IFRS TRANSITIONS AND EFFECTIVE DATES 2011 CA RAKESH CHOUDHARY M 9198685003512.doc

advertisement

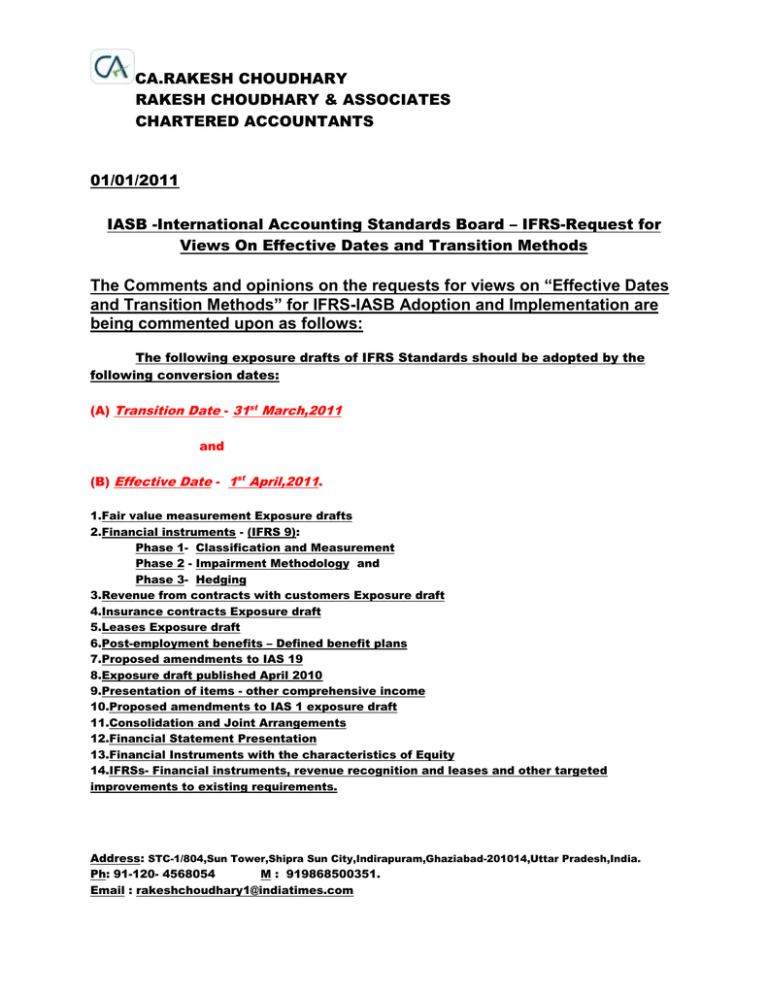

CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS 01/01/2011 IASB -International Accounting Standards Board – IFRS-Request for Views On Effective Dates and Transition Methods The Comments and opinions on the requests for views on “Effective Dates and Transition Methods” for IFRS-IASB Adoption and Implementation are being commented upon as follows: The following exposure drafts of IFRS Standards should be adopted by the following conversion dates: (A) Transition Date - 31st March,2011 and (B) Effective Date - 1st April,2011. Project Status 1.Fair value measurement Exposure drafts 2.Financial instruments - (IFRS 9): Phase 1- Classification and Measurement Phase 2 - Impairment Methodology and Phase 3- Hedging 3.Revenue from contracts with customers Exposure draft 4.Insurance contracts Exposure draft 5.Leases Exposure draft 6.Post-employment benefits – Defined benefit plans 7.Proposed amendments to IAS 19 8.Exposure draft published April 2010 9.Presentation of items - other comprehensive income 10.Proposed amendments to IAS 1 exposure draft 11.Consolidation and Joint Arrangements 12.Financial Statement Presentation 13.Financial Instruments with the characteristics of Equity 14.IFRSs- Financial instruments, revenue recognition and leases and other targeted improvements to existing requirements. Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS 15.The standard-setting structure in the United States undergoing review: the US Securities and Exchange Commission is evaluating whether and how to incorporate IFRSs into the US reporting system 16.The IASB recognising the need to help interested parties to manage the pace and cost of changes to financial reporting through IFRS Board representation with governments and institutions,courses,memberships etc. Views,Opinions and Comments: Background Information Q. Please describe the entity (or the individual) responding to this Request for Views: (a) “We are Statutory Auditors of Companies and Preparers of Financial Statements in accordance with IFRS ‘s,US GAAP,INDIAN GAAP,UK GAAP etc. “ From: CA.RAKESH CHOUDHARY,B.Sc.,MIMA.,MICA.,FICWA.,FCA CHARTERED ACCOUNTANT RAKESH CHOUDHARY & ASSOCIATES,CHARTERED ACCOUNTANTS STC-1/804,SUN TOWER,SHIPRA SUN CITY,INDIRAPURAM,GHAZIABAD, GHAZIABAD-201014,UTTAR PRADESH,INDIA. M:919868500351 E.Mail: rakeshchudhary1@indiatimes.com (b) (1)Primary Business of the Firm : STATUTORY AUDIT (2) Size of Firm: Gross Receipts – INR 5.00 LAKHS PER ANNUM (3) Number of Persons in the Firm: 10 Persons (4) Not registered in any Securities Exchange (c) Main Focus: PUBLIC LIMITED COMPANIES,PRIVATE LIMITED COMPANIES, NATIONALISED BANKS,SME ENTERPRISES etc. (d) N.A (e) Please describe the degree to which each of the proposed new IFRSs is likely to affect you and the factors driving that effect (for example, preparers of financial statements might explain the frequency or materiality of the transactions to their business and investors and creditors might explain the significance of the transactions to the particular industries or sectors they follow). Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS “In India,Statutory IFRS Compliance as per Companies Act and IGFRS (Indian Government Financial Reporting Standards) formed by the Government Accounting Standards Advisory Board(GASAB) has been developed as standards on Accrual Basis (Under Consideration) i.e. 1.IGFRS 1- Framework for financial reporting under accrual basis of accounting 2.IGFRS 2- Property,Plant and Equipment 3.IGFRS 3- Revenue from exchange transactions 4.IGFRS 4- Inventories 5.IGFRS 5- Provision,contingent liabilities and contingent assets Which is under consideration,that the transition date to be 31st March,2011 and effective date to be from 1st April,2011. Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS Applicability of IFRS for Indian Concerns Roadmap for convergence in respect of Companies other than Banking Companies, Insurance Companies and NBFCs Converged Accounting Standards will be applied to specified class of companies in Three phases: Phase-I Conversion of opening balance sheets as at April 1, 2011, if the financial year commences on or after April 1, 2011. 1) Companies which are part of NSE - Nifty 50 2) Companies which are part of BSE - Sensex 30 3) Companies whose shares or other securities are listed on stock exchanges outside India 4) Companies, whether listed or not,which have a net worth in excess of Rs.1,000 crore Phase-II Conversion of opening balance sheets as at April 1, 2013, if the financial year commences on or after April 1, 2013 The companies, whether listed or not, having a net worth exceeding Rs. 500 crore but not exceeding Rs. 1,000 crore Phase-III Conversion of opening balance sheets as at April1,2014,if the financial year commences on or after April 1,2014 Listed companies which have a net worth of Rs. 500 crore or less Note 1: When the accounting year ends on a date other than March 31,the conversion of the opening Balance Sheet will be made in relation to the first Balance Sheet which is made on a date after March 31. Note 2: Companies covered in Phase I will prepare their financial statements for 2011 - 12 in accordance with converged Accounting Standards, but will show previous years’ figures as per the financial statements for 2010 - 11 i.e. as per non-converged Accounting Standards. However, the entity shall have the option to add an additional column to indicate what these figures could have been if converged Accounting Standards had been applied in that previous year. Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS Non-listed companies which have a net worth of Rs. 500 crore or less and whose shares or other securities are not listed on Stock Exchanges outside India and Small and Medium Companies (SMCs) will not be required to follow the notified Accounting Standards which are converged with the IFRS (though they may voluntarily opt to do so) but need to follow only the notified Accounting Standards which are not converged with the IFRS. Roadmap for convergence in respect of Insurance Companies All insurance companies will convert their opening balance sheet as at April 1, 2012 in compliance with the converged Accounting Standards. Date of conversion of opening balance sheet in compliance with converged Accounting Standards April 1, 2013 April 1, 2014 Class of Banking Companies All scheduled commercial banks and those urban co-operative banks (UCBs) which have a net worth in excess of Rs. 300 crore Urban co-operative banks which have a net worth In excess of Rs. 200 crore but not exceeding Rs. 300 crore Urban co-operative banks which have a net worth not exceeding Rs.200 crore and Regional Rural banks (RRBs) will not be required to apply the converged Accounting Standards (though they may voluntarily opt to do so) and need to follow only the existing notified Accounting Standards which are not converged with IFRSs. Conversion of opening balance sheet in compliance with converged Accounting Standards Categories of NBFCs April 1, 2013 Companies which are part of NSE – Nifty 50 Companies which are part of BSE - Sensex 30 Companies,whether listed or not,which have a net worth in excess of Rs.1,000 crore April 1, 2014 All listed NBFCs and those unlisted NBFCs which do not fall in the above categories and which have a net worth in excess of Rs. 500 crore Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS Unlisted NBFCs which have a net worth of Rs. 500 crore or less will not be required to follow converged Accounting Standards, though they may voluntarily opt to do so, but need to follow only the notified Accounting Standards which are not converged with the IFRSs. Note: if the financial year commences on any other date than April 1, then the conversion of the opening Balance Sheet will be made in relation to the first Balance Sheet which is made on a date after April 1. Preparing for transition to the new requirements The International Financial Reporting Standards (IFRS) should be ready by the transition date of 31st March 2011 and Effective Date be 1ST April,2011 and large multinational enterprises should comply the IFR Standards.The cost of implantation is negligible compared to the benefits it will give to the enterprises in the long run in terms of mergers,acquisitions,fund raising,accounting and financial harmonization,employments generated,expansion programmes of companies,comparative studies,benefits to all stakeholders etc. International Financial Reporting Standards should be complied from the Transition Date of 31st March,2011 and Effective Date 1st April,2011 and the following IFR Standards complied Prospectively: oject Transition Method Consolidation Fair value measurement Financial instruments (IFRS 9) Insurance contracts Joint arrangements Leases Limited Post-employment benefits – Defined benefit plans Presentation of items of other comprehensive income Revenue from contracts with customers Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS Questions about managing the cost of implementation through the implementation timetable (effective dates) are raised below. Q. (a) Which of the proposals are likely to require more time to learn about the proposal, train personnel, plan for, and implement or otherwise adapt? “IFRS Membership,Courses-Certificate and Doctorate,Training the Trainers-CFO’SProfessors’-Professionals-Various Institutes,Advance Rulings by IFRS,IFRS offices in all the 202 countries and various appointments etc.” (b) What are the types of costs you expect to incur in planning for and adapting to the new requirements and what are the primary drivers of those costs? What is the relative significance of each cost component? “Not Substantial” Q. Do you foresee other effects on the broader financial reporting system arising from these new IFRSs? For example, will the new financial reporting requirements conflict with other regulatory or tax reporting requirements? Will they give rise to a need for changes in auditing standards? “IFRS office representations with respective countries is required,get it complied through United Nations,harmonization with respective countries laws and legal notifications etc.” Q. Do you agree with the transition method as proposed for each project, when considered in the context of a broad implementation plan covering all the new requirements? If not, what changes would you recommend, and why? In particular,please explain the primary advantages of your recommended changes and their effect on the cost of adapting to the new reporting requirements. International Financial Reporting Standards should be complied from the Transition Date of 31st March,2011 and Effective Date 1st April,2011 and the following IFR Standards complied Prospectively: tion Method Consolidation Fair value measurement Financial instruments (IFRS 9) Insurance contracts Joint arrangements Leases Limited Post-employment benefits – Defined benefit plans Presentation of items of other comprehensive income Revenue from contracts with customers Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS There has to be a Systematic Identification,Codification,Valuation of Assets and Liabilities,Accounting Policies,Accrual Basis of Accounting,Fair Valuation etc. Government Accounting Reforms has been under consideration in public sector accounting and financial reporting systems with increasing convergence to an accrual basis of accounting.The world bank has been conducting gap analysis of government accounting with cash basis IPSAS of IFAC and their consequent convergence to accrual basis of accounting and IFRS of IASB. Standard Codified Chart of Accounts Classification has to be introduced uniformly under IFRS and IFAC globally. Standard Codified Financial Reporting Standards Classification has to be introduced under IFRS Reporting Systems. Standard Codified Financial Reporting Standards Classification for Budget Accounting and Budget Classification should be introduced for Government Departments of respective countries. Standard Codified International Financial Reporting Standards Classification of Accounting Policies to be framed to be complied and reported by companies in Annual Reports Standard Codified International Financial Reporting Standards Classification of Valuation Methods,Accounting and Fair Valuation of Assets to be prescribed. Effective dates for the new requirements and early adoption and Considerations for firsttime adopters of IFRSs International Financial Reporting Standards should be complied from the Transition Date of 31st March,2011 and Effective Date 1st April,2011 for all the IFRS Nine(9)Standards. Other IFRS Standards which will come up later on will be effective through annual improvements plans and made mandatory each sequential year. International convergence considerations Q. Do you agree that the IASB and FASB should require the same effective dates and transition methods for their comparable standards? Why or why not? “YES Benefits of Global Listing,Fund Raising,Mergers,Acquisitions,Capacity Expansions, Comparative Evaluations etc.” Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com CA.RAKESH CHOUDHARY RAKESH CHOUDHARY & ASSOCIATES CHARTERED ACCOUNTANTS Q. Should the IASB permit different adoption dates and early adoption requirements for first-time adopters of IFRSs? Why, or why not? If yes, what should those different adoption requirements be, and why? International Financial Reporting Standards should be complied from the Transition Date of 31st March,2011 and Effective Date 1st April,2011 for first time adopters of IFRS. Disclosures for Insurance Contracts (exposure draft published July 2010) Effective date and transition International Financial Reporting Standards should be complied from the Transition Date of 31st March,2011 and Effective Date 1st April,2011 At the beginning of the earliest period presented, an insurer shall, with a corresponding adjustment to retained earnings - measure each portfolio of insurance contracts at the present value of the fulfilment cash flows. In applying paragraph 92(e)(iii), an insurer need not disclose previously unpublished information about claims development that occurred earlier than five years before the end of the first financial year in which it first applies this [draft] IFRS. Redesignation of financial assets At the beginning of the earliest period presented, when an insurer first applies this [draft] IFRS, it is permitted, to redesignate a financial asset as measured at fair value through profit or loss if doing so would eliminate or significantly reduce an inconsistency in measurement or recognition. The reclassification is a change in accounting policy and IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors applies. The insurer shall recognise the cumulative effect of that redesignation as an adjustment to opening retained earnings of the earliest period presented and remove any related balances from accumulated other comprehensive income and/or capital reserve created for the same. From: CA.RAKESH CHOUDHARY,B.Sc.,MIMA.,MICA.,FICWA.,FCA CHARTERED ACCOUNTANT RAKESH CHOUDHARY & ASSOCIATES,CHARTERED ACCOUNTANTS STC-1/804,SUN TOWER,SHIPRA SUN CITY,INDIRAPURAM,GHAZIABAD, GHAZIABAD-201014,UTTAR PRADESH,INDIA. M:919868500351 E.Mail: rakeshchudhary1@indiatimes.com Address: STC-1/804,Sun Tower,Shipra Sun City,Indirapuram,Ghaziabad-201014,Uttar Pradesh,India. Ph: 91-120- 4568054 M : 919868500351. Email : rakeshchoudhary1@indiatimes.com