility bills = $33000) in order to avoid paying the late charge or financial charge. Advice for The Chins’ expenses Stage 1) Starting from year 0 The living expenses of Chin family is rather large comparing to their income. Problems of negative income surplus sometimes arise. Hence, we suggest the Chin family to cut down some of their expenses. We found out that the money spent on entertainment purpose is relatively high. Hence, we would like to suggest the Chin family to cut 25% of their living expenses on entertainment ($100000/year$75000/year). Stage 2) Starting from the retirement of Mr. Chin (year 8) We suggest Chin family to sell their car after Mr. Chin retires. The car will be seldom used as Mr. Chin will not need to go to work anymore. Besides, the two sons will grow old enough to be capable to use public transport. By then, the car will become an unnecessary luxury. Hence, selling the car can help reducing the Chin family’s living expenses (Motor expenses$120000/year). However, Chin family’s transportation expenditure will increase by $3000 = $48000+$3000=$51000 after they sell their car as they have to use more public transportation. Moreover, we advice the Chins to cut their expenses on food and meal since Mr Chin has retired, he can stay at home and cook for the family. Money can be saved from not eating outside. Therefore, they can cut down 25% of their expenses on food and meal ($150000/year$112500/year) which is still a reasonable budget. HSBC Young Financial Planner Competition 2008 10 St. Francis’ Canossian College Insurance Planning Stage 1 (from year 1 to year 13) We advice Mr. and Mrs. Chin to increase their accident insurance from year 1 until year 14 as the family is not being well-protected with a compensation of $1000000 if Mr. or Mrs. Chin die in an accident unfortunately. We expect the total expense from year 1 until Mr Chin’s youngest son graduate from university (year 14) is $9160207 (from appendix after planning), which is greater than $1000000. This has proven that a compensation of $1000000 was not enough to serve as a protection purpose. With our financial needs approach, we suggest that the accident insurance should cover their expenses until their sons graduate and move out (year1-14). With well-planned accident insurance, the Chin family is under adequate protection and a stable living standard can be sustained even Mr. or Mrs. Chin die in an accident. Stage 2 (start from year 14) When Mr. and Mrs. Chin’s children graduate from university and move out to live, Mr. and Mrs. Chin can stop to contribute for the two sons’ medical insurance as their sons can buy them themselves. Mr. and Mrs. Chin’s own accident insurance can also be cut down because they are getting older and will involve less in high-risk activities. The money saved in cutting down accident insurance should be allocated to increase the total annual premium for medical insurance with of Mr. and Mrs. Chin as their medical expenses will increase substantially since they will start to have elderly diseases for example high blood pressure, coronary heart disease, diabetes, high cholesterol level which HSBC Young Financial Planner Competition 2008 11 St. Francis’ Canossian College Invesment Planning Stage 1 (Mr. & Mrs. Chin both at work -- from year 1) Mr. & Mrs. Chin’s risk tolerance level is moderate since they are both at work and have a quite stable income. There is still period of time until they retire. They do not have any great debt (except mortgage). They can accept negative fluctuations in order to earn potential returns. Stocks and bond are the perfect investment for the Chins. Though investing in stocks is risky, the potential dividends earned may be higher than other investments. We advice Mr. & Mrs. Chin to put 50% of $150000 from their bank deposit in stock investment and the remaining 50% on buying bond. $150000 is a favourable amount of money to invest which leaves at least 6 months’ expense for emergency use in the bank deposit. *However, the Chin’s bank deposit in year 1 ($300000) is not enough to cover 6 month’s total expenses in year 1 ($414675). So, all investment should start from year 2. Therefore, they will start to invest on bond and stocks from year 2. Investment (Stage 1) Bond 50% HSBC Young Financial Planner Competition 2008 Stock 50% 12 St. Francis’ Canossian College Stage 2 (Mr Chin retired, Mrs Chin still at work -- from year 8) Mr. & Mrs. Chin’s risk tolerance level is conservative since Mr. Chin has already retired. Mrs. Chin will become the sole breadwinner of the Chin family, income of the Chins will therefore drop. However, they need to ensure they have money for their sons’ university fee. They would like to preserve their investment but they are willing to accept minor negative fluctuations in short term. Low risk is important to them. We advice them to put 30% of the investment capital*, 50% on bond, and 20% on monthly income retirement plan. As Mr. Chin has retired, their total income has decreased and should reduce high-risk investments such as stocks due to their risk tolerance will become conservative. More money can be spent on buying bond which is more stable and less risky. Buying monthly income retirement plan gives more saving and less protection, it is advisable as they are getting old and seldom involve in high-risk activities. *Between year 8 to year 12, the Chins’ income and expenses vary dramatically as Mr. Chin has retired and his sons has gone to the university. Therefore, we have arranged some reasonable change in the amount of the investment capital, but meanwhile we make sure there are enough and appropriate savings (at least half of their yearly expenses) to maintain their living. Investment (Stage 2) Monthly income retiremet plan 20% Stock 30% Bond 50% HSBC Young Financial Planner Competition 2008 13 St. Francis’ Canossian College Stage 3 (Mr & Mrs Chin both retired -- from year 22) Mr. & Mrs. Chin’s risk tolerance level is risk averse since both of them have already retired and they are old, so they may be uncomfortable with short-term investment fluctuations and wish to minimize the risk of capital loss. When Mr. & Mrs. Chin both retire, they will no longer earn a monthly income from work. Their risk tolerance will be lowered to risk averse. We advice them to give up buying stock as its risk is high. They can invest all their money* on buying bonds to ensure a stable investment and still earn money from interest. They can release all their money from the monthly income retirement plan all in one time so that they have more money in their bank account to prepare for the huge medical expenses in their elderly years. *We advice Mr Chin & Mrs Chin to invest $400000 every year, leaving a reasonable amount of cash deposit preparing for emergency use. (e.g. unexpected medical expenses) Investment (Stage 3) Bond 100% HSBC Young Financial Planner Competition 2008 14 St. Francis’ Canossian College 7.) Conclusion With well-adapted financial planning, Mr. and Mrs. Chin can accumulate assets, grow assets, and also protect their own assets. Moreover, the couple can achieve a series of financial goals through financial planning. When Mr. Chin is 65 years old, they have a bank deposit of $590207, also, as we have increased his medical insurance, thus, he will surely be able to cover his medical expenses in his elderly years. When Mrs. Chin has retired, she will receive a lump sum of $2391315 from the return of monthly retirement plan . Hence, they will have a bank deposit of $1092269, so she does not have to worry about her medical expenses either. In short, they are prepared for unexpected huge medical expenses, meanwhile still can maintain their present living standard. With our financial planning, there are much fewer years of negative income surplus in the Chin family. However, they still have two years with negative income surplus after the year Mr. Chin retires. But the whole family’s financial situation has improved a lot. We have analyzed that the Chin family has spend too much on unnecessary expenses. Therefore we advise them to cut down their entertainment expenses, motor expenses and food and meal expenses. This results in a increase in income surplus and has fulfilled our expectation marvelously. We have done wonderfully in helping the Chin family to buy different insurance plans in different stages in order to suit their changing financial needs. They do not have to worry about having insufficient money to deal with sudden medical expenditure. To sum up, this financial planning is successful. HSBC Young Financial Planner Competition 2008 15 St. Francis’ Canossian College Appendices HSBC Young Financial Planner Competition 2008 16 St. Francis’ Canossian College #1 http://news.bbc.co.uk/chinese/trad/hi/newsid_6430000/newsid_6438800/6438877.stm 香港男性的平均壽命是79.5年,女性為85.6年 #2 www.soco.org.hk/publication/elderly/elderly_2007_11.doc 在受訪者中,以公立門診為主要醫療佔 56%,其次為專科門診 26%及私家醫生 (13%), 可見超過 80%的長者是非常依賴政府提供的醫療服務(表 4) 1.8. 在受訪者中,有 82%的長者患有長期病,其中以高血壓 (54 人) 及骨科病 (25 人) 的患者最多(表 5)。 受訪長者當中,有超過 80%的人需要長期服藥(表 17),當中以高血壓(42 人)及糖尿病 的人(19 人)為最多。 2. 醫療開支 受訪者的每月平均開支為$2356、中位數為$2200,而當中的醫療費用平均開支為 $316,約佔長者的收入約 20%。就醫療費用的問題上,95%的長者表示醫療費用的加 增會令他們感到壓力。93%的長者希望政府能給予長期病患者及 60 歲以上的長者免費 醫療服務。 #3 www.hkcss.org.hk/download/folder/el/el_chi.doc 長者一般指65歲以上的人口。這也是現時香港法定的退休年齡。 HSBC Young Financial Planner Competition 2008 17