ORP Contribution Concepts

advertisement

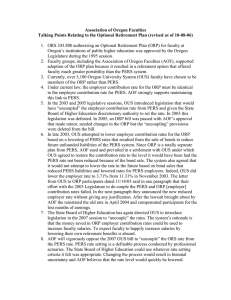

ORP Contribution Concepts IFS-Sponsored Presentation Denise Yunker, Benefits Director Human Resources Division, OUS denise_yunker@ous.edu Goals for ORP Rates • Competitive – including total compensation • Stable - reduced rate volatility • Sustainable – responsive to budget and funding limits ORS 243.800 (9) The State Board of Higher Education shall – contribute monthly to the optional retirement plan … the percentage of salary of each employee – … equal to the percentage of salary that would otherwise have been contributed as an employer contribution on behalf of the employee – to the Public Employees Retirement System – if the employee had not elected to participate in the optional retirement plan. Measure 29 Bond Sale and Payment to PERS • November 2003 – March 2004 • Why Measure 29 reduced ORP contributions • Measure 29 Correction – How much – When • What’s Next? 2003 PERS “Reform” • Created two pension plans and the IAP – PERS pension – hired before 8/29/04 – OPSRP pension - hired on or after 8/29/04 – IAP – all PERS members • Legal challenges to benefit changes pending • Set employer rate at 11.31% • Directed employee 6% to IAP Reason to Amend ORS 243.800(9) • PERS and ORP are “apples and oranges” – Employer contribution rate changes do not affect PERS benefits, but significantly change ORP participants’ retirement account growth • New PERS/OPSRP plan funding could decrease employer contribution rate; market returns could increase it • Frequent contribution rate changes undermine dollar cost averaging and retirement planning for ORP participants Employer ORP Rate Options • Revise portions of the statutory language and retain PERS Total Employer Cost Rate • Adopt PERS Normal Cost Rate • Adopt a Fixed Rate • Set a “floor” rate in combination with any of the above Employer Total Cost Rate • Made up of: – – – – Normal cost Accrued actuarial liability Asset valuation Actuarial gains and losses • Affected by investment performance; asset smoothing that delays recognition of gains and losses; Employee entry age changes, turnover, wage changes Employer Normal Cost Rate • Normal Cost Rate – Annual cost associated with service accrued during the current year • Oregon PERS – uses Entry Age Normal method • Normal cost is average level percentage of payroll from entry age to retirement age • Can increase or decrease over time due to changes in: – – – – Actuarial funding method Actuarial assumptions Plan benefits Employee demographics “Fixed” Employer Rates Options: • Actuarially determined rates based on projected retirement account goals • “Market” based to be competitive • Recognition of total compensation effects Goals for ORP Rates • Competitive – including total compensation • Stable - reduced rate volatility • Sustainable – responsive to budget and funding limits