Policy Review

advertisement

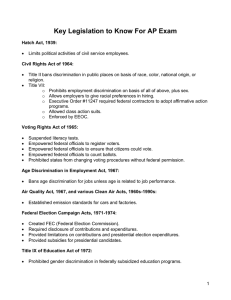

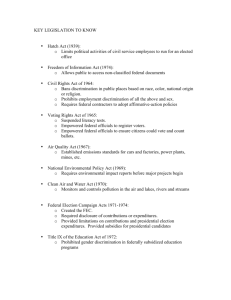

Briones Policy Vocab & Statutes APG Economic & Regulatory Policy: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. Public policy – A specific course of action taken by government to achieve a public goal. Policy agenda – The informal list of issues that Congress and the president consider most important for action. Distributive policy – A type of policy that provides benefits to all Americans. Redistributive policy – A type of policy that takes benefits (usually through taxes) from one group of Americans and gives them to another (usually through spending). Rule – The precise legal definition of how government will implement a policy. Iron triangle – A policy-making alliance that involves a very strong ties among a congressional committee, an interest group, and a Federal Department or agency. Issue network – A policy-making alliance among loosely connected participants that comes together on a particular issue, then disbands. Fiscal policy – Government policy that attempts to manage the economy by controlling taxing and spending. Monetary policy – Government policy that attempts to manage the economy by controlling the money supply and thus interest rates. Inflation – A rise in the general price level (and decrease in dollar value) owing to an increase in the volume of money and credit in relation to available goods. Unemployment – The number of Americans who are out of work but actively looking for a job. The number does not usually include those who are not looking. Excise tax – Consumer tax on a specific kind of merchandise, such as tobacco. Deficit – The difference between the revenues raised annually from sources of income other than borrowing and the expenditures of government, including paying the interest on past borrowing. Tariff – Tax levied on imports to help protect the nation’s industries, labor, or farmers from foreign competition. It can also be used to raise additional revenue. Progressive tax – A tax graduated so that people with higher incomes pay larger fraction of their income than people with lower incomes. Regressive tax – A tax whereby people with lower incomes pay a higher fraction of their income than people with higher incomes. National debt – The total amount of money the Federal government has borrowed to finance deficit spending over the years. Office of Management and Budget (OMB) – Presidential staff agency that serves as a clearinghouse for budgetary requests and management improvements for government agencies. Congressional Budget Office (CBO) – An agency of Congress that analyzes presidential budget recommendations and estimates the cost of proposed legislation. Sales tax – General tax on sales transactions, sometimes exempting food and drugs. Value-added tax (VAT) – A tax on increased value of the product at each stage of production and distribution rather than just at the point of sale. Tax expenditure – Loss of tax revenue due to Federal laws that provide special tax incentives or benefits to individuals or businesses. Monetarism – A theory that government should control the money supply to encourage economic growth and restrain inflation. Federal Reserve System – The system created by Congress in 1913 to establish banking practices and regulate currency in circulation and the amount of credit available. It consists of 12 regional banks supervised by the Board of Governors. Often called simply the Fed. Laissez-faire economics – Theory that opposes governmental interference in economic affairs beyond what is necessary to protect life and property. Keynesian economics - Economic theory based on the principles of John Maynard Keynes stating that government spending should increase during business slumps and be curbed during booms. Trade deficit – An imbalance in international trade in which the value of imports exceeds the value of exports. World Trade Organization (WTO) – International organization derived from the General Agreement on Tariffs and Trade (GATT) that promotes it free trade around the world. General Agreement on Tariffs and Trade (GATT) – An international trade organization with more than 130 members, including the United States and the People’s Republic of China, that seeks to encourage free trade by lowering tariffs and other trade restrictions. North American Free Trade Agreement (NAFTA) – Agreement signed by the United States, Canada, and Mexico in 1992 to form the largest free trade zone in the world. Protectionism - Policy of erecting trade barriers to protect domestic industry. Offshoring – The practice of exporting U.S. jobs to lower paid employees in other nations. Briones 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. Policy Vocab & Statutes APG Regulation – Efforts by government to alter the free operation of the market to achieve social goals such as protecting workers and the environment. Monopoly - Domination of an industry by a single company; also the company that dominates the industry. Antitrust legislation – Federal laws (starting with the Sherman Antitrust Act of 1890) that try to prevent a monopoly from dominating an industry and restraining trade. Trust – A monopoly that controls goods and services, often in combinations that reduce competition. Closed shop - A company with a labor agreement under which union membership is a condition of employment. Union shop – A company in which new employees must join a union within a stated time period. Labor injunction – A court order forbidding specific individuals or groups from performing certain acts (such as striking) that the court considers harmful to the rights and property of an employer or community. Collective bargaining – Method whereby representatives of the union and employer determine wages, hours, and other conditions of employment through direct negotiation. Environmental impact statement – Statement required by Federal law from all agencies for any project using Federal funds to assess the potential effect of the new construction or development on the environment. Deregulation – A policy promoting cutbacks in the amount of Federal regulation in specific areas of economic activity. Social Policy: 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. Unfunded mandates – Programs that the Federal government requires States to implement without Federal funding. Entitlements – Programs such as unemployment insurance, disaster relief, or disability payments that provide benefits to all eligible citizens. Means-tested entitlements – Programs such as Medicaid and welfare under which applicants must meet eligibility requirements based on need. Public assistance - Aid to the poor; “welfare.” Social insurance – Programs in which eligibility is based on prior contributions to government, usually in the form of payroll taxes. Social Security – A combination of entitlement programs, paid for by employer and employee taxes, that includes retirement benefits, health insurance, and support for disabled workers and the children of deceased or disabled workers. Medicare – National Health Insurance program for the elderly and disabled. Medicaid – Federal program that provides medical benefits for low-income persons. Health maintenance organization (HMO) – Alternative means of health care in which people or their employers are charged a set amount and the HMO provides health care and covers hospital costs. Medical savings account – Alternative means of health care in which individuals make tax-deductible contributions to a special account that can be used to pay medical expenses. Foreign & Defense Policy: Realism – A theory of international relations that focuses on the tendency of nations to operate from selfinterest. Idealism – A theory of international relations that focuses on the hope the nations will act together to solve international problems and promote peace. Isolationism – The desire to avoid international entanglement altogether. Internationalism – The belief that nations must engage in international problem solving. Unilateralism – A philosophy that encourages individual nations to act on their own when facing threats from other nations. Bush Doctrine – A policy adopted by the Bush administration in 2001 that asserts America’s right to attack any nation that has weapons of mass destruction that might be used against U.S. interests at home or abroad. Multilateralism – A philosophy that encourages individual nations tacked together to solve international problems. Hard power – The reliance on economic and military strength to solve international problems. Soft power – The reliance on diplomacy and negotiation to solve international problems. Theory of deterrence – A theory that is based on creating enough military strength to convince other nations not to attack first. Weapons of mass destruction – Biological, chemical, or nuclear weapons that can cause a massive number of deaths in a single use. Briones 65. 66. 67. 68. Policy Vocab & Statutes APG Normal trade relations – Trade status granted as part of an international trade policy that gives a nation the same favorable trade concessions and tariffs that the best trading partners receive. National Intelligence Director – The Federal government’s primary intelligence officer, responsible for overseeing all national intelligence agencies and providing advice to the President on terrorist threats. Bipartisanship – A policy that emphasizes a united front and cooperation between the major political parties, especially on sensitive foreign policy issues. Economic sanctions – Denial of export, import, or financial relations with the target country in an effort to change that nation’s policies. Legislation to know: Hatch Act, 1939: Limits political activities of civil service employees. Civil Rights Act of 1964: Enforced the 14th Amendment. Title II bans discrimination in public places on basis of race, color, national origin, or religion. Ended Jim Crow segregation in hotels, motels, restaurants, and other places of public accommodation. Prohibited discrimination in employment on the basis of race, color, national origin, religion, or gender. Created Equal Employment Opportunity Commission (EEOC) to monitor and enforce protections against job discrimination. Upheld by Supreme Court on grounds that segregation affected interstate commerce. Voting Rights Act of 1965: Suspended literacy tests. Gave federal officials oversight responsibility in voter registration in areas with a history of discriminatory voting practices. Empowered federal officials to ensure that citizens who registered could vote. Empowered federal officials to count ballots. Prohibited states from changing voting procedures without federal permission. Age Discrimination in Employment Act, 1967: Bans age discrimination for jobs unless age is related to job performance. Air Quality Act, 1967: Established emission standards for cars and factories. Clean Air Act, 1970: Increased power of federal government relative to power of state governments in controlling air quality. Established national air quality standards. Required states to administer new standards and to appropriate funds for their implementation. Federal Election Campaign Acts, 1971-1974: Created FEC (Federal Election Commission). Required disclosure of contributions and expenditures. Provided limitations on contributions and presidential election expenditures. Provided subsidies for presidential candidates. Briones Policy Vocab & Statutes APG Title IX of Education Act of 1972: Prohibited gender discrimination in federally subsidized education programs. War Powers Act, 1973: President could send troops overseas to an area where hostilities were imminent only if: o He notified Congress within 48 hours. o He withdrew troops within 60-90 days, unless authorized by Congress. o He consulted with Congress if troops were to engage in combat. Congress can pass resolution to have troops withdrawn at any time. Freedom of Information Act, 1974: Allows public access to nonclassified federal documents. Budget and Impoundment Control Act, 1974: Established congressional budget committees. Established CBO (Congressional Budget Office) to evaluate president’s budget. Established and then extended budget process by three months. Allows either house to override temporary impoundment (deferral). Automatically voids permanent impoundment (rescission) unless both houses approve within 45 days. Federal Election Campaign Act, 1974: Created the Federal Election Commission (FEC) Tightened reporting requirements for campaign contributions. Provided full public financing for major party candidates in the general election. Gramm-Rudman-Hollings Bill, 1985: Set gradual budget reduction targets to lead to a balanced budget. Across-the-board budget cuts (sequestering of funds) to kick in if targets not met. Loopholes: abandonment in late 1980s. Americans with Disabilities Act, 1990 Bans job discrimination against disabled if “reasonable accommodation” can be made. Requires access to facilities for handicapped. Permits non-paid leave of absence (in some situations) without jeopardizing job participation. National Voter Registration Bill (“Motor Voter Act”), 1993: Requires states to allow people to register to vote when applying for driver’s licenses applications, or completing license renewal forms. Religious Freedom Restoration Act, 1993: Restored compelling purpose guideline for courts to use when states restrict religious liberty. Struck down by Supreme Court in Boerne v. Flores. Unfunded Mandates Reform Act of 1995: Requires CBO to analyze impact of unfounded mandates on states. Requires separate congressional vote on bills that impose unfounded mandates. Personal Responsibility and Work Opportunity Reconciliation Act (Welfare Reform Act of 1996): Ended federal entitlement status of welfare—ended Aid to Families with Dependent Children (AFDC). Briones Policy Vocab & Statutes APG Replaced AFDC with block grants to states to administer welfare—Temporary Assistance to Needy Families (TANF). Strings attached to these grants include: o Recipients must work within 2 years. o Recipients cannot receive benefits for more than 5 years. Communications Decency Act (CDA), 1997: Prohibited circulation of “indecent” material on Internet to minors. Struck down by Supreme Court. No Child Left Behind Act, 2001: States must adopt education accountability standards and measurable goals. States must develop assessment tools and annually test students. Sanctions against schools that fail to meet adequate yearly progress. Dramatic expansion of federal role in education. USA Patriot Act, 2001: Expands definition of terrorism to include domestic terrorism. Strengthens the federal government’s power to conduct surveillance, perform searches, and detain individuals in order to combat terrorism. McCain-Feingold Bill (Bipartisan Campaign Finance Reform Act), 2002: Raised hard money limits to $2,000. Banned soft money contributions to national political parties. Affordable Health Care Act (2011): Requires all persons not currently covered by insurance to purchase a policy. Expands Medicaid eligibility. Creates insurance exchanges—a marketplace where individuals and small businesses can compare policies and premiums, and buy insurance. Insurance companies can no longer limit or deny benefits to children under age 19 due to a pre-existing health condition. Persons have the right to keep “grandfathered” health plans if they were covered before the health care law was enacted. Dependents under 26 may be eligible for health insurance coverage under their parent’s plan. Tax credits will be provided for small businesses and non-profits. Requires employers with more than 50 employees to offer health insurance to full-time employees (2014)