Sources of General Revenue for the State Government, Fiscal Year 1991-92

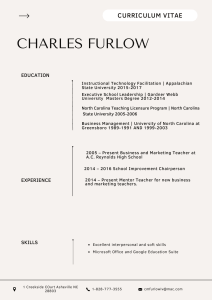

advertisement

CEN TER FOR LE G I S LA T I VE S TUDIES Sources of General Revenue for the State Government, Counties and Municipalities in North Carolina, Fiscal Year 1991-92 Source State Counties Municipalities Federal Government 24.9% 1.4% 4.3% State Government – 50.9% 14.5% Sales Tax 14.6% 6.4% 9.9% Corporate Income Tax 4.3% – – Personal Income Tax 24.1% – – Property Tax – 20.5% 32.7% Other Note: Various small sources are excluded; thus columns do not ad to 100%. Source: State and Local Government Relations in North Carolina: Their Evolution and Current Status, edited by Charles D. Liner, Institute of Government, University of North Carolina at Chapel Hill, 1995. CEC/June 2007 University of North Carolina at Greensboro 237 Graham Building, Post Office Box 26170, Greensboro, NC 27402-6170 Telephone 1 (336) 334-4360 Fax 1 (336) 334-4315