Management Compensation

advertisement

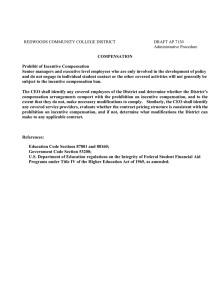

Management Compensation 2 Management Compensation Every organization has goal. An important role of management control systems is to motivate organizational members to attain those goals Research Findings on Organizational Incentives Research on incentives tends to support the following : • Individuals tend to be more strongly motivated by the potential of earning rewards that by fear of punishment. • A personal reward is relative or situational • Individuals are highly motivated when they receive reports or feedback about their performance • Incentives become less effective as the period between an action and feedback on it increases. • Motivation is weakest when the person believes an incentive is either unattainable or too easily attainable • The incentive that a budget or other statement of objective provides is strongest when managers work with their superiors to arrive at the budgeted amounts 3 Characteristics of Incentive Compensation Plans 4 A manager’s total compensation package consists of three components : 1. Salary 2. Benefits (principally retirement and health care) 3. Incentive compensation • The three components are interdependent, but the third is related specifically to the management compensation • Incentive compensation plans can be divided into short term and long term plans. • Short term incentive plans are based on performance in the current year. • Long term plans tie compensation to longer term accomplishments and are related to the price of the company’s common stock. Characteristics of Incentive Compensation Plans Short Term Incentive Plans a. The Total Bonus Pool • The total amount of bonus that can be paid to qualified group of employees in a given year is called the “bonus pool” • There are several ways to establish the bonus pool : a. The bonus equal to a set percentage of the profits b. The bonus on a percentage of earnings per share has been attained. 5 Research Findings on Organizational Incentives Short Term Incentive Plans b. Deferred Compensation • Although the amount of the bonus is calculated annually, payments to recipients may be spread out over a period of years. • This deferred payment method offers the following advantages : a. Managers can estimate their cash income for the coming year. b. Deferred payments smooth the manager’s receipt of cash. c. A manager who retires will continue to receive payments for a number of years. d. The deferred time frame encourages decision makers to think long term. 6 Research Findings on Organizational Incentives Short Term Incentive Plans b. Deferred Compensation • Although the amount of the bonus is calculated annually, payments to recipients may be spread out over a period of years. • This deferred payment method offers the following advantages : a. Managers can estimate their cash income for the coming year. b. Deferred payments smooth the manager’s receipt of cash. c. A manager who retires will continue to receive payments for a number of years. d. The deferred time frame encourages decision makers to think long term. 7 Characteristics of Incentive Compensation Plans Long Term Incentive Plans A basic premise of many long term incentive plans is that growth in the value of the company’s common stock reflects the company’s long run performance. a. Stock Options • The major motivational benefit of stock option plans is that they direct manager’s energies toward the long term, as well as the short term, performance of the company. • Managers are not permitted to sell this stock for a specified period after it was acquired. 8 Characteristics of Incentive Compensation Plans Long Term Incentive Plans b. Phantom Shares • A phantom stock plan awards managers a number of shares for bookkeeping purposes only. • At the end of a specified period, the executive is entitled to receive an award equal to the appreciation in the market value of the stock since the date of award c. Phantom Shares • A stock appreciation right is a right to receive cash payments based on the increase in the stock’s value from the time of the award until a specified future date. 9 Characteristics of Incentive Compensation Plans Long Term Incentive Plans d. Performance Shares • A performance share plan awards a specified number of shares of stock to a manager when specific long term goals have been met. e. Performance Units • In a performance units plan, a cash bonus is paid when specific long term targets are attained. • This plan thus combines aspects of stock appreciation rights and performance shares. 10 11 Incentives for Corporate Officers • To stimulate motivation, the CEO (Who recommends awards to the compensation committee of the board of director) usually bases awards on an assessment of each person’s performance. CEO Compensation • The CEO’s compensation usually is discussed by the board of directors compensation committee after the CEO has presented recommendations for subordinates’ compensation. Incentives for Business Unit Managers Types of Incentives a. Financial : salaries increases, bonuses, club memberships, etc b. Psychological and social : promotion possibilities, increased responsibilities, etc. Bonus Basis • A business unit manager’s incentives bonus could be based solely on total corporate profits or on business unit profits or some mix of the two. • One argument for linking bonus to unit performance is that the manager’s decisions and actions more directly impact the performance of his or her own unit than that of other business units. 12 Incentives for Business Unit Managers Size of Bonus Relative to Salary Two Philosophies on Incentive Compensation 1. Fixed Pay Recruit Good People Pay Them Well Expect Good Performance 13 Incentives for Business Unit Managers Size of Bonus Relative to Salary Two Philosophies on Incentive Compensation 2. Performance Based Pay Recruit Good People Expect Good Performance Pay Them Well if Performance is Actually Good 14 Incentives for Business Unit Managers Performance Criteria The difficult problem is to decide which criteria shall be used to determine the bonus a. Financial Criteria • If the unit is a profit center, financial criteria could include contribution margin, net income etc. • If the unit is an investment center, decisions need to be made in three area : definition of profit, definition of investment and choice between ROI and EVA • If the unit a revenue center, the financial criteria would be sales volume or sales dollar b. Benchmarks for Comparison • A business unit manager’s performance can be appraised by comparing actual results to profit budget, past performance or competitor’s performance. 15 16 Agency Theory Concepts An agency relationships exists whenever one party (the principal) hires another party (the agent) to perform some service and, in so doing, delegates decision making authority to the agent. One of the key elements of agency theory is that principals and agents have divergent preferences or objective. a. Divergent Objectives of Principals and Agents • Agency theory assumes that all individuals act in their own self interest. Agents area assumed to receive satisfaction not only from financial compensation but also from the perquisites involved in agency relationship, such as generous amount of leisure time • Principal (shareholders), are assumed to be interested only in the financial returns that accrue from their investment in the firm. 17 Agency Theory Control Mechanisms Agency theorists state that there are two major ways of dealing with the problems of divergent objectives and information asymmetry : monitoring and incentives. a. Monitoring • The principal can design control systems that monitor the agent’s actions, limiting actions that increase the agent’s welfare at the expense of principal’s interest. Example : audited financial statement b. Incentive Contracting • A principal may attempt to limit divergent preferences by establishing appropriate incentive contracts. The more an agent’s reward depends on a performance measure, the more incentive there is for the agent to improve the measure.Therefore, the principal should define the performance measure so that it furthers his or her 18 Agency Theory Control Mechanisms Agency theorists state that there are two major ways of dealing with the problems of divergent objectives and information asymmetry : monitoring and incentives. c. CEO compensation and Stock Ownership Plans • A company that pays its CEO a bonus in the form of stock options offers an example of the agency cost inherent in incentive compensation. d. Business Unit Managers and Accounting Based Incentives • It is difficult to isolate the contributions that individual business units make to increases in the firm’s stock price. For this reason, a company might base the business unit manager’s bonus on business unit net income. 19 Agency Theory A Critique • Agency theory implies that managers in nonprofit and governmental organizations, who cannot receive incentive compensation, inherently lack the motivation necessary for goal congruence, many people do not accept this implication. • Models are no more than statements of obvious facts expressed in mathematical symbols. • Others state that the elements in the models can’t be quantified (what is the “cost of information asymmetry” ?), and that the model vastly oversimplifies the real world relationship between superiors and subordinates. 20 Summary The incentive compensation system is a key management control device. An incentive system that explicitly incorporates the following has a much better chance of success : • The needs, values, and beliefs of the general managers who are rewarded. • The culture of organization • External factors, such as industry characteristics, competitor’s compensation • The organization’s strategies 21 The End