Benefit Cost Ratio Course Outline 8 Matakuliah : D0762 – Ekonomi Teknik

advertisement

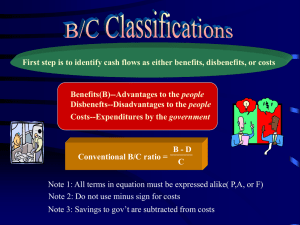

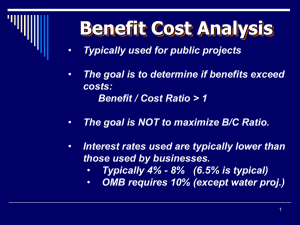

Matakuliah Tahun : D0762 – Ekonomi Teknik : 2009 Benefit Cost Ratio Course Outline 8 Outline • • • • Definition Benefit Cost Ratio for Single Project Alternative Selection B/C selection from multiple alternatives 2 Definition • Benefit Cost Ratio is a method for selecting alternatives for public works project. • B/C method of analysis is based on the ratio of the benefits to costs associated with a particular project • First steps : determine which of the elements are benefits, disbenefits, and costs 3 What is Public Project? • Public Sector is owned by the citizens • Public Sector Projects provide needed services at ‘no profit’ • Facts… • Generally large investment size • Long life span (30-50 years) • Revenues are used to cover future cost KGA-Spr09®Reserved 4 Terminology • Costs: estimated expenditures for operations, maintenance, and construction -- Government • Benefits: economic advantages experienced by the owners -- Public • Disbenefits: expected undesirable consequences to the owners -- Public • Note: defining the benefit and disbenefit are not as easy as one two three for some public sectors • Discount rate: interest rate for public sector projects KGA-Spr09®Reserved Be Consistent! • Select a viewpoint prior determining costs, benefits, and disbenefits and stick with one only! • The Do-Nothing option! • Several viewpoints: • Citizen • Economic development • Job creation/retention, etc KGA-Spr09®Reserved Conventional B/C Ratio - Single Project • Calculated as follows B/C =benefits –disbenefits B-D= C Costs B/C = PW(B-D) = AW(B-D) = FW(B-D) PW(C) AW(C) FW(C) • Decision Criteria • If B/C ≥ 1, then … accept the alternative at the discounted rate • Otherwise, … not acceptable however it can still be funded for other reasons… NOTE • In B/C analyses, costs are not preceded by a minus sign • Salvage values are subtracted from costs • Disbenefits are generally subtracted from benefits 7 Modified B/C For Single Project • Conventional B/C • Modified B/C benefits - disbenefits B-D B/C = = costs C benefits - disbenefits - M&O costs initial investment • Benefit and Cost difference measure of worth B – C, if (B-C) ≥ 0, accept the project and vice versa KGA-Spr09®Reserved Alternative Selection: B/C Incremental Analysis • • Given: ≥ 2 mutually exclusive alternatives Steps… • • • Estimate total equivalent costs for all alternatives Rank the alternatives from low to high based upon total costs in the denominator of the ratio Calculate the incremental cost (ΔC) for the larger-cost alternative Calculate the total benefits and disbenefits for both benefits - disbenefits B-D alternatives – incremental benefits B / C = (ΔB) for the larger-cost = costs C alternative Δ(B-D) Calculate ΔB/C ratio • Accept the higher cost alternative if ΔB/C ≥1 • • KGA-Spr09®Reserved B/C Incremental Analysis for Multiple Alternatives • Given ≥ 3 mutually exclusive alternatives, must select one • Conduct pairwise ΔB/C • Selection rule: choose the largest-cost alternative after justfied by incremental B/C ≥1 • Note: any alternatives that have an overall B/C <1.0 can be eliminated immediately and no need not to be considered in the incremental analysis KGA-Spr09®Reserved Independent Projects • As long as the budget is unlimited, • Compare each alternative with DN • Choose all that have B/C ≥ 1 • If the budget is limited, • Use optimization methodology (capital budgeting) KGA-Spr09®Reserved Example … (Example 9.1) The Wartol Foundation, a nonprofit educational research organization, is contemplating an investment of $1.5 million in grants to develop new ways to teach people the rudiments of a profession. The grants will extend over a 10-year period and will create an estimated savings of $500,000 per year in faculty salaries, student tuition and fees, and other expenses. The foundation uses a rate of return of 6% per year on all grant awards. Since the new program will be in addition to ongoing activities, an estimated $200,000 per year will be removed from other program funding to support this educational research. To make this program successful, a $50,000-peryear operating expense will be incurred by the foundation from its regular M&O budget. Use the following analysis methods to determine if the program is justified over a 10-year period: (a) conventional B/C, (b) modified B/C, (c) (B-C) KGA-Spr09®Reserved Analysis Example …(Cont’d) • AW, PW, or FW? Use the one with… • Conventional B/C B/C = (500k – 200k)/(203,805+50k) = 1.18, thus… • Modified B/C B/C = (500k – 200k – 50k)/203,805 = 1.23, thus… • Benefit and Cost Difference B-C = (500k – 200k) – (203,805+50k) = $46,195, thus… KGA-Spr09®Reserved Another One… (Example 9.3) Two routes are under consideration for a new interstate highway segment. The northerly route N would be located about 5 km from the central business district and would require longer travel distances by local commuter traffic. The southerly route S would pass directly through the downtown area, and, although its construction cost would be higher, it would reduce the travel time and distance for local commuters. Assume that the costs for the two routes are as follows: Route N Route S Initial cost, $ 10,000,000 15,000,000 Maintenance cost/year, $ 35,000 55,000 Road-user cost/year, $ 450,000 200,000 If the roads are assumed to last 30 years with no salvage value, which route should be selected on the basis of B/C analysis using an interest rate of 5%/ year? KGA-Spr09®Reserved Another One…(Cont’d) • AW, PW, or FW? Use the one with… • AWN = $685,500 and AWS = $1,030,750 Incremental cost value = $345,250/year Incremental benefit = $250,000/year B/C ratio = $250,000/$345,250 = .724 thus… KGA-Spr09®Reserved Example (Example 9.4) Consider the four mutually exclusive alternatives, apply incremental B/C analysis to select the best alternative for a MARR = 10% per year. Use a PW analysis Location A B C D Building cost, $ -200,000 -275,000 -190,000 -350,000 Annual cash flow, $ 22,000 35,000 19,500 42,000 Life, years 30 30 30 30 KGA-Spr09®Reserved Example • Find the PW of the cash flows … • Eliminate those with B/C <1, why? • Start performing incremental analysis … • B to A Incremental cost = 75,000 Incremental benefit = 122,551 incremental B/C ratio = 1.63 Choose? • D to B Incremental cost = 75,000 Incremental benefit = 65,989 incremental B/C ratio = .88 Choose? KGA-Spr09®Reserved (Example 9.6) Six different sites are into consideration as possible location to construct a dam. If MARR of 6% per year is required and dam life is infinite for analysis purposes, select the one best location using the B/C method Site Choose E Construction Cost, $ (millions) Annual Income, $ A 6 350k B 8 420k C 3 125k D 10 400k E 5 350k F 11 700k KGA-Spr09®Reserved Spreadsheet Example • Alternative routes are being considered by the local highway district for a new bypass. Route A, costing $4000,000 to local business. Route B, costing $6,000000 can provide $1000,000 in annual benefits. The annual cost of maintenance is $200000 for A and $120000 for B. If the life of each road is 20 years and an interest rate of 8% per year is used, which alternative should be selected on the basis of a conventional B/C analysis? 19 Solution 20