Click HERE to read more.

advertisement

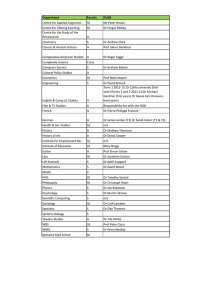

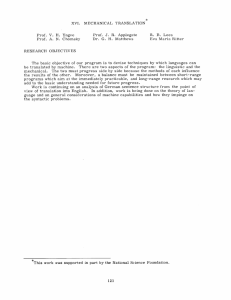

Report on the 9th EIASM Interdisciplinary Workshop on “Intangibles, Intellectual Capital and Extra-Financial Information” Copenhagen Business School, 26-27 September 2013 The 9th EIASM Interdisciplinary Workshop on “Intangibles, Intellectual Capital and Extra-Financial Information” was hosted by Copenhagen Business School on 26-27 September 2013. The chosen venue was particularly relevant as much of the ground-breaking work in Intellectual Capital (IC) occurred in the Nordic Countries. For this reason, this year’s Workshop aimed to combine theory and practice and to give a state-of-the-art overview of IC measurement and management. It was therefore focused on taking stock on the developments over the last decade and providing testimony on the progresses made in raising awareness, developing robust measurement and reporting methods, and helping organizations to better manage IC resources. With this aim, the Workshop brought together academics, practitioners and policy makers to consider the field’s theoretical status and ambitions. Resulting discussion has been illuminating for the future progress of the field. Nearly eighty delegates attended, representing eighteen countries. The programme consisted of three plenary sessions and seventeen parallel sessions, where forty research papers were presented. The majority of attendees felt that the IC Workshop is a small enough gathering to allow easy navigation and networking opportunities, whilst maintaining a comprehensive scientific program with renowned international speakers. Delegates were welcomed by the Workshop Coordinators Prof. Jan Mouritsen (Copenhagen Business School), Prof. Stefano Zambon (University of Ferrara) and Dr. Cristiana Parisi (Copenhagen Business School). The opening plenary speaker was Prof. Christian Nielsen from the Center for Research Excellence in Business Models of Aalborg University. In a session chaired by Prof. Jan Mouritsen, he discussed “Business Models and Intellectual Capital”. His lively presentation offered a new angle to the field. In fact, he discussed his research combining the notions of the company’s business models and IC performance management with the external analysts’ understanding of its strategy. The second plenary session, which concluded the first day of the Workshop, was chaired by Prof. Jan Mouritsen. The plenary speaker was Prof. Mats Alvesson from Lund University, who gave a talk on “A Stupidity-Based Theory of Organisations” grounded on the well renowned paper he recently published with André Spicer (City University) in the Journal of Management Studies. In his engaging presentation, Prof. Alvesson discussed 'functional stupidity' in organizations, which is demonstrated by the absence of reflexivity, justification and substantive reasoning of their human capital. The final plenary session, which concluded the Workshop, was chaired by Prof. Stefano Zambon and started with a presentation by Mr. Paul Druckman, CEO of the International Integrated Reporting Council (IIRC), on “An idea whose time has come: Integrated Reporting to provide the missing link to Intangibles and Intellectual Capital”. Mr. Paul Druckman presented the IIRC as a 1 global coalition of regulators, investors, companies, standard setters, accounting profession and NGOs, and introduced the Consultation Draft of the International Integrated Reporting Framework. Mr Druckman’s presentation was followed by a round table discussion on the role of integrated reporting for the IC research field. The Round Table, entitled “Integrated Reporting: Challenges, Role and Prospects” was chaired by Prof. Stefano Zambon. Panel members were Prof. Jan Mouritsen (Copenhagen Business School), Mr. Paul Druckman (IIRC), Mr. Stig Enevoldsen (Technical Director, Danish Professional Accountancy Body and former Chairman of EFRAG and IASC) and Dr. Richard Slack (Durham University). The panellists discussed several of the most controversial aspects relating to the integration of existing guidelines and approaches for the company’s voluntary reporting. Moreover, they addressed the relevance of integrated reporting from a stakeholders’ perspective, critically pointing out the various difficulties and open issues. During the Workshop a generous time slot was allocated to the presentation, discussion and feedback of each of the forty papers included in the parallel sessions. Moreover, a whole parallel session was dedicated to “Intellectual Capital Accounting in Practice” and was chaired by Ludo Pyis (Areopa Consultancy Firm) and Prof. Mariia Molodchik (National Research University, Perm, Russia). This special session was centred on the theme of how IC can be calculated on the basis of the concept of “added value creating phenomena.” More specifically, it addressed IC accounting based on the “Integrated IC Accounting & Reporting System” (IICARuS) model and discussed the audit practices from the perspective of a revised IAS 38. The forty papers presented a considerable diversity in topics and research approaches within the field of intangibles and intellectual capital. Parallel sessions and individual papers were dedicated, among others, to the antecedents and impacts of IC disclosure and integrated reporting also taking financial markets into consideration; the formation of rules and standards in the field; R&D and intellectual property; IC and strategy; and the related topics of modelling and measuring IC, and value and IC. Moreover, the papers analysed the themes of IC and resources, structural capital and financial returns, IC technology and open innovation, as well as more practical issues concerning observed practices and actual approaches to IC accounting. Finally, specific topics like IC in Universities and non-profit sector, and IC and sustainability disclosure were also represented. 2 Picture 1: The attribution of the best paper award, the co-runner ups and the special mentions The coordinators Prof. Jan Mouritsen, Dr. Cristiana Parisi and Prof. Stefano Zambon closed the Workshop by thanking all participants and with the attribution of the “Best Junior Contribution to the Intangibles and IC Theory and Practice Award”. The winners were Tami Dinh Thi and Baljit Sidhu (both at University of New South Wales) for the paper "Improving Investment Efficiency: The Case of R&D Capitalization". The coordinators, together with the leading scholars in the IC field attending the Workshop, also identified two co-runner-ups for the prize: Christine Miller, Wolfgang Schultze and Thomas List (all at University of Augsburg) for the paper "Economic Consequences of Voluntary Intellectual Capital Disclosures", and Peter Clearly (University College Cork) for the paper "Exploring The Relationships Between Management Accounting, Structural Capital and Business Performance". Finally, two special mentions were awarded to Shibashish Mukherjee (University of Ferrara) for the paper "What Happened to the 'Liquidity Premium' since Reg Fd of 2000 and Sox of 2002: A Systemic Study of Index, Size and ‘Intangibility’” and to Anne Cazavan-Jeny (ESSEC Business School), Pierre Astolfi (University Paris-Est Créteil) and Luc Paugam (ESSEC Business School) for the paper "Should Additional Disclosures Be Mandated for Intangibles Assets? Insights from Purchase Price Allocations". 3 Picture 2: The Workshop Coordinators (from the left): Prof. Stefano Zambon, Dr. Cristiana Parisi and Prof. Jan Mouritsen Next year’s EIASM Interdisciplinary Workshop on “Intangibles, Intellectual Capital & ExtraFinancial Information” will have a special edition that will take place in Ferrara, the location of the very first Workshop in 2005, on 18-19 September 2014, to celebrate its 10th anniversary. Cristiana Parisi Copenhagen Business School 4